July 26, 2024

Money Education Financial literacy Economy Commentary In the news News Annual updateJuly 2024 Market Update

July 2024 Market Update

On July 9th the Nasdaq Composite index and technology stocks in general, reached an inflection point, and since then, large cap technology stocks have been falling as investors take profit and redistribute gains into small cap stocks and cyclicals (financials, industrials, healthcare, and materials). What’s driving this rotation, and is it the result of a technology stock bubble popping or simply a normal market course correction and much less alarming reversion to the mean relative to the broader equity market?

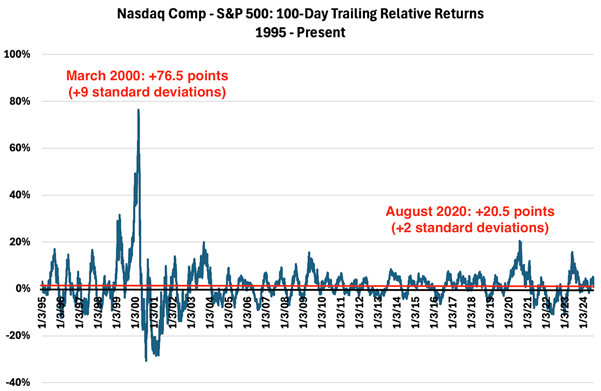

If we look at the 100-day (about 4.5 calendar months) trailing relative returns of the Nasdaq Composite and the S&P500 Index since 1995, we see that the Nasdaq’s outperformance versus the S&P500 this year has been nowhere near a historical bubble and is entirely normal. When the blue line is above/below the x-axis, the Comp has outperformed/underperformed the S&P500 over the prior 100 days.

Source: DataTrek Research

However, the S&P500 index is a market weighted index, meaning each stock is represented in proportion to it’s market capitalization. The bigger the stock in the index, the bigger it’s weighted in the index. As a result, and as mega cap Tech stocks have grown in size, it’s composition is much different today than it was in the early 2000s. Having grown it’s exposure to Big Tech significantly over that time period, technology names now represent 44% of the index’s composition. Like it or not, the S&P500 index is much more of a tech index than in the recent past. So how have technology stocks performed this year relative to the broader markets?

The chart below shows the Nasdaq Composite Index relative to the equal weighted S&P500 index, where each stock in the index has an equal weight.

Source: DataTrek Research

This chart clearly shows how technology stocks have out-performed the non-tech names in the broader market. In fact, on July 9th of this year, the out-performance had reached a two standard deviation variance, or 13.7%, one day before the Index’s peak. This is a rare event, having only happened three other times since 2004.

When the Comp’s 100-day return beats the equal weight S&P index by this much, it goes on to out-perform three quarters of the time (77 percent), and by an average of 4.9% points over the next 100 days. Furthermore, with the pullback we have seen in the last two weeks since the Nasdaq peaked, technology stocks have only out-performed the broader market by 3.5 percentage points, well within the normal variance and not statistically significant.

So what can we conclude from this? What this tells us is the Nasdaq Composite index and technology stocks more generally, tend to keep out-performing the broader markets as measured by the equal weight S&P500 index, even after doing so by a highly unusual amount, but at a lesser degree. We have already seen this happen with the Composite’s 100 day moving average out-performance still above average, but now within a more normal range.

So does this mean we now have the all clear signal to buy technology names again and take advantage of this recent pullback is prices? History tells us there may be more selling in tech before this rotation has run it’s course. Consider the CBOE Volatility Index (VIX), which continues to be one of the best indicators to watch when deciding when a selloff has reached its climax.

The VIX measures the short term volatility of the market by looking at the amount of buying of 30 day hedging using call and put options. The VIX right now is trading around 18, still below it’s long term average of about 20. Over the last year, the VIX has seen 2 notable closing peaks, both above current (July 25th) levels. The first was on October 20th, 2023 at 21.7. The second was on April 15th 2024, at 19.2. The S&P bottomed in both instances, 7 and 4 calendar days after these peak VIX levels.

We would also expect to see the market participation broaden out from here. There are several reasons for this. Firstly, investors have rightly pointed out that the market has been far too concentrated in a handful of mega cap technology stocks this year. Normal healthy markets would see much more broad participation from many other sectors of the stock market. This hasn’t happened so far this year, as investors have remained skeptical about the strength of the economy and how persistent inflation would be, worrying that interest rates would have to stay higher for longer. It’s natural then, for investors to stay with technology stocks, which are largely immune from the effects of higher interest rates and inflation, because of their dominant brands and little or no debt, and huge free cash flows. But with inflation levels continuing to fall, now below 3%, and a Federal Reserve signaling rate cuts, and the Bank of Canada now cutting rates two times this year, the market is convinced it is now time for the rest of the market to begin to participate in a greater way.

