“That Guy Who Tweets Down South”

In client reviews, especially with clients who have more life experience, they often say, “I have never seen anything like this,” or, “We will see what happens with that guy who tweets down south”—and I don’t think they are talking about the governor of California!

Things are as good or bad as what we focus on, read about constantly, and consume daily on our phones, as this creates our own reality, which is further compounded by the dubious algorithms that feed us more of the same. In fact, in conversations with clients, it is interesting that people’s mood and anxiety levels are often a direct reflection of their news feed, as opposed to what is really going on.

In 1990, when I moved to Calgary1, I can still recall eating breakfast one day and “watching the news” as the US invaded Kuwait. It was the story, and the media made a massive deal of it, just like they are about Venezuela today or the Middle East last year. Now, we do not mean to ever downplay the realities of the human suffering that goes on in the world. We are fully aware of that, and that there are global issues. For those challenges, we encourage you to respond in ways that foster hope and a greater sense of control—something that social and legacy media seldom provide. These approaches can range from charitable giving to seeking out reference materials that offer a deeper understanding of the how and why—insights which, interestingly, sometimes date back centuries and often challenge the old adages, “this is new” or “we’ve never seen this before.”

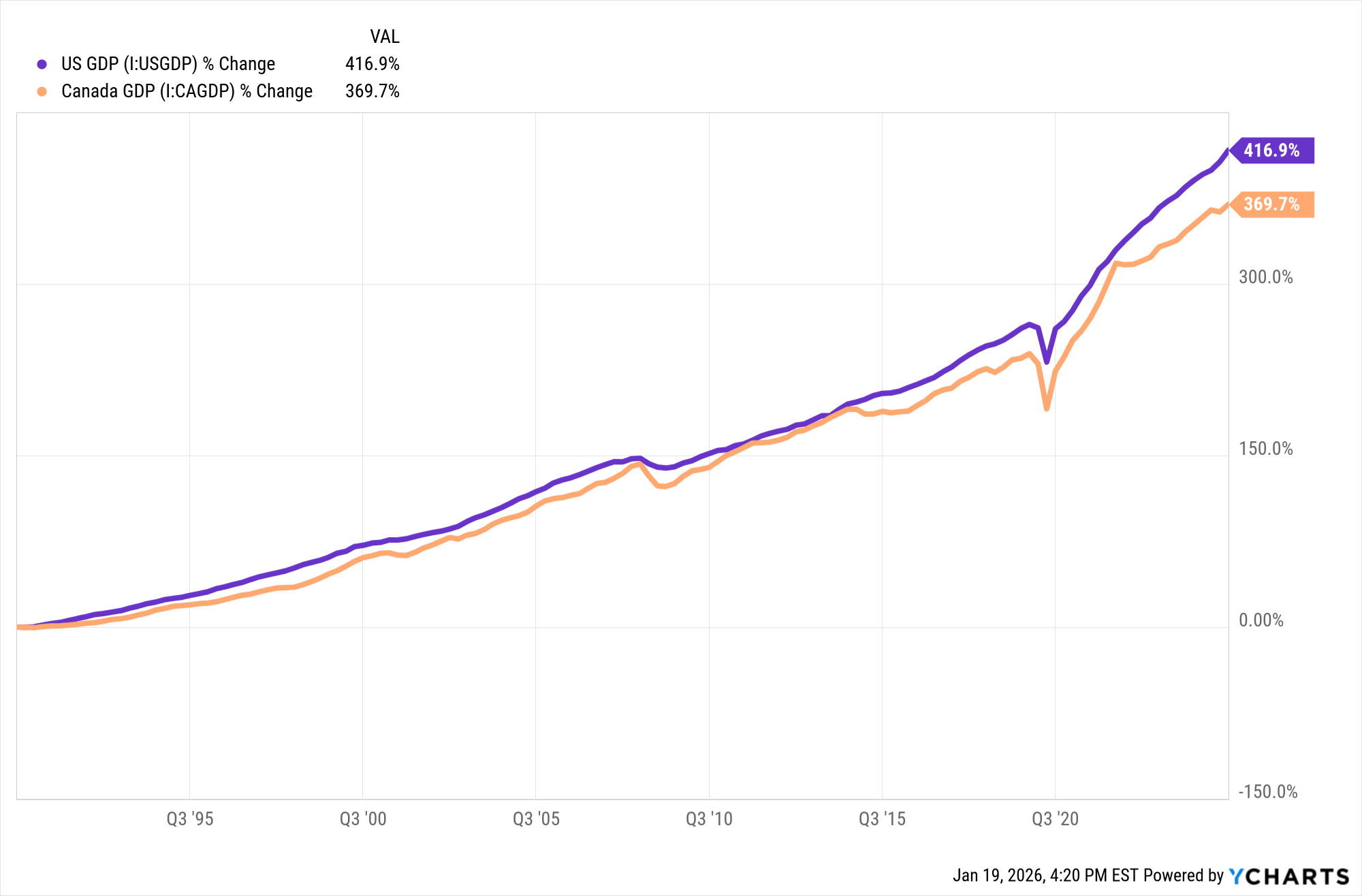

What we are discussing here is the relationship between economics and your portfolio. Since the onset of the war in Kuwait on August 2, 1990—which concluded on February 28, 1991 and dominated television coverage during that period—both US and Canadian GDP have exhibited the following growth2:

