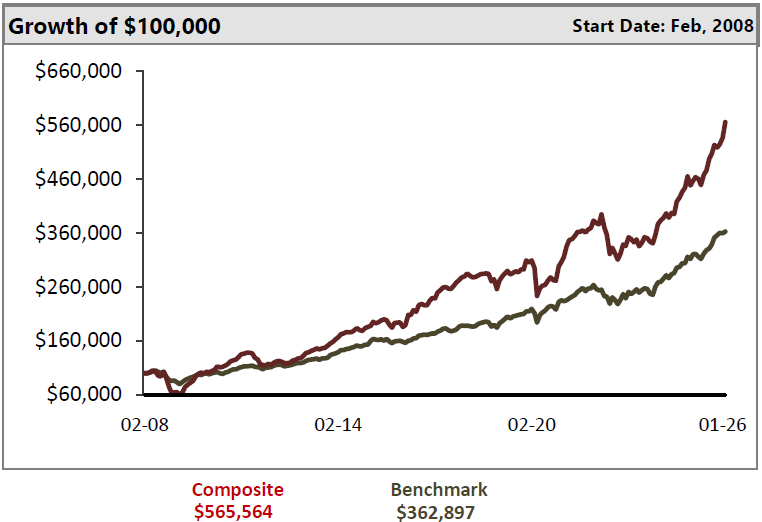

Leacock Group Income and Value Portfolio: Growth of $100,000 as of January 31, 2026

This graph depicts the growth in value of a $100,000 investment in the Leacock Group's Income and Value portfolio. An initial investment of $100,000 made in February 2008 would be worth $565,564 as of January 31, 2026, while a $100,000 investment in the portfolio's benchmark would have grown to $362,897 over the same time period.

Quarterly AMA Factsheet

Performance results set out in these documents are based on composite of CIBC Wood Gundy Advisor Managed Accounts ("AMA") with more that $75,000 invested in a specified investment strategy managed by the AMA Portfolio Manager. Composite inception date is based after the second month the first AMA account opened in the strategy. The subsequent AMA accounts in the strategy are included after second month following their inception. Also included in the composite are closed AMA accounts that held in the strategy, up to the last full month the strategy was held. Composite performance returns are geometrically linked and calculated by weighting each AMA account's monthly performance, including changes in securities values, and accrued income (i.e. dividend and interest), against its market value at the beginning of each month, as represented by the market value at the opening of the first business day of each month. Performance results are expressed in stated strategy's base currency and are calculated based on gross of fees. Individual account performance results for clients of AMA invested in the Strategy may also materially differ from the performance results set out in this document, which are based on the Composite, due to the factors described above, and other factors such as an account's size, the length of time the Strategy has been held, cash flows in and out of the individual AMA client account, trade execution timing, market conditions and movements, trading prices, foreign exchange rates, specific client constraints against purchasing securities of related and connected issuers to CIBC Wood Gundy.