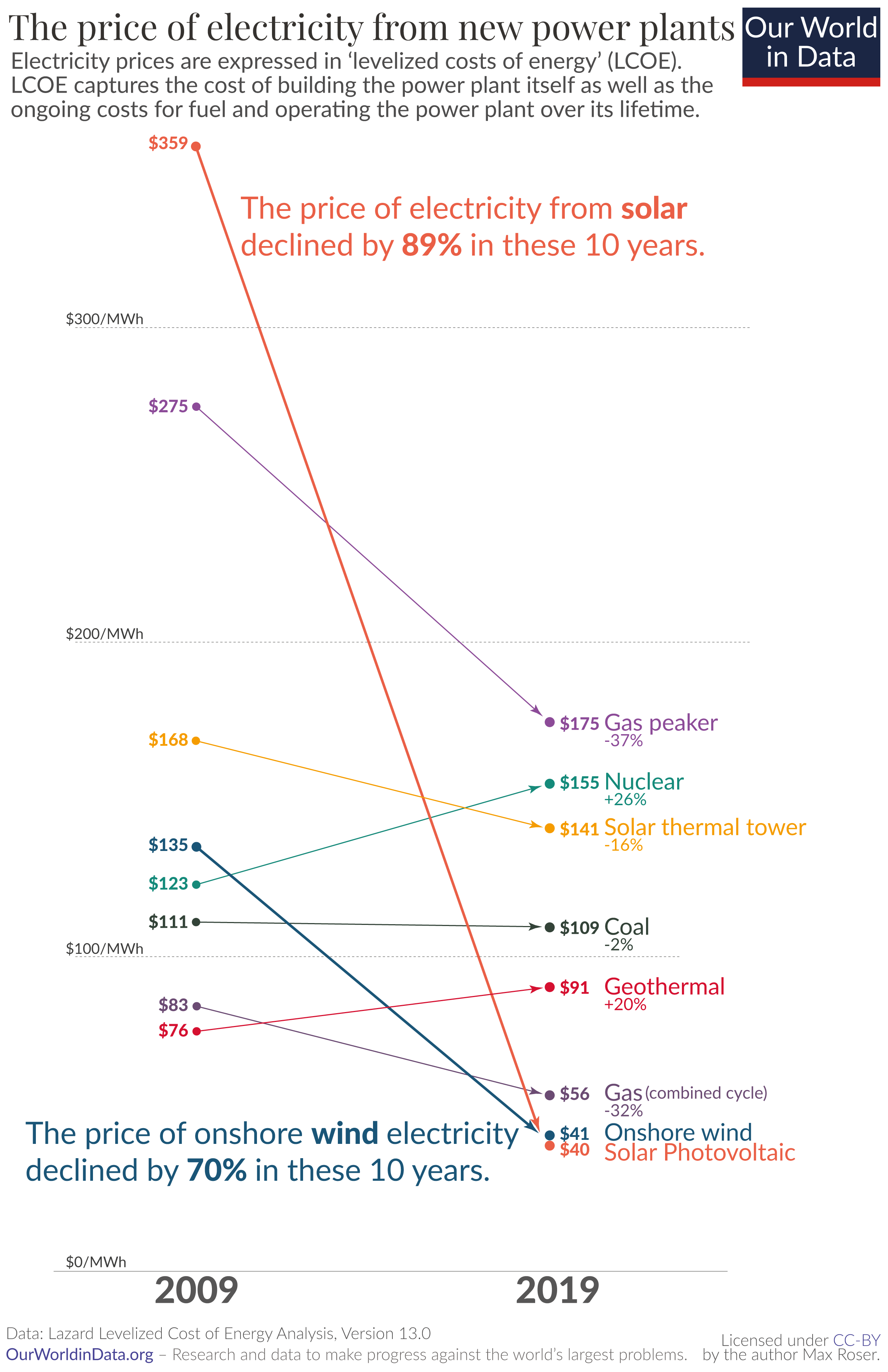

This infographic from Ourworldindata.org tells a fascinating story about the price of electricity from various sources over the past ten years. I've had conversations with clients who are hesitant to look at renewables as part of their portfolio because they're still under the impression that it's too expensive compared to traditional fossil fuels. This may have been the case a decade ago, but that is changing and it's changing quickly.

Source: https://ourworldindata.org/cheap-renewables-growth

The main thrust of the article is that many renewable energy sources have benefited from an exponential improvement in the underlying technology over the past decade and more. Whereas traditional fossil fuels have to contend with both the cost of technology to build generation plans as well as the cost of the fuels themselves, renewable prices are determined primarily by the cost of the underlying technology. And that technology has gotten a whole lot cheaper over the past few years. As the technology improves, prices fall. As prices fall more capacity is brought online, spurring more demand and greater interest in the sector. This leads to more improvements in the underlying technology and you end up with a self-perpetuating cycle of technology growth and price decline.

The full article also spends some time looking at Wright's Law and Moore's Law and how they apply to solar technology. However, if you're looking for the takeaway it is this: the energy sector is changing in a fundamental way, spurred in large part by the falling costs in technologies related to renewable energy. While it may not have been cost effective for energy firms to consider renewable energy sources when building new plants a decade ago, that calculus has changed. Looking ahead we can expect to see greater adoption of renewables and, likely, stagnation for some of the traditional fossil fuel sources of electricity like coal and natural gas.

The full article is here: https://ourworldindata.org/cheap-renewables-growth. Please feel free to reach out to us if you have any questions about it or if you would like to discuss ways in which you can position your portfolio for a greener future.