Andrew Pittet

October 07, 2025

Retirement wave

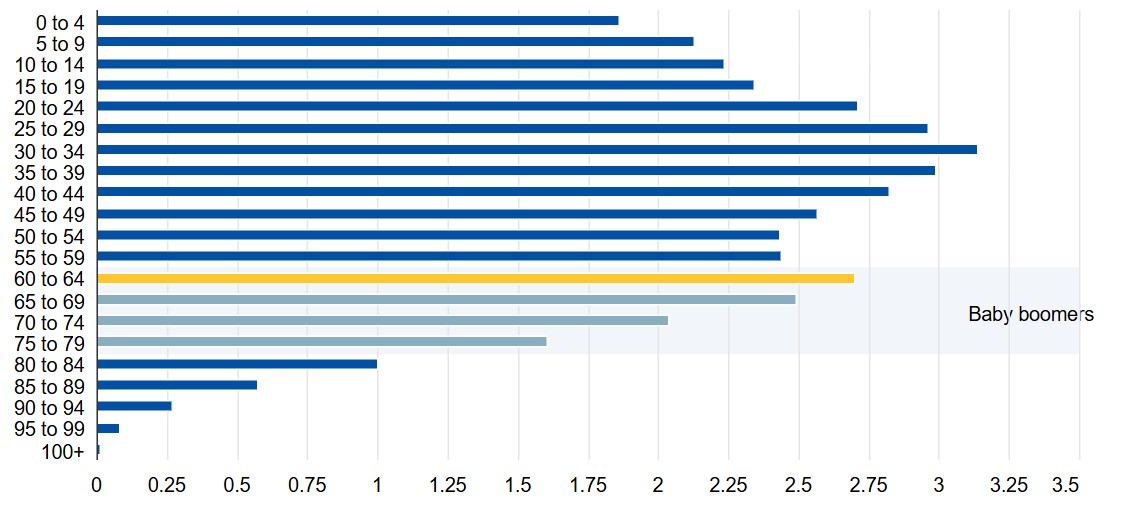

We are about to enter the age of peak retirements in Canada. The Baby Boomer generation -those born between 1946 and 1964 – represent one of the largest demographic groups in the country. The last and largest segment of this cohort is now reaching retirement age. In fact, more people will turn 65 this year than ever before and over the next few years 2.7 million Canadians will enter retirement.1 Baby Boomers have shaped our economy and society for decades, and their retirement will have a significant impact on the country’s future.

Canada’s 2025 demographics by age group (millions of people) 2

As an investment advisor, I have a lot of personal experience with retirement (although I'll be working for a while yet to support my two-year-old son's fresh blueberry habit). Many of my clients are in retirement and both my parents retired from their jobs in the past year. For these clients, their investment focus often shifts from growth to generating income to fund their retirement. Cashflow becomes key and their portfolios often move toward more dividend-paying stocks and bonds to provide regular payments. Financial planning is critical and I frequently run portfolio simulations to find a safe withdrawal rate that balances spending needs with preserving long-term wealth.

For those who are still working, this wave of retirements will affect the broader economy. There has been a lot of discussion about how technology and artificial intelligence (AI) are changing employment. If these productivity gains come to fruition, their greatest benefit may be helping Canada address its demographic challenges since the number of working-age Canadians supporting each retiree is shrinking. In 1966, there were 7.7 working-age individuals for every senior; by 2022, that ratio had fallen to 3.4.3 Rather than replacing jobs, advances in AI may help fill gaps left by retirees and support our growing population of seniors.

Whether you’re retiring soon or still working, this wave will affect us all.

Stay disciplined,

-Andrew

Sources: 1) Wall Street Journal, Financial Post 2) RBC Economics 3) Fraser Institute