What Country Should You Invest Your Money In?

The term "reserve currency" refers to a currency widely accepted for international transactions, granting significant economic power to the issuing country. This concept has existed for centuries, beginning with Portugal around 1450. Today, consider how, when booking an international flight or purchasing goods from overseas, you often pay in US dollars. This is because the greenback currently serves as the world’s reserve currency. Taking a wider view, you can understand why the US dollar is widely used in global trade and financial transactions due to its stability, the size of the US economy, its role in pricing key commodities like oil, its dominance in international debt markets, and the trust in US financial institutions.

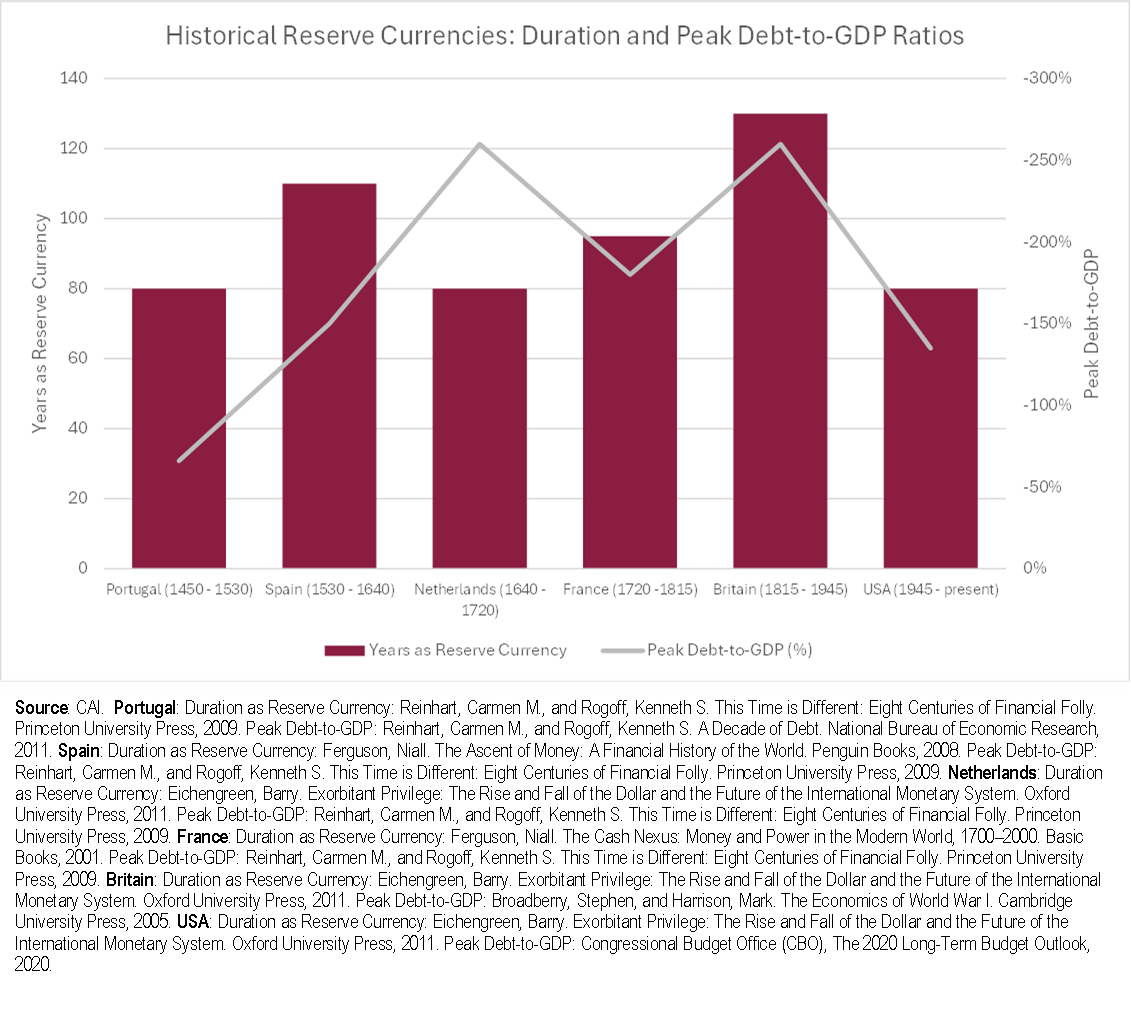

The chart below, starting with the aforementioned Portugal, shows the countries that have played the role in the past that the US does now, global economic and financial superpower, with the red bars indicating how long each country’s currency laid claim to world’s reserve currency. Of note, over the centuries, these countries have passed the baton of their role as global economic leaders, but none of them disappeared into oblivion when they stopped being the world’s reserve currency as the pundits today would have us believe about the US.

As of 2023, the United States remains the world’s largest economy by nominal GDP ($26.9 trillion), driven by its robust services, manufacturing, and technology sectors. It also boasts the largest and most liquid stock and bond markets globally, known for their transparency, regulation, and adherence to the rule of law. Additionally, the US dollar has dominated global financial systems as the world’s reserve currency since the Bretton Woods System was established in 1945 following World War II.

On top of all that, the US is home to some of the world’s most recognizable and successful companies, and we can’t help but think that: consumers will still buy a Coca Cola on a hot summer day, do-it-yourself homeowners will head to Home Depot to buy a replacement faucet, a finance student will pick up a Texas Instruments BA II Plus, contractors will replace their Ford, RAM, or GMC pick-up with another. In addition, although many other well-known companies are domiciled in the US, their businesses are global in nature and generate a significant portion of their revenue globally, and you’re probably familiar with some of them: Apple Inc., Microsoft Corporation, McDonald’s Corporation, and Proctor & Gamble, to name just a few. Just as Brookfield Asset Management, though headquartered in New York, is a “Canadian” company it operates as a truly global business with investments spanning numerous markets, countries, and currencies. Likewise, we apply this global perspective to the dollars our clients entrust to us.

Finally, because we’re their immediate and friendly neighbours to the north, Canada has benefited and prospered due to the geographical ease of north south trade with such an economic and financial powerhouse.

We recognize that the significant government debts in the US and Canada, along with ongoing political tensions, are ongoing issues that we need to follow. However, for investors seeking short-term income and long-term growth, we still suggest you consider cash for immediate needs and investing in a well-balanced portfolio of Canadian, US, and global publicly traded businesses (often referred to as stocks, but better understood as ownership in businesses) to help achieve your financial goals.

Randy, Ian, and Harrison