Jay Smith & Brad Brown

April 01, 2024

Monthly commentaryApril 2024

MONTHLY MARKET MUSINGS

April 2024

Drowning Out The Noise & Keeping Emotional Control

The market can be an emotional roller coaster for many people. Being far too tuned into the markets can create stress and anxiety as moods shift between euphoric highs and regretful lows. Those emotions tend to drive many behavioural biases which very often make for irrational decisions and hurt results. Following a more tranquil approach and recognizing when a bias is emerging can prove to be very helpful to many investors as it can reduce the frequency of poor investment decisions. With the financial markets continuing to make new highs, the number of media outlets suggesting an impending market correction is rising with every passing day. And while this is to be expected, maintaining the right frame of mind and controlling the pressure to exit the market is a key proponent to longer term success. Within this context, there are some biases that investors should be aware of in order to avoid the aforementioned pitfalls.

- Confirmation bias: This is the tendency to seek out and prioritize information that confirms a preconceived idea and ignore anything that contradicts it. With the abundance of information available to investors these days, it is easier than ever to fall into this trap. An investor could see an article that argues for a market collapse and then it becomes the only thing that investor finds wherever they look from that point on. This typically can lead to stress and anxiety and cause investors to make rash conclusions which can be suboptimal from a portfolio management standpoint and present an obstacle to achieving their long-term financial ambitions.

- Activity bias: This is the human tendency to prefer an immediate active approach during periods of high stress. In terms of the markets, rather than maintaining your long-term strategy that was built under rationale thought, this can lead investors to pursue quick inferior solutions. Investors seek reassurance through these actions even though it may be harmful to their returns, in contrast to their goals and the consequences not thoroughly examined. While quick action is required at times, it is best for investors to take the time to fully assess the market situation and understand whether or not an immediate action will have a major impact on their primary objectives.

- Herd Mentality bias: This is when investors tend to mimic and follow what the majority of other investors are doing without a clear convincing reason to do so. This can be especially disruptive when the market is in the midst of a setback as it can result in a constant chasing of the market both on the exit and the re-entry. A better approach is one that ignores the crowd and is focused on the bigger picture and one's own personal investment objectives. Given the amount of influence the media tends to have these days, a sensationalist headline calling for a correction combined with herd mentality can even potentially become a self-fulling prophecy. As the panic sets in from this, people rush for the exit, and this can drag the market lower without any real justification for the wave of negativity.

Emotional investing impairs judgment and produces worse outcomes. Arguably, it can even pay off to not pay attention most of the time. Not looking at your investments daily, weekly or even monthly can be a healthy development for many people so long as you trust the process and have a committed game plan in place that is diligently followed and objectively reviewed on a regularly scheduled basis. That game plan should consist of a portfolio viewed from a long-term perspective with high-quality businesses that have the discipline and ability to continue to grow and generate cash flow going forward.

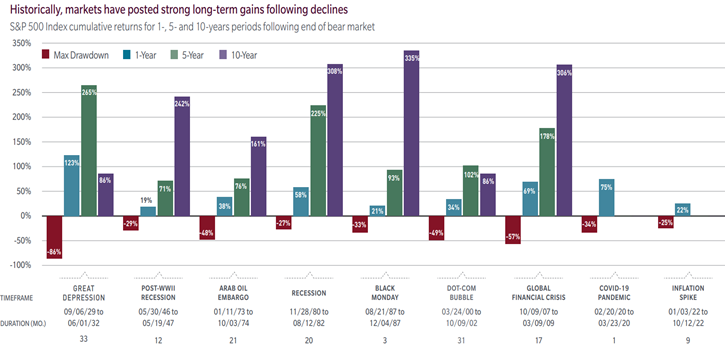

Source: MFS Investment Management - PDF Link - as of Dec. 31st, 2023

With a solid strategy in place, market corrections should become less of a concern even when they do occur. As seen in the chart above, the market has displayed throughout its history that every setback and most major events have provided an opportunity for those willing to remain invested in the market and resist the emotional pull to exit. Within the five to ten years that followed every one of these market corrections, the market was up in the three-digit range. So, while it is tempting to give in to our biases and react abruptly to both the media's negative rhetoric or even a market setback, it usually is not worth the stress and very rarely results in better returns than just carrying on in regular fashion. Adjustments are always necessary, but wholesale changes rarely are rewarded.

JAY SMITH, CIM®, FCSI

Senior Portfolio Manager & Senior Wealth Advisor

BRAD BROWN, MBA, CFA

Portfolio Manager & Associate Investment Advisor