Andrew Pittet

January 12, 2026

Sticky Services

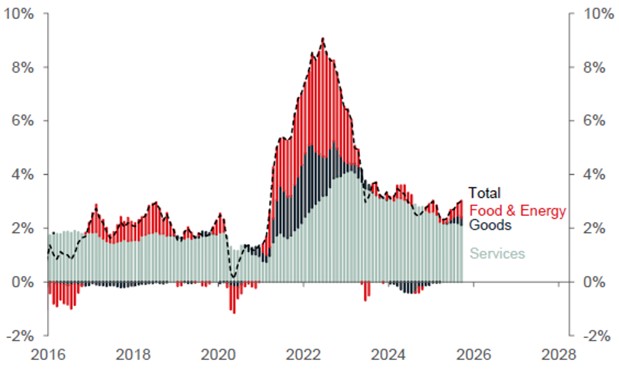

Inflation has played a major role in shaping both the overall economy and our personal finances. It began rising during the COVID-19 pandemic and peaked at over 9% in 2022. While inflation has since come down, it remains higher than usual. The most recent reading was 2.7%, which means inflation has stayed above the central bank’s 2% target for almost five years.

A key reason inflation has been so persistent is rising costs in the service sector. Services include everything from housekeeping and healthcare to teaching and tourism. This sector covers a wide range of jobs and accounts for about 68% of consumer spending—making it the largest part of our economy.1

The chart below shows how inflation has shifted over time. During the pandemic, prices for goods like cars, appliances, and furniture jumped as supply chains struggled to keep up with demand. Later, food and energy costs surged, especially after the war in Ukraine disrupted global markets. Now, inflation has shifted to the service sector, which continues to drive prices higher.

Key Drivers of U.S. Headline CPI Inflation 2

The challenge with service sector inflation is its staying power. Unlike food, energy, or goods, prices for services rarely go down—think about the last time your haircut cost less than before. Historically, the only times we’ve seen service prices drop were during major recessions, such as the 2007-2009 financial crisis. With services representing such a large share of our spending, rising prices in this area can contribute to what economists call a “wage-price spiral”: as costs increase, workers seek higher wages to keep up, which in turn pushes prices even higher.

All of this leads me to believe that reaching inflation targets may be tougher than many expect, with the "last mile" likely to be the most challenging. Investors might consider positioning their portfolios for a world where inflation settles below its peak but stays above 2% for a longer period of time.

Stay disciplined,

-Andrew

Sources: 1) Apollo, 2) National Bank

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

This commentary is for informational purposes only and is not being provided in the context of an offering of any security, sector, or financial instrument, and is not a recommendation, an endorsement, or solicitation to buy, hold or sell any security.

Please note that rate of return projections are for demonstration purposes only. They are based on a number of assumptions and consequently actual results may differ, possibly to a material degree.

Andrew Pittet is an Investment Advisor with CIBC Wood Gundy in Calgary. The views of Andrew Pittet do not necessarily reflect those of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.