Andrew Pittet

July 15, 2025

America’s expensive. Europe isn’t.

Lately the US stock market has been on a roll. Over the past 10 years, it’s delivered an impressive 14.8% annual return, thanks in large part to a booming tech sector. In comparison, European markets returned 7.8% per year during that time.1 While that’s a significant gap, past performance in investing often tells us little about the future.

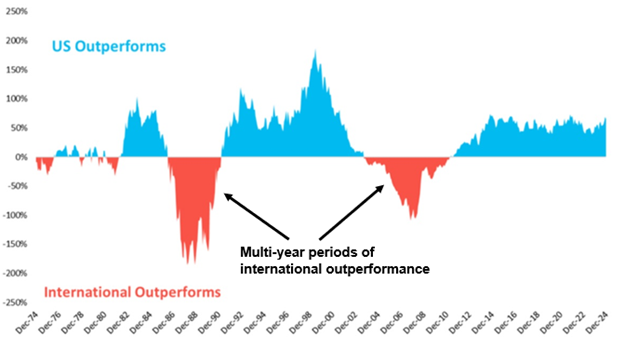

Markets tend to move in cycles and when one region has had a long run of strong performance, it often cools off and other regions start to shine. The chart below shows that US stocks have now outperformed international stocks for 13 straight years. That’s one of the longest winning streaks on record, but history also tells us this won’t last forever.

US vs. International Stock Market Performance

Rolling 5-year Total Returns (S&P 500 minus MSCI World Ex-US) 2

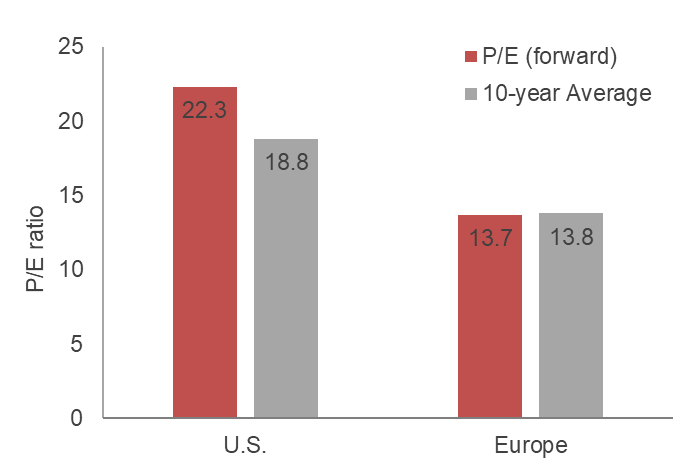

Another important idea in investing is reversion to the mean. Over time, valuations tend to move back to their long-term averages. One way to view this is through the price-to-earnings ratio (P/E). Right now, US stocks are trading well above their 10-year averages while European stocks are closer to long-term norms. That tells us U.S. stocks might be priced for perfection, while Europe could offer better value.

Forwards & Average P/E Ratios3

As an investor, diversification remains essential. US stocks should still be a core part of any portfolio, but it’s important to look beyond North America – especially at international markets like Europe. So far in 2025, 8 of the 10 best-performing stock markets globally have found in that region. With strong momentum and reasonable valuations, Europe might finally be stepping back into the spotlight.

Stay disciplined,

-Andrew

Sources: Vanguard 2. Charlie Bilello 3. Fidelity 4. Bloomberg