Our two previous blog posts have looked at a case study of a client who came to us with a question about buying a second property. In the course of answering their question as to whether it would be better to buy the property using existing investments assets or borrow the funds, we uncovered a few other areas for their consideration. Our last post addressed the personal side of the equation, with a look at the estate implications of their registered assets. This post will address some items for consideration around the client's corporate holdings.

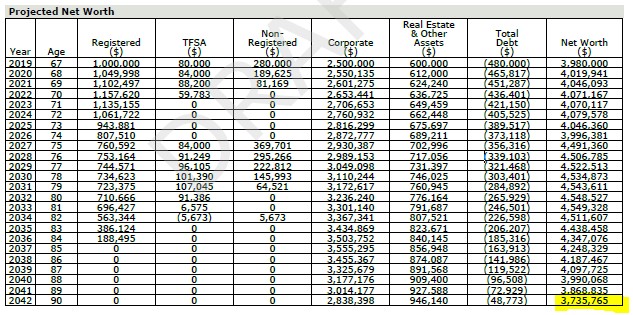

As a reminder, here is the schedule of the client's assets:

As you can see, this client holds significant corporate assets that are expected to grow over the long term. The client intends to pass these assets along to their children and has made plans with their accountant and other professional advisors to ensure this is done as efficiently as possible. It is important to bring in tax and legal professionals for any kind of corporate succession as this can be a complicated process and the details of the succession plan should be worked out well in advance of any transfer.

Building on our previous post, let's assume that the client has determined that they would like to buy insurance to offset some or all their expected estate liability. They now have the option to buy it personally or buy it through their corporation. But why would anyone want to buy insurance through their corporation?

Tax Benefits of Corporate-Owned Insurance

Although life insurance premiums are not generally tax deductible, low corporate tax rates may result in savings on insurance premiums. When the life insurance policy is owned by the corporation, premiums are paid from corporate funds that have only been subject to tax at the corporate level. The corporate tax rate is generally lower than the personal tax rate. When life insurance premiums are paid with personal funds that were earned through a corporation, they are generally subject to tax at a higher rate as salary or taxed at both the corporate and personal levels if received as dividends. So, corporate-paid premiums have a lower after-tax cost than premiums that were paid personally. For example, assume Sally is the sole shareholder and an employee of a private company, and her marginal tax rate is 50%. If Sally acquires life insurance with annual premiums of $2,000.00, she would need to withdraw $4,000.00 in salary to cover the annual premium; however, if the policy was held by the corporation, assuming it pays tax at a 25% tax rate, the pre-tax cost of the premiums would be only $2,666.00. There would be an additional $1,334.00 in the corporation to distribute to Sally as salary. After tax, Sally would have $6674 more than if she had paid the insurance premiums personally.

Tax-Free Life Insurance Proceeds

The death benefit associated with life insurance is generally received on a tax-free basis, whether such proceeds are received by an individual, or by a corporation. So, if the life insurance policy is held by a corporation, the proceeds on death will not be subject to tax within the corporation. As a result, how those proceeds will be paid out to the shareholder(s) of the corporation must be considered.

Capital Dividend Account

The Capital Dividend Account (CDA) is a notional account of a private corporation. An amount equal to the CDA balance at any point in time can be distributed to shareholders as tax-free capital dividends. Amounts added to the CDA include certain tax-free amounts received by the corporation, including the life insurance death benefit less the adjusted cost basis (ACB) of the policy.

If the ACB is nil, then the entire proceeds of the policy would be added to the CDA. As long as there is a positive balance in the CDA, 100% of the insurance proceeds can be paid out to the shareholder tax-free.

It is important to note that it is not safe to assume that the ACB of the policy will be always be nil. The ACB of a policy may take years to decline to zero. Until that time, a portion of the life insurance proceeds will not be available to be added to the CDA and will be subject to tax when ultimately distributed to the shareholder.

Determining whether to hold life insurance personally or corporately is a decision that should be made in concert with your tax and legal advisor. There are implications to both options, however if the circumstances are favorable, it can be extremely beneficial to hold insurance through your corporation. Should you have any questions about corporate owned insurance, or your overall business succession plan, please do not hesitate to contact any one of us at your convenience.