Jay Smith & Brad Brown

October 01, 2024

Monthly commentaryOctober 2024

MONTHLY MARKET MUSINGS

October 2024

Don't Fight The Fed…You'll Lose

As we have been alluding to for the past few months, the U.S. Federal Reserve (Fed) predictably executed its first rate cut, formally shifting to an easing cycle. While the cut was no surprise, the 50-basis point cut was to some degree. The market seemed to have been leaning more towards a 25-basis point initial cut. CIBC Economics continues to anticipate a soft landing for the U.S. economy and notes that the September larger rate cut shifts the timing rather than the magnitude of the projected cuts. For the remainder of the year, CIBC Economics expects another 50-basis point cut in November followed by a 25-basis point cut in December and then further cuts throughout 2025 to bring the Fed Funds rate down to a midpoint of 3.375%. On the Canadian side, the Bank of Canada (BoC) is expected to continue cutting in 2024 and into 2025 similar to the U.S. but the BoC overnight rate is now expected to drop faster than initially thought. CIBC Economics expects that the overnight rate will bottom out in June 2025 at 2.25% with likely two larger 50-basis point cuts coming in the December and January meetings. These anticipated drops in the BoC overnight rate will provide relief for homeowners with mortgage terms up for refinancing in the coming 12-18 months. Specifically, this should alleviate some of the concern regarding the impact of the 5-year term variable rate mortgages which were initiated at peak housing prices in 2020/2021 and are up for refinancing in 2025/2026.

What Happens To The Markets When The Fed Pivots?

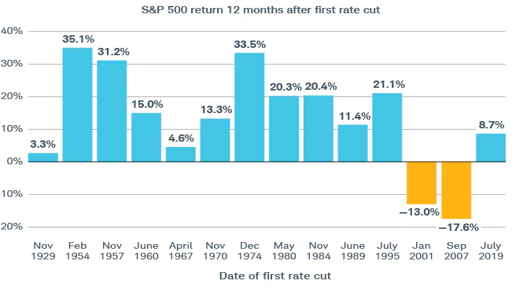

Most people can rationalize that lower interest rates benefit the economy and the markets. Lower rates help consumers by lessening their debt burdens and leaving them with more disposable income. Similarly, corporations also see a drop in interest expenses and borrowing costs, leaving them with more free cash flow which can be used for further capital investments and thus creating growth opportunities. Historically, this has led to solid returns in the twelve months that followed the beginning of a Fed rate cutting cycle. This can be seen in the Charles Schwab table below which dates back to 1929 and shows that, with the exception of the 2001 Dot-com crash and the 2007-2009 Global Financial Crisis, the S&P has posted strong, mostly double-digit returns in the year that followed the kick-off of an easing cycle.

Source: Charles Schwab, https://www.schwab.com/learn/story/what-past-fed-rate-cycles-can-tell-us

Data from 08/09/1929 through 07/31/2020. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

The two exceptions mentioned (2001 & 2007-2009) were reactionary rate cuts at the beginning of major market crises as opposed to a shift in monetary policy and gradual rate cuts. Thus, without a clear triggering event, this cutting cycle seems to be more like those prior positive periods as opposed to the two negative ones. Taking the simple average of these fourteen periods gives us an average return of about 13.4%. Taking this view a bit deeper, Morningstar looked at the periods from 1974 to 2019 following the Fed's first cut and provided the returns for 3 months, 6 months, 1 year, 3 years, and 5 years[1]. In the study, Morningstar carved out the periods where a recession had occurred and those periods where there was no recession. The results showed that when a recession had happened after the first Fed rate cut, returns were negative in the year that followed 66% of the time but were positive 3-5 years following the cut. It is worth noting that Morningstar excluded 1974, 1980, 1981 from the recession averages given that the recessions in those periods were already underway prior to the Fed cutting rates. If we were to include this data, the averages would have been much higher, and the returns would have been positive in recessionary periods 66% of the time 12 months after the initial Fed rate cut.

In the end, with no signs of a crisis on the horizon to sour the economy and negate the benefits of an easing cycle, equities remain our preferred asset class. Lower rates make income-oriented assets less attractive and as we noted above, many corporations may experience a decrease in expenses and an increased capacity for capital investments. This will likely result in further growth, which should drive overall earnings higher and improve profit margins leading to higher share prices.

JAY SMITH, CIM®, FCSI

Senior Portfolio Manager & Senior Wealth Advisor

BRAD BROWN, MBA, CFA

Portfolio Manager & Associate Investment Advisor

[1] https://www.morningstar.ca/ca/news/254399/whats-next-for-us-markets-and-economy-after-the-fed-rate-cut.aspx