Robert Mill

March 18, 2022

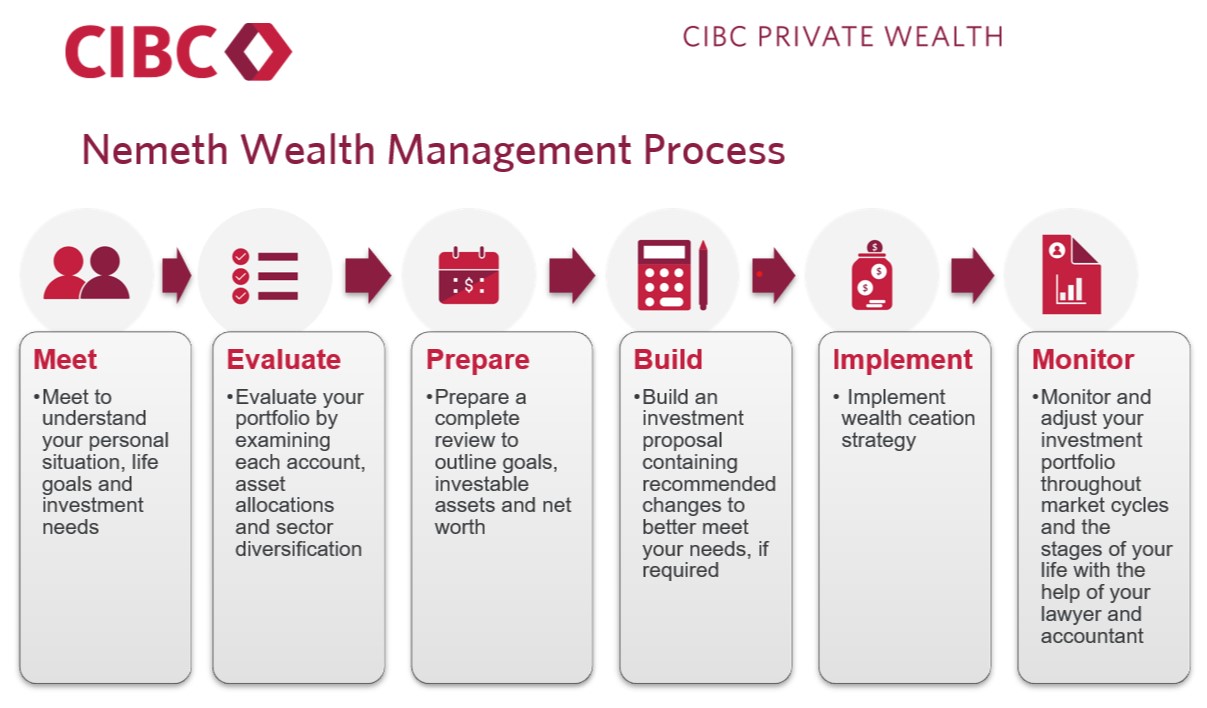

Money Financial literacy EconomyThe Six Step Wealth Management Plan

As you head towards retirement, a well balanced portfolio and guaranteed sources of income such as a pension plan sets you on track to accumulate the resources to create a life long income-stream. In order to ensure your wealth management plan is sustainable and tax-efficient, it is important to understand how you want to use your savings and how much money you want to withdraw on a yearly basis. Some options to consider is using your savings include estate planning for your loved ones, any charitable donations to organizations that are dear to you. It is important that general financial objectives be broken down into specific, measurable, realistic,and time-bound goals. Creating a prioritized list of your individual goals helps create clarity for your decision making in pursuit of the optimal financial plan. Some examples are as follows:

- Design a retirement income plan to account for full retirement as of a specific date

- Budget a specific amount for travel and leisure

- Maximize estate for your children

The Nemeth Wealth Management (NWM) process involves six steps that are fully customizable to your specific needs. This process is based on long term sustainable growth, and does not rely on short term speculation.

Step 1: Meet

Part of our core beliefs at NWM is establishing long term relationships with our clients and understanding their personal needs. We strive to understand your personal life situation, your goals, and your investment needs.

Step 2: Evaluate

With an Investment Advisor (IA), go over your current portfolio and recommend any changes, if necessary. You can trust that at NWM we provide the a high quality of expertise in our evaluations. With over 34 years of industry experience, Richard has met all of the most stringent qualifications and industry certifications.

Step 3: Prepare

At this point we create a personalized set of goals, investable assets and net worth of each client, so they gain clarity in their investment timeline taking into account their risk level and time horizon. You will receive a complete document containing visuals and in depth description of our targets.

Step 4: Build

Building a comprehensive plan that is flexible but rooted in strong, long term oriented investment principles. Our exclusive Delaware Income Portfolio (DIP) has outperformed the benchmark (50% FTSE Canadian Universal Bond Index, 50% S&P/TSX Composite Index) every year since its inception nine years ago. You can learn more about the DIP portfolio here.

Step 5: Implement

We provide you with open communication and support in every step of your implementation process, including any adjustments, if needed. You can contact our team at any time to discuss your investment process and learn more about the state of each of our holdings in the Delaware Portfolio.

Step 6: Monitor

We monitor you portfolio on a daily bases and make adjustments as necessary based on market cycles and monetary/fiscal policies so you can have the peace of mind that your portfolio is in the best position. Our top ranked research team provides you with best in class research and advice for investing in the ever-changing economy.