Pharus Wealth Advisory Group

August 13, 2024

Monthly commentaryPharus Perspectives - August 2024

As we near the end of summer, we’ve witnessed a season full of extraordinary events. The financial markets have reached record-breaking highs, market volatility is back and the GTA has experienced unprecedented rainfall, levels not seen since 2008. In this issue, we are thrilled to bring you the latest updates, group news, and insightful economic trends. Stay tuned below for all the details and more!

Monthly Markets Report

Key Insights

In recent times, market volatility made a comeback and has been influenced by several factors, including the Bank of Japan’s rate hike and weaker-than-expected U.S. jobs data. Let’s look at the economic situation that we face:

Global Sovereign Debt Concerns

High national debts in Europe, Japan, and the U.S. are raising concerns, with France, Italy, and Japan facing significant fiscal challenges due to high debt-to-GDP ratios and budget deficits.

U.S. Fiscal Outlook

The U.S. national debt reached $33.2 trillion (120% of GDP) in fiscal 2023, with deficits expected to continue. Interest payments on the debt are rising, consuming a larger portion of government revenue. Despite the recent market volatility, U.S economic activity and consumer spending continue to show strength. The various forecasts indicate steady growth, and there is an expectation that the Federal Reserve may start lowering interest rates by September.

Canada’s Relative Stability

Canada’s fiscal situation is comparatively better, with a net national debt of 42.2% of GDP and a budget deficit of 1.3% in fiscal 2023. This positions Canada favorably against its peers. However, Canada faces persistent productivity challenges, exacerbated by rapid population growth. This situation has led to high wage inflation despite rising unemployment. Addressing these productivity issues is essential for sustainable economic growth and competitiveness.

Eurozone Recovery

The Eurozone is expected to experience moderate economic recovery, driven by consumer spending and net exports. However, inflation challenges persist, requiring careful policy management. Investors should monitor these developments to identify potential investment opportunities in the region.

China’s Economic Struggles

China’s economic growth is hindered by a downturn in residential construction and inadequate policy responses. More stimulus is needed to support the economy and drive growth. Understanding these dynamics is crucial for investors looking to engage with the Chinese market.

Portfolio Strategies

The recent downturn in U.S. markets, driven by disappointing job numbers and economic uncertainties, has sent ripples through global markets, leading to a significant sell-off in equities. In response, our portfolios have been strategically adjusted to provide cushion against potential risks but stay agile to take advantage of growth opportunities and sticking to the core principles. Diversification and maintaining a high-quality bias are fundamental strategies that can help navigate through market turbulence. By spreading investments across various asset classes and focusing on high-quality assets, we can mitigate risks and enhance potential returns.

Performance Highlights by Region and Sector

While U.S. equities, especially tech stocks, have faced sharp declines, defensive sectors such as Real Estate and Utilities have shown resilience and gains. Interestingly, Canadian equities have outperformed their U.S. counterparts, showcasing relative stability in these turbulent times.

Equities: The Resilience of High-Quality Companies

Despite recent selloffs, high-quality companies have a track record of delivering healthy earnings through different market cycles. Investing in these companies can provide stability and growth, even when the market is volatile.

Fixed Income: Reading the Yield Curve

The recent steepening of the U.S. yield curve suggests that investors are anticipating easier monetary policy ahead. This can be a signal to adjust fixed income strategies, accordingly, potentially favoring longer-duration bonds. Investors should consider diversifying their portfolios with corporate bonds, given the better condition of corporate balance sheets compared to sovereign debt, especially in light of potential U.S. debt ceiling issues.

| Market Performance – July 31, 2024 | ||||||

| Index | 1 Month | 3 Months | YTD | 1 year | 3 Years | 5 years |

| S&P TSX | 5.60% | 6.40% | 10.30% | 12.00% | 4.40% | 7.10% |

| S&P 500 | 1.10% | 9.70% | 15.80% | 20.30% | 7.90% | 13.10% |

| NASDAQ | -0.80% | 12.40% | 17.20% | 22.70% | 6.30% | 16.60% |

| MSCI EAFE | 2.90% | 4.40% | 6.50% | 8.30% | 0.90% | 4.70% |

| MSCI Emerg. Mkts | -0.10% | 3.70% | 6.00% | 3.60% | -5.30% | 0.90% |

| MSCI World | 1.70% | 8.10% | 12.70% | 16.60% | 5.20% | 10.30% |

| FTSE Canada Bond Univ. | 2.40% | 5.40% | 2.00% | 7.30% | -1.21% | 0.08% |

Click here to access all market returns.

If you are interested in GIC rates, we have attached a collection of GICs with this email that we could help you with.

CIBC Smart Advice Feature

Economic update: 5 key insights from CIBC’s Chief Economist

The Canadian economy is at a pivotal moment, with inflation, interest rates and consumer confidence playing central roles in shaping the financial landscape. CIBC’s Chief Economist, Avery Shenfeld, shares his view on what Canadians can expect for the remainder of 2024.

Interest Rate Cuts: The Bank of Canada has reduced interest rates to 4.5%, signaling potential economic relief, but more cuts are needed to make borrowing more affordable.

Spending and Savings: Rising mortgage costs have led Canadians to save more and spend less. A decline in interest rates is expected to boost spending, especially in housing-related sectors.

Inflation: Rent and mortgage interest costs are key to reaching the Bank of Canada’s 2% inflation target. Changes in immigration policies may help ease rent inflation by 2025.

Economic Growth: Slow economic growth is expected for the rest of 2024, with hopes for improvement in 2025 following further interest rate cuts.

Investment Opportunities: While equities may be fully valued, there are opportunities in the bond market that could provide shelter from market volatility.

Click Here to Access the Full Article

Financial Planning Feature

Impact of New Capital Gains Inclusion Rates on Cottage Owners

As of June 25, 2024, the Canadian government has introduced new capital gains inclusion rates, significantly affecting cottage owners. The new policy allows individuals to benefit from a 50% inclusion rate for the first $250,000 of capital gains on the sale of a cottage. This change aims to provide tax relief and encourage the sale of secondary properties. However, gains exceeding this threshold will be subject to the standard inclusion rate, potentially increasing the tax burden for high-value properties. The below article from Advocis.ca outlines the impact of the capital gains inclusion rate on cottage owners. This summary highlights the key points and potential tax impacts for cottage owners under the new capital gains inclusion rates.

Scenario Analysis:

Scenario 1 - Single Ownership: Charlotte inherited a cottage valued at $350,000 in 2001. Upon her death in November 2024, with the cottage now worth $1,350,000, the capital gains tax would be $334,563 due to the new inclusion rates.

Scenario 2: Renovation Costs: If Charlotte’s children find receipts for $200,000 in renovations, the adjusted cost base increases, reducing the capital gains tax to $263,190.

Scenario 3: Joint Ownership: If Charlotte and her brother Philippe inherited the cottage together, each would face a capital gain of $400,000 upon their deaths. The combined tax would be $240,886, lower than if Charlotte owned it alone.

Scenario 4: Mitigating Tax with Life Insurance: To avoid selling the cottage to cover taxes, Charlotte’s and Philippe’s children could purchase life insurance, covering the $240,886 tax liability.

Investment Feature

In this section, we educate the reader on different investments. We discuss and elaborate each idea over a couple monthly editions. This section is not to be taken as specific investment advice.

The Idea of Investing in DISCOUNT BONDS

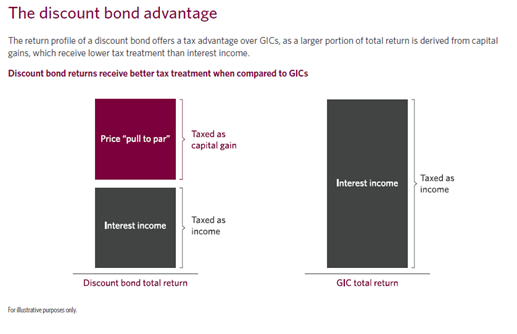

Due to the rapid increase in interest rates over last couple of years, both government and corporate bonds are currently trading at a discount to their par value – a phenomenon that has not occurred since the 1980s.

Investors may benefit from buying bonds at a discount due to their potential tax advantages.

Investors may benefit from buying bonds at a discount due to their potential tax advantages. For example, two bonds with the same yield to maturity at 5% and a one-year duration hold different benefits.

Bond A

-

-

- Trades at $100 with a 5% coupon.

- Maturity value of $100.

- Returns fully taxed as interest income.

-

Bond B

-

-

- Trades at $90 with a mix of price appreciation and its coupon.

- Taxed as a combination of capital gains and interest.

-

After-Tax Returns: Because Bond B is trading at a discount, it can potentially offer better after-tax returns, making it preferable for investors in non-registered accounts. Bond A, on the other hand, would be taxed as income, which is often at a higher rate for investors.

Fun Feature

Experience the Excitement of the Canadian National Exhibition 2024!

As summer draws to a close, there’s no better way to celebrate than at the Canadian National Exhibition (CNE), fondly known as “The Ex.” From August 16th to September 2nd, in Toronto, enjoy 18 days of fun with thrilling rides, captivating performances, and a diverse selection of food trucks at the Food Truck Frenzy and Craft Beer Festival.

Highlights include:

- Food Truck Frenzy and Craft Beer Festival: Unique treats and craft beers.

- Thrilling Rides: Classic favorites and new attractions.

- Live Performances: Music concerts, acrobatic displays, and cultural shows.

- Gaming Garage: eSports tournaments, VR experiences, and interactive games.

- Innovation Garage: Latest technology and interactive exhibits.

- Celebrity Chef Stage: Live cooking demos from renowned chefs.

- SuperDogs Show: Talented dogs performing amazing tricks.

Wrap up your summer with family and friends at the CNE! For more information, visit The Ex’s official website. Are you planning to visit this year?

Click here for CNE’s Official Website.

Pharus Corner

The Pharus Corner is a special feature with the purpose to keep you apprised of relevant updates on our Team, what’s going on in our lives and about upcoming events that we wish to host for you.

Currently we are working on 2 exclusive events:

- Economic Beat and Tax Strategies: We are bringing together two of Canada’s preeminent experts for an inside view on the macroeconomic situation in Canada and globally, to share insights into advanced tax and wealth strategies. Featuring Benjamin Tal and Jamie Golombek, we will dig deep to get a beat on where the economy is going and key strategies on closing off this tax year. The event is scheduled for September 19th, 2024, at CIBC Square.

- Investment Landscape Overview and Private Equity Opportunities: We are inviting the globally renowned Private Equity asset manager KKR & Co Inc. along with CIBC Asset Management. They will delve into current investment trends, value creating strategies and special insights on Private Equity and leveraged buyout strategies from KKR & Co. Inc. The event is scheduled for October 17th, 2024, at CIBC Square.

Hope you enjoyed the read. For any Financial Planning, Investments or Insurance related questions, feel free to reach out to our office to get personalized assistance.