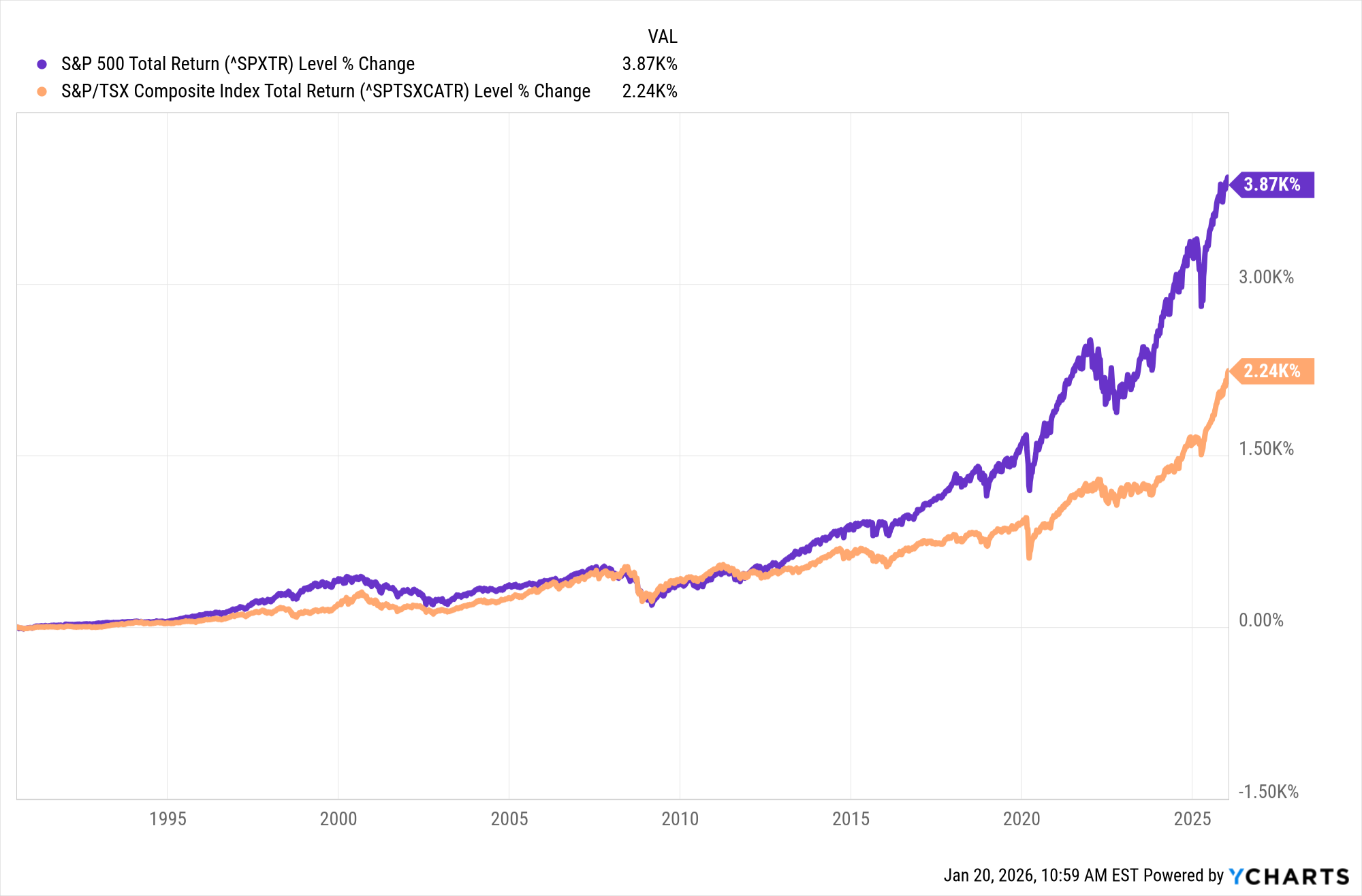

And each country’s stock market has grown as shown below3:

This is why we stand by these three maxims:

- We invest in companies, not media noise.

- Companies and their executives strive daily to enhance business performance.

- Over the long-term, economic issues work themselves out, and that is in spite of what the government does to “fix things”.

Optimism truly is the only realism, and along the way, the markets will have fits and starts, and ups and downs. That is normal and to be expected.

Keep your short-term cash bucket full and your long-term bucket invested—that is the recipe for success.

Randy, Ian, and Harrison

1. Randy's arrival!

2. US GDP: Quarterly Seasonally Adjusted Annual Rate (USD), as of December 23, 2025. Canada GDP: Quarterly Seasonally Adjusted Annual Rate (CAD), as of November 28, 2025.

3. S&P 500 Total Return (USD), as of January 20, 2026. S&P/TSX Composite Index Total Return (CAD), as of January 20, 2026