Secondly, valuation levels are more attractive in other sectors of the market expected to benefit from declining inflation and lower interest rates (cyclicals). These sectors include financials, industrials, healthcare and materials.

Thirdly, US politics might be affecting the markets perception of winning sectors versus losing ones. A Republican President would likely promote an agenda of cutting taxes, reducing regulation, and raising tariffs on foreign imports, all of which would benefit US domestic companies, and small caps in particular. Since small cap stocks have lagged the broader market for some time now, it is natural to expect a catch up trade going forward.

All this is not to say technology stocks will not continue to make advances. It’s simply more likely they will still do well, but the outperformance they have enjoyed this year will moderate somewhat as other sectors catch up and attract investor money. Small caps and cyclical stocks may finally be getting their moment in the sun.

As always, if you would like to discuss any of this material, or if you would like to review your current portfolio, please do not hesitate to contact me or any member of my team and we can arrange an in-person meeting, Teams video conference call, or a telephone call to discuss your investments.

Best regards,

Gordon Forsey | Portfolio Manager, Senior Wealth Advisor | CIBC Private Wealth

1801-1969 Upper Water St., Halifax NS B3J 3R7 | Tel: 902-420-6203 | Toll Free: 1-800-565-0601

Email: gordon.forsey@cibc.ca

Gordon Forsey Advisory Group:

Gordon Forsey P.Eng., MBA, CIM®, FCSI

Portfolio Manager, Sr. Wealth Advisor

Tel: 902-420-6203

Andreas Demone BBA

Client Associate

Tel: 902-420-9624

Terri MacPhail

Client Associate

Tel: 902-420-8263

Michael Forsey BA

Administrative Assistant

Tel: 902-420-8232

™Trademark of CIBC World Markets Inc. CIBC Wood Gundy will be responsible to CIBC Wood Gundy Investment Consulting Service clients for the advice provided by any Investment Manager. The ICS Program Manager, CIBC Asset Management Inc., is a subsidiary of CIBC. This material comes from the computer calculations of Gordon Forsey. In the event of a discrepancy between the data used in this report and the data generated by CIBC Wood Gundy, reliance must be placed on the data generated through the facilities of CIBC Wood Gundy. Yields/rates are as of the above date and are subject to availability and change without notification. Minimum investment amounts may apply. Insurance services are available through CIBC Wood Gundy Financial Services Inc. In Quebec, insurance services are available through CIBC Wood Gundy Financial Services (Quebec) Inc. Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors. CIBC Wood Gundy is a division of CIBC World Markets Inc

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.

Insurance services are available through CIBC Wood Gundy Financial Services Inc. In Quebec, insurance services are available through CIBC Wood Gundy Financial Services (Quebec) Inc.

This report is not an official record. The information contained in this report is to assist you in managing your investment portfolio recordkeeping and cannot be guaranteed as accurate for income tax purposes. In the event of a discrepancy between this report and your client statement or tax slips, the client statement or tax slip should be considered the official record of your account(s). Please consult your tax advisor for further information. Information contained herein is obtained from sources believed to be reliable, but is not guaranteed. Some positions may be held at other institutions not covered by the Canadian Investor Protection Fund (CIPF). Refer to your official statements to determine which positions are eligible for CIPF protection or held in segregation. Calculations/projections are based on a number of assumptions; actual results may differ. Yields/rates are as of the date of this report unless otherwise noted. Benchmark totals on performance reports do not include dividend values unless the benchmark is a Total Return Index, denoted with a reference to 'TR' or 'Total Return'. CIBC Wood Gundy is a division of CIBC World Markets Inc., a subsidiary of CIBC.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns, including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed. Their values change frequently, and past performance may not be repeated.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

There are ongoing fees and expenses associated with owning shares of an Exchange-Traded Fund (ETF). An ETF must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. The indicated rate[s] of return is are the historical annual compounded total return[s] including changes in share value and reinvestment of all distributions and does not take into account income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

You will usually pay brokerage fees to your dealer if you purchase or sell units or shares of the Exchange- Traded Fund on the New York Stock Exchange. If the shares are purchased or sold on the New York Stock Exchange, investors may pay more than the current net asset value when buying shares of the ETF and may receive less than the current net asset value when selling them.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

The contents of this document are for informational purposes only and are not being provided in the context of an offering of a security, sector, or financial instrument, and is not an endorsement, recommendation, or solicitation to buy, hold or sell any security.