Jay Smith & Brad Brown

March 01, 2024

Monthly commentaryMarch 2024

MONTHLY MARKET MUSINGS

March 2024

A Stronger Than Expected Fourth Quarter (Q4) Earnings Season

Many strategists and market pundits believed that the Q4 earnings season would be a further sign of cracks in the market's foundation but that seemingly has not been the case. The results overall were quite strong and continued to signal further strength in the corporate environment. 473 of the companies in the S&P 500 Index (S&P) have reported. Of those, 360 have topped consensus estimates on earnings with the average earnings beat coming in 7.46%[1] higher than consensus forecasts. For the S&P/TSX Composite Index (TSX), 149 companies have reported and 92 have either beaten or were in line with consensus earnings estimates. This has allowed the strong start of the year which we experienced in January to carry into February. While the TSX has incrementally gained so far this year, it does trail its counterpart south of the border. The S&P has been moving higher in a linear fashion and the recent results suggest that trend will continue. Late last year, earnings growth turned positive again following an earnings recession - consecutive year-over-year earnings declines lasting two or more quarters. Now, earnings are forecasted to grow year-over-year for the foreseeable future. While it can be argued that the end of the earnings recession is mostly due to the skewed positive results of the index's largest components, it should none-the-less be viewed positively for the broader market.

Results Broken Down By Sector

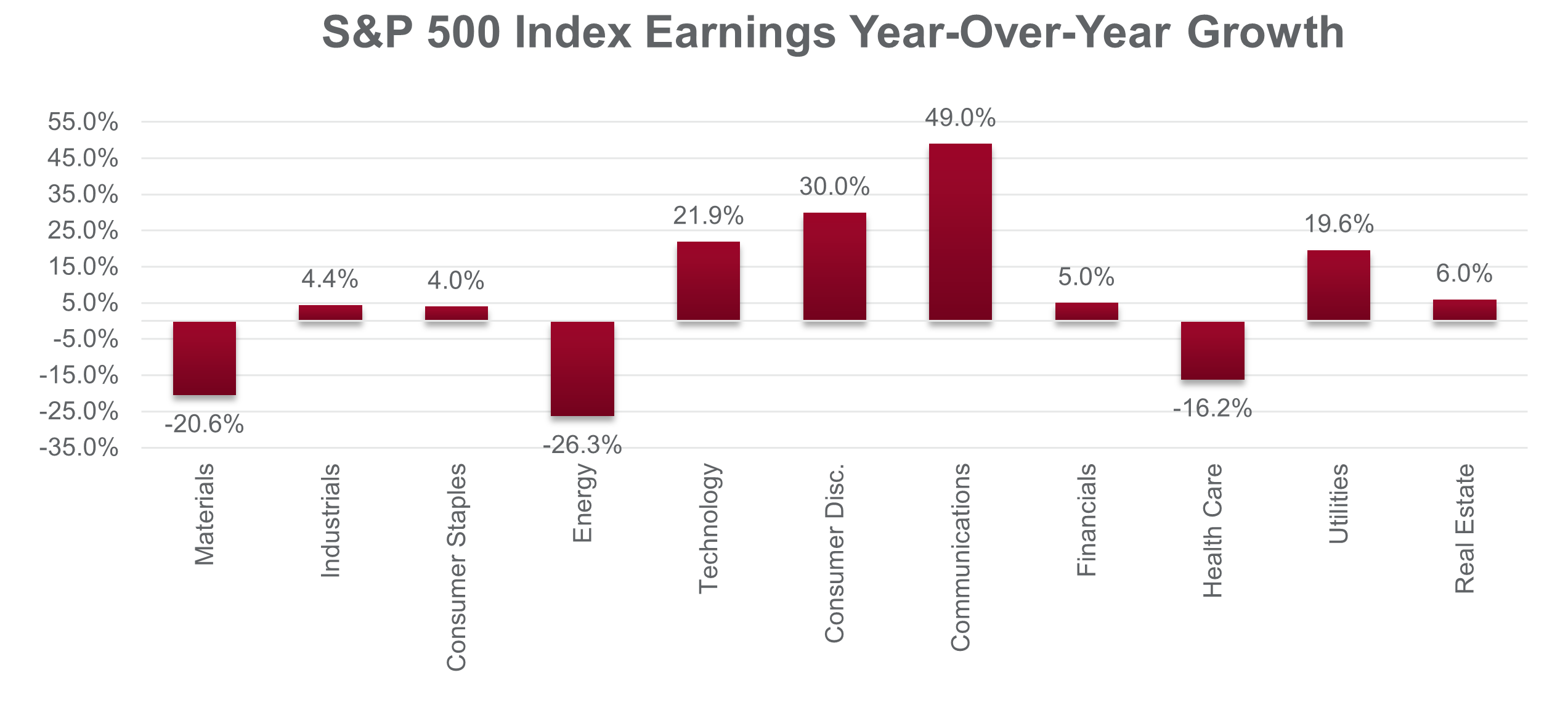

Below we can see the S&P 500 Index's year-over-year results (Q4/2022 to Q4/2023) broken down and classified as per the GICS[2] sectors.

Source: Bloomberg

What Are The Takeaways From The Q4 Results?

Looking at the above chart, it becomes clear that the overall year-over-year earnings growth was driven by the Communication Services, Consumer Discretionary and Technology sectors. This is consistent with two of the major themes from last year which helped to support the market: the rise of Artificial Intelligence (AI) and the ongoing strength of the U.S. consumer. While much of the AI excitement has been directly tied to the Technology sector and internet-based businesses in the Communication Services sector, there are many other possible applications of AI throughout other sectors. Other areas such as the Health Care and Energy sectors, which saw declining earnings year-over-year, could potentially benefit enormously from AI but incorporating the technology into these areas is likely less obvious to investors and potentially more difficult to do which infers a longer term time frame for integration and monetization.

Looking back at the fourth quarter results, one takeaway that seemed to resonate across the quarterly conference calls was that the U.S. consumer continues to remain resilient.[3] Some have even begun to argue that the market's focus has shifted away from inflation and towards a growth narrative. While this gives us reason to remain optimistic, we are not quite out of the woods yet. Some economist have suggested that a potential second wave of inflation could happen and this would send the focus right back to inflation which could further pressure both consumer spending and corporate earnings. Despite this possibility, as we have noted previously, we believe that money is better off invested in the markets rather than sitting on the sidelines. An equity portfolio containing high-quality businesses with stable earnings and further growth prospects provides a strong foundation for every well-constructed investment portfolio. The recent earnings results are supportive of our view that equities continue to look promising and we continue to believe that there are still legs to the current market run.

JAY SMITH, CIM®, FCSI

Senior Portfolio Manager & Senior Wealth Advisor

BRAD BROWN, MBA, CFA

Portfolio Manager & Associate Investment Advisor