Bram Houghton

July 31, 2023

Economy CommentaryWeekly Market Update – July 28th, 2023

Wicks Houghton group BI-Weekly Market Update

IN A NUTSHELL: Markets have experienced a strong two weeks with better than expected inflation data this month, while the economy remained resilient specifically in consumer spending and continued strength in labour markets. GDP grew in line with expectations in Canada and above forecast in the US.

Statistics Canada says the Consumer Price Index (CPI) tumbled to 2.8% in June, from 3.4% in May, and below forecasts of 3.0%, putting it within the Bank of Canada’s target range. Canada’s Gross Domestic Product (GDP) increased 0.3% in May from April, in line with analyst expectations.

Canadian retail sales increased 0.2% in May vs. the 0.5% increase expected. Core retail sales were unchanged. New home prices in Canada rose 0.1%, in June, the same pace as in May, and slightly above the market's forecast of a flat reading.

Canadian housing starts rose 41% in June compared with the previous month, the largest increase in the last 10 years, led by groundbreaking on multiple unit urban homes, data from the national housing agency showed on Tuesday.

The US Federal Reserve raised interest rates by a 0.25% on Wednesday, citing still elevated inflation as a rationale for what is now the highest US central bank policy rate in 16 years. The rate hike, the Fed's 11th in 12 meetings, setting the benchmark overnight interest rate in the 5.25%-5.50% range, and the accompanying policy statement left the door open to another increase.

US GDP grew at a faster-than-expected pace during the second quarter, increasing by 2.4% vs. the 2.0% forecast.

US retail sales rose less than expected in June as receipts at service stations and building material stores declined, but consumers boosted or maintained spending elsewhere, which likely kept the economy on a solid growth path in the second quarter.

Initial claims for state unemployment benefits dropped for the week ended July 15, the lowest level since mid-May. Economists polled by Reuters had forecast 242,000 claims for the latest week. US initial jobless claims declined further this week as well to the lowest level since February.

US single-family homebuilding fell in June, but permits for future construction rose to a 12-month high as a severe shortage of previously owned houses for sale supports new construction.

Euro zone GDP was flat in the first three months of this year against the previous quarter, the EU's statistics agency Eurostat said on Thursday, