Andrew Pittet

February 09, 2026

The High Cost of Alchemy

Artificial Intelligence (AI) is everywhere these days. Venture capitalist Marc Andreessen summed up AI’s promise best when he described it as a kind of alchemy. It essentially turns sand, one of the earth’s most common elements and the foundation of silicon chips, into thought. I’ve started to see the benefits firsthand, using AI both in my work as an investment advisor and in my personal life (it designed a custom invitation for my son’s recent Hawaii-themed third birthday party complete with cartoon palm trees).

AI’s influence on the markets is undeniable. Since the launch of ChatGPT in November 2022, some estimates suggest that AI-related stocks have contributed to 75% of the returns in the US S&P 500.1 That’s a remarkable statistic, but it’s only part of the story. While the promise of AI makes headlines, the risks deserve just as much attention, especially for investors.

Let’s start with the scale of investment pouring into AI. The four largest US tech companies are projected to spend more than $650 billion on data centers in 2026. This represents a 60% increase over previous years, and some forecasts suggest the total cost to build out AI infrastructure in the next few years could exceed $5-7 trillion.3 To put that in perspective, the total federal debt accumulated by the Canadian government from Confederation in 1867 to today is $1.2 trillion.4 Initially, tech giants funded their AI investments from their own profits, but now they’re increasingly turning to debt to finance these ambitious projects.

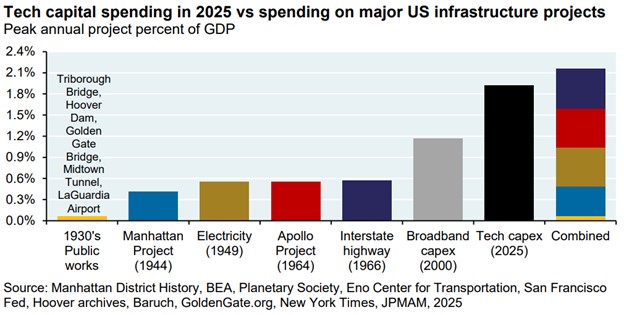

These investments are remarkable not just in their sheer size, but also when measured against historic spending on infrastructure and technology. As a share of GDP, AI spending in 2025 almost matched the combined investments in the Hoover Dam, the Manhattan Project that developed the first atomic bomb, the interstate highway system, electricity buildout, and the Apollo space program. This surge in spending is having a real impact on the economy; according to Harvard economists, AI-related capital investments accounted for more than 90% of US GDP growth in the first half of 2025.5 However, there is a risk that if AI spending slows or fails to meet expectations, the ripple effects could be felt throughout the broader economy.

Source: JP Morgan

While the investment is enormous, the potential returns are far less certain. Although industry-wide revenues are difficult to estimate, monetization currently remains a challenge. For example, ChatGPT—one of the most popular AI models—has about 700 million active users, yet only 5% pay for the service, resulting in just $20 billion in annual revenue.6 The industry’s ability to generate substantial returns from its large user base will be critical and for now, most of those profits remain in the future.

AI holds tremendous potential, but like any investment, managing risk is essential. That’s why investors should consider diversifying across a range of industries—not just technology. Expanding beyond the US to developed markets in Europe can also help balance risk, since these regions are less exposed to the tech sector. As I like to say, if you protect yourself from the downside, the upside tends to take care of itself.

Stay disciplined,

-Andrew

Sources: 1) JP Morgan 2) Bloomberg 3) Morgan Stanley 4) Statistics Canada 5) Jason Furman 6) Open AI