Bram Houghton

May 29, 2023

Economy CommentaryBi-Weekly Market Update - May 19th, 2023

Wicks Houghton group BI-Weekly Market Update

In a nutshell: Inflation shows signs of persistence, validating the thesis that we will need to see recessionary conditions in developed economies to tame it to Central Bank targets. The signs of softening continue show as we consider retail sales, jobless claims and lending conditions tightening across North America.

The April annual inflation rate in Canada rose higher than the expectation to 4.4%. This is the first acceleration in headline CPI since June 2022. Canadians paid more in rent and mortgage interest costs.

Canadian retail sales decreased in March, in line with consensus. The decrease was led by motor vehicles and parts dealers, with five of nine subsectors contracting. Retail sales volumes also decreased in March.

Canada’s April New Housing Price Index declined 0.1% monthly. The Index decreased by 0.2% annually in April, the first decline since November 2019. The rapid increase in interest costs since April 2022 contributed to lower new home prices.

The annual inflation rate in the U.S. fell to 4.9% in April vs. the 5% expected, while Core Consumer Price Index rose 0.4% in line with forecasts. The reading increased bets that the Fed will pause interest rate hikes in June and cut later in the year.

The Fed's quarterly Senior Loan Officer Opinion Survey, or SLOOS, among the first measures of sentiment across the banking sector since the recent run of bank failures, showed a net 46.0% of banks tightened terms of credit for a key category of business loans for medium and large businesses compared with 44.8% in the prior survey in January.

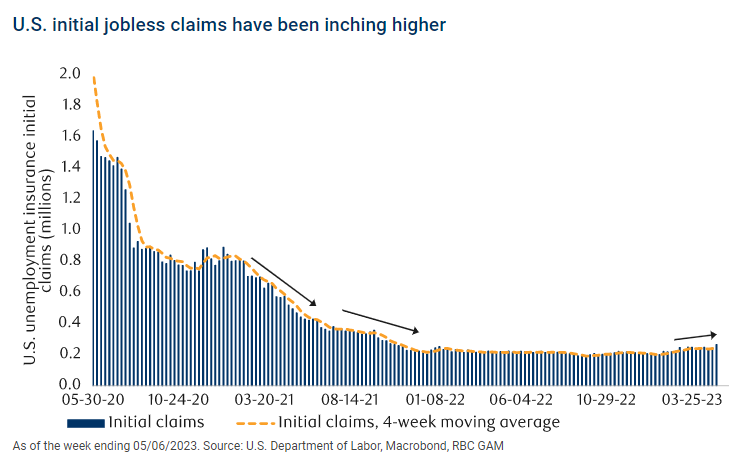

Last week, it was revealed that 264,000 jobless claims were filed in the United States, which was the highest outcome since October 2021, representing a 9% increase compared to the previous reading. The number contracted this week however to 242,000. The drop was the largest since Nov. 20, 2021. Economists polled by Reuters had forecast 254,000 for the week.

U.S. retail sales rose 0.4% monthly but below estimates of 0.8% growth. Sales in building materials, garden stores, health and personal care rose while furniture, clothing and grocery sales declined.

The University of Michigan's preliminary reading on the overall index of consumer sentiment came in at 57.7 this month, the lowest reading since last November and down from 63.5 in April. Economists polled by Reuters had forecast a preliminary reading of 63.0.

Bank of England raised the Bank Rate by 25bps to 4.5%, its twelfth consecutive rate hike.

U.K.'s gross domestic product grew just 0.1% in Q1 from the previous quarter while, industrial production in March slightly increased to 0.7% for the month. Data also showed economic expansion slowed to a crawl in the euro zone, which grew by 0.1% in the first quarter. British retail sales growth held steady in April as spending increased 5.1% in annual terms.

German industrial production fell more than expected in March by 3.4% vs. a 1.3% decline expected partly due to a weak performance by the automotive sector, raising recession fears.

Chinese Industrial production for April rose 5.6% annualized vs. 10.9% expected, and retail sales rose by 18.4% vs. 21% consensus. China’s trade data also showed a decline in imports of 1.4% and a slowed growth in exports of 8.5%, calling into question domestic demand strength.

Oil prices are flat over the two weeks with the usual pressures pulling in opposing directions with supply tightening from OPEC+ and concerns about fuel demand in the top global oil consumers, US and China.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | FLAT | +1.6% | +0.4% | +3.0% | +0.9% | +2.3% | -2.0% |

| Last Week | -0.6% | -0.3% | -1.1% | +0.4% | +0.2% | -1.8% | -0.2% |

Can you solve the neutral rate challenge? by Avery Shenfeld Link to Article

Recent labour market data has made it unlikely that there will be any near-term rate cuts in the US and Canada, and there is still a risk of another rate hike in Canada. However, a deceleration in inflation may give the Bank of Canada the freedom to wait and see. If there is just a long pause through 2023, markets will remain convinced that next year will bring a policy ease. The Bank of Canada estimates the neutral rate to be 2.5%, but the policy rate was persistently below the neutral rate in the past, which allowed 10-year bond yields to hover below the neutral rate. However, it is unclear why this was the case, and the answer will determine whether we can expect a long period where overnight rates are below neutral. Trade barriers and energy transition costs may keep goods inflation on a firmer trend, while fiscal restraint may require a more stimulative monetary stance. If neutral is the norm for overnight rates, it may require 10-year bonds to settle near 3%, resulting in an unsustainable upward-sloping yield curve.

Global Insights

Bank Problems Aren’t Over, But It’s Not 2008 by Brian S. Wesbury Link to Article

The current banking problems in the US can be compared to the 1970s Savings & Loan crisis rather than the 2008 financial crisis. The problems the banking sector has experienced are duration (asset-liability) problems rather than credit problems. The Federal Reserve held interest rates too low for too long, which encouraged institutions to hold long-term fixed rate mortgages. This resulted in huge losses when short-term rates rose above rates on loans. Similarly, today, banks got stuffed with deposits at the same time government debt exploded due to Quantitative Easing (QE), and banks could pay depositors very little while holding long-term bonds. Now that the Fed is lifting interest rates, bank assets bought at lower rates are worth less, and rates paid on deposits are higher than rates earned on many assets, resulting in huge losses. The Fed is backstopping the problem by taking back government debt at par, which restarts QE and helps the government at the expense of private sector loans. More small, medium, and regional banks may get in trouble if the Fed does not insure all deposits. While M2 has contracted by 4.1%, it is still up from pre-pandemic levels, resulting in inflation likely to remain elevated, and the Fed unlikely to cut rates anytime soon. There may be more banking problems, but they will likely be dealt with by policies that kick the can down the road.

MacroMemo - May 16 -29, 2023 by Eric Lascelles Link to Article

Banking stress

The Fed’s special liquidity program can help stop a bank run, but if depositors continue to withdraw their money, the program may not be enough to keep the banks operational. Although the liquidity program allows banks to pay out their depositors, the cost of the new funding is much more expensive, which makes it hard for the bank to run viably. Even if the bank stabilizes eventually, it may be unlikely to rebuild its deposit base over a reasonable timeframe. commercial real estate sector and smaller business clients. At the most negative end of the spectrum, this situation could develop into a crisis like the US savings and loan crisis of the 1980s and 1990s.

Sticky inflation

Inflation in the US was not significantly different in April than in March, with the current yearly inflation rate at 4.9%. While some core inflation metrics have decreased, other factors like housing costs, gas prices, and used car prices continue to put pressure on inflation. There is a risk that inflation could remain at an elevated level, but the definition of "elevated" has changed. The biggest risk is that a recession fails to occur which would make it difficult to bring down service-sector inflation. Home prices in North America could reignite inflation if there is a sustained rebound, but it is doubtful that this will occur. Inflation could also be impacted by rising energy prices due to the Ukraine conflict or China's economic reopening. Manufacturers are becoming slightly worried about raw material prices but not to the extent seen in previous years.

Business cycle still ‘end of cycle’

The US business cycle scorecard shows a weak economy that is at risk of entering a recession, despite strong employment figures. Indicators such as rising default rates on high-yield debt, a decrease in low-skilled workers' wage-growth, and a downward trend in the San Francisco Fed's news sentiment index suggest economic difficulties. Additionally, second-tier employment indicators are skewing more negatively than positively, and lending standards are tight, particularly for commercial real estate loans. Although consumers' demand for loans has slightly increased, it is still weaker than normal.

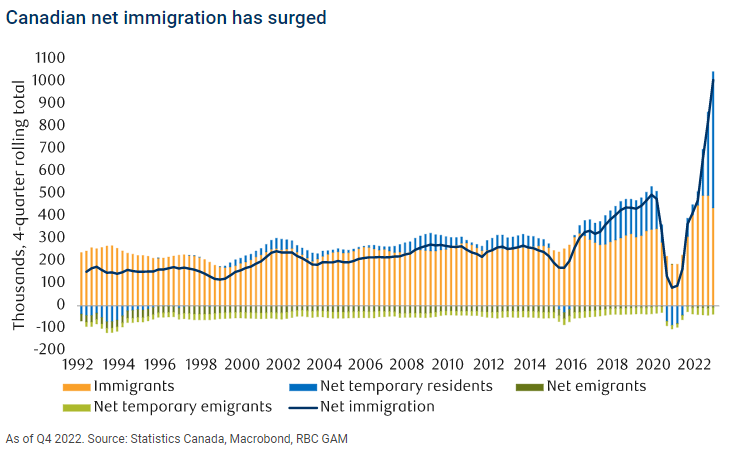

A less-bad Canadian recession?

The Canadian experience of the developed-world recession may not be worse than that of the US, as Canada's strong immigration rate has created a pool of additional workers and demand for products. Despite Canada's worse productivity growth rate than the US, the country's demographic profile may enable a faster potential growth rate and provide a buffer against economic decline. Additionally, Canada has enjoyed positive terms of trade shocks over the past few years, and its fiscal position is better than most of its peers. Despite remaining in deficit, Canada does not face the same austerity measures as other developed countries with larger deficits.

- Canadian households are carrying more excess savings from the pandemic than most countries.

- Canadian inflation is moderately lower than in the U.S. and many other developed countries. This argues there is a lower risk that additional monetary tightening will be needed in Canada.

- Canadian banks are not suffering the same stress as U.S. mid-sized lenders, with the result that lending standards are not tightening as sharply.

Notable News

Wendy’s is one of several restaurants incorporating AI and automation to improve customer service, while grappling with labor shortages. What’s more, drive-thrus have surged in popularity during the pandemic, with the chain saying 80 per cent of its customers prefer ordering that way.

61 firms, most with 25 or fewer employees - to take part in the world's biggest four-day week trial last year. Pleased with the outcome, 56 have stuck with the policy.

Gary Conroy said his 15 workers had smashed through their targets since switching to the shorter week last June and introducing four-hour periods each day when they ignore emails, don't answer phone calls and turn off instant messaging.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

CIBC Private Wealth Management consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth Management" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2022.