Jay Smith & Brad Brown

September 01, 2023

Monthly commentarySeptember 2023

MONTHLY MARKET MUSINGS

September 2023

The Fall Classic

A Look Back

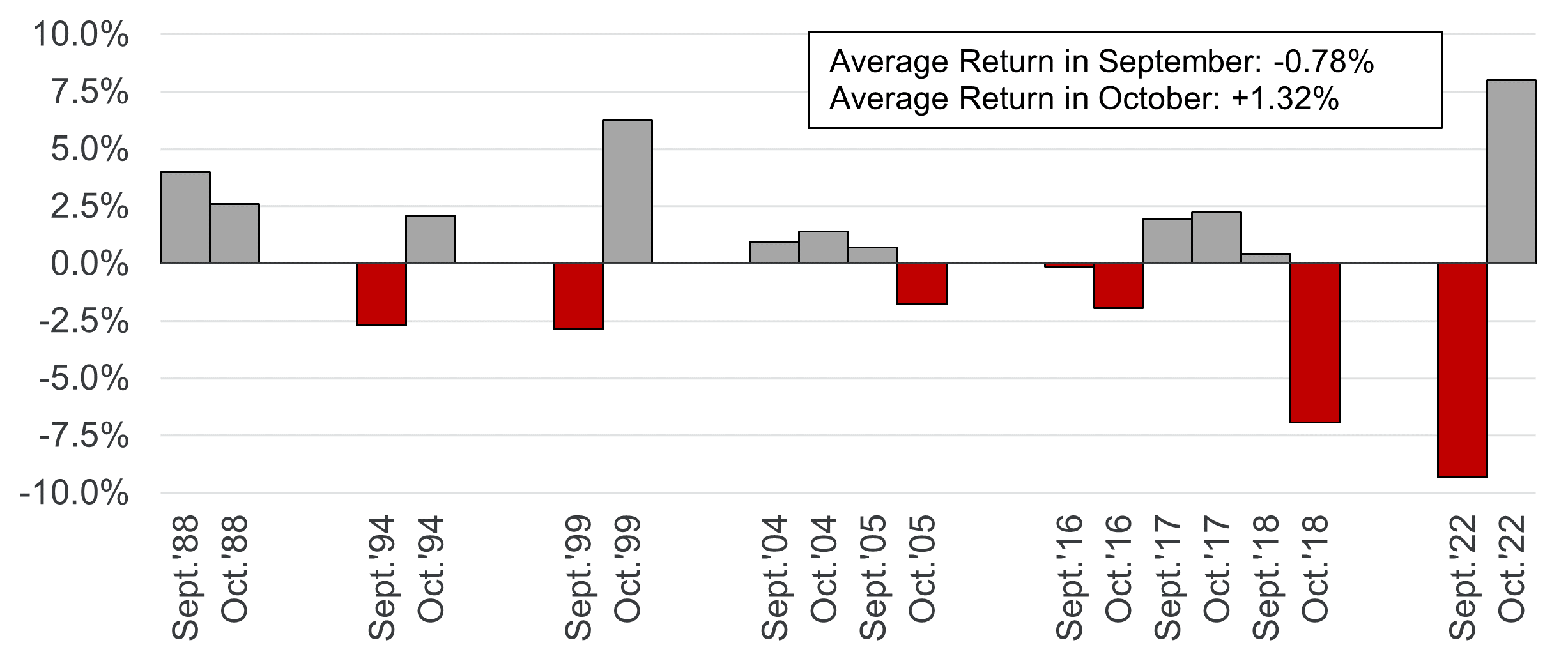

Many of those who follow the financial markets may have heard that September and October are typically more bearish than the other months of the year historically. The increased volatility and anticipation of weakness in these months can sometimes be referred to as the "September Effect" and the "October Effect". With many of the most famous negative market events happening in these two months (September - Lehman Brothers Bankruptcy and other financial crisis events, 9/11 Terrorist Attacks; October - the Bank Panic of 1907, the Wall Street Crash of 1929, Black Monday in 1987, etc.) it is easy to see why they get labelled as such. While there is some truth to this notion given that September, on average, has been the worst performing month over the past century, the belief that October is inherently a negative month is not true. October has actually been a net positive month for stocks historically[1]. In an attempt to increase the relevancy of the historical performance data during these months, we looked back at the monthly performance in prior interest rate hiking cycles dating back to 1988. In the chart below, we can see that equities have had negative returns more often in September than in October. This is no surprise given the above-mentioned historical weakness of September. The market has seen positive total returns in September 56% of the time during rate hiking cycles since 1988. Meanwhile, October has produced positive total returns 67% of the time during rate hiking cycles for that same period. It is difficult, if not impossible, to predict whether the markets will finish September or October higher or lower in any given year, that said, the average return in these months during a rate hiking cycle has not been bad - on average September has seen a drop of less than 1% and October has produced a gain of more than 1%.

S&P 500 Index Total Returns in September and October During Prior Rate Hiking Cycles Dating Back to 1988

Source: Bloomberg, data as of August 21st, 2023

On all but one occasion when the market experienced a weak September during the rate hiking cycles, it was followed by a strong October that offset much of the prior month's losses. Additionally, the calendar fourth quarter, which starts October 1st, tends to be one of the strongest quarters more often than not as enthusiasm for the coming year provides support to the broader equity markets[2]. With inflation having come back down to more tolerable levels and still falling, the rate hiking cycle nearing its end and the economy still doing relatively well given the past twelve months of aggressive monetary tightening, we can probably expect that these two months will provide a market which performs likely no worse than it has in the past rate hiking cycles and potentially performs even better than the historical average during that period. The underlying assumption here is that we don't experience any unforeseen negative economic events which turn the potential mild recession/soft landing into a more severe downturn.

So What Do We Do With All This Information?

As we discussed last month, putting cash to work and positioning for the coming year by taking advantage of any setbacks in these two months will likely provide investors with good entry points over the longer term. As noted above, not only do these months sometimes provide a solid buying opportunity but they can also precede a strong year-end rally. For those currently fully invested, time in the market will always beat trying to time the market and therefore keeping your portfolio levered to equities is likely the best course of action as we move towards the anticipated rate cuts of 2024 and more normalcy in the economy and financial markets.

JAY SMITH, CIM, FCSI

Senior Portfolio Manager & Senior Wealth Advisor

BRAD BROWN, MBA, CFA

Portfolio Manager & Associate Investment Advisor

[1] https://www.cnbc.com/2021/10/01/october-may-have-a-bad-reputation-but-stocks-are-entering-a-normally-positive-period.html

[2] https://www.spglobal.com/marketintelligence/en/news-insights/blog/q4-s-historical-performance-will-this-quarter-live-up-to-its-reputation#:~:text=Historically%2C%20Q4%20of%20any%20year,rising%2077%25%20of%20the%20time.