Wes Taylor

February 15, 2024

2023 in Review and 2024 Market Outlook

2023 was another year where macroeconomic conditions – inflation, interest rates, and economic data - took center stage. When we entered 2023, investors were concerned about inflation and expected a recession to appear at some point in the second half of the year. These questions are still with us now.

Last year, inflation cooled and the economy remained solid for the majority of the year, especially in the US. While both the Federal Reserve and the Bank of Canada raised interest rates several times in 2023, the tone from Central Bankers changed in the Fall and the expectation is now that rates will move lower in 2024.

While there is general agreement that we are not going to see further interest rate hikes, the debate now is around when, and by how much, interest rates will fall in 2024. “When will we get interest rate cuts?” is a much better question to be asking than “How many more rate hikes will there be?, and this change in tone has strengthened stock and bond markets in recent months.

But the market may be getting a bit ahead of itself, as it often does. Right now, US bond markets are pricing in 1.5% of cuts in 2024, but the Federal Reserve itself is only projecting 0.75% of cuts.[1] Either the Fed is talking tough to promote further disinflation, or the market is getting ahead of itself. Time will tell who gets it right, but as long as the story continues to be about interest rate cuts, we can expect bond and stock prices to perform relatively better than they did when rates were rising.

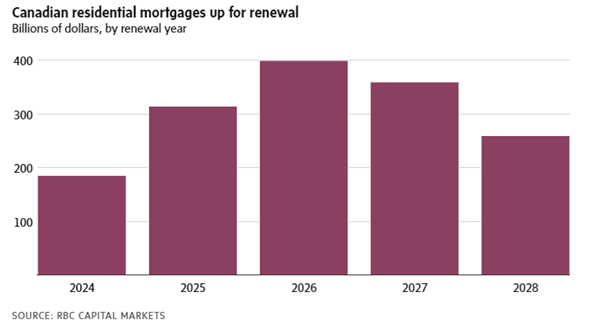

In Canada, many economists expect rates to come down more aggressively in the second half of this year than our neighbours to the South. This is in large part due to the hundreds of billions of dollars worth of mortgage renewals coming due in 2025 and 2026. Leaving interest rates at current levels into 2025 could have more serious consequences on our economy as so many Canadians are forced to absorb higher debt costs.

We are not in the clear yet, and I expect that we will continue to see volatility until Central Bankers lay out a clear path to interest rate cuts.

[1] https://www.morningstar.com/markets/4-biggest-market-stories-2023-whats-next-2024