Smith Falconer Financial Group

February 25, 2024

Contributions

To be eligible for a Registered Retirement Savings Plan (RRSP) deduction for any given tax year, you must either contribute within that calendar year, or in the first 60-days of the following year. This Thursday, February 29th, 2024 is the last day to make an RRSP contribution for the 2023 tax year. The 2023 contribution limit is 18% of the previous years’ earned income to a maximum of $30,780.

While many Canadians will aim to make their 2023 RRSP contribution before this deadline, we are writing about the benefits of making your 2024 RRSP contribution as early in the calendar year as possible. The 2024 contribution limit is 18% of the previous years’ earned income to a maximum of $31,560.

In order to take full advantage of the tax-sheltered growth of an RRSP, savings should be allocated as soon as possible. Ideally, January of the calendar year that it is for.

Waiting until February of the following year means that you miss out on an additional 14-months of tax-sheltered growth that can compound to a significant amount overtime.

An EdgePoint article we have routinely referred to in our blog is Compounding’s Magic. We continue to look to this article to succinctly summarize the impact compounding has on long-term outcomes.

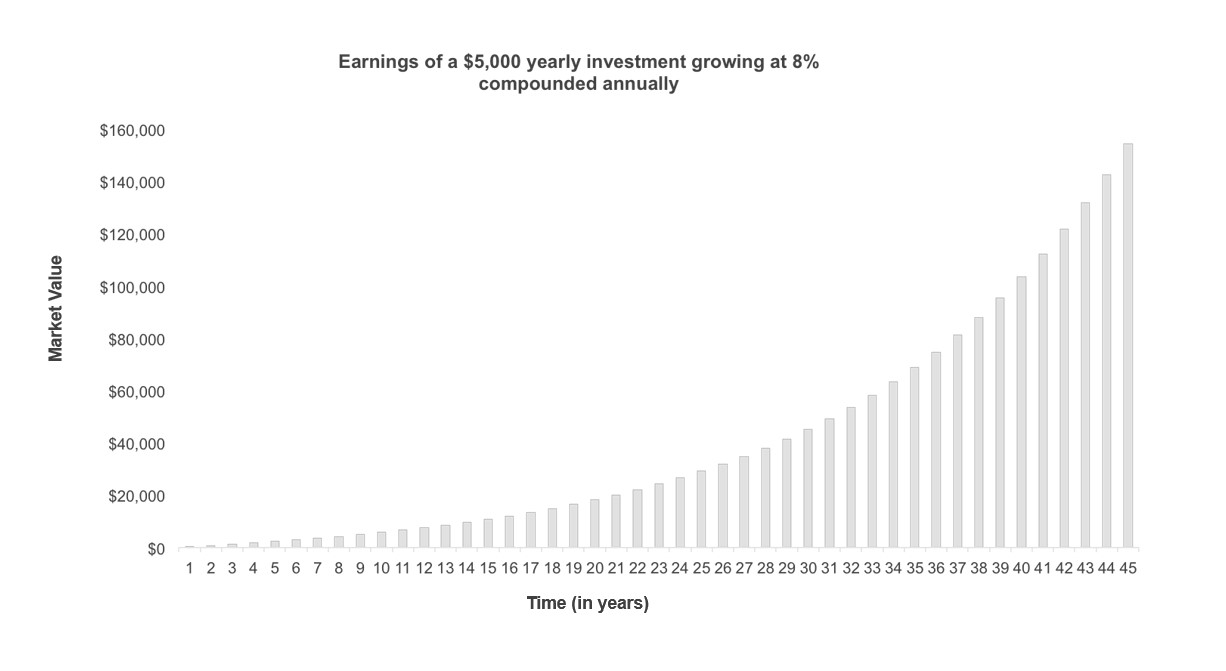

This week, we reflect on The Procrastination Blues. In this section, they share the implications of deciding to delay just a $5,000 contribution to your portfolio by one-year. They conclude that waiting 12-months longer to invest the $5,000 translates to “an earnings loss of more than $150,000 in the 45th year of your investment assuming an 8% return”.

They caution that many investors believe that in delaying their contributions they are simply forfeiting a year of savings. However, they must consider the significant long-term earnings they are giving up.

This is an important consideration when determining the best approach to making your RRSP contributions. Smith Falconer Financial Group (SFFG) strongly believes that you should contribute as soon as you have the capacity to. This ensures that you maximize your ability to tax-shelter growth, for the benefit of your retirement years.

Reference and Chart Source:

EdgePoint Wealth Management Inc. “Compounding’s Magic (Or How $5k Can Cost You $150k)”. https://edgepointwealth.com/article/compoundings-magic-or-how-usd5k-can-cost-you-usd150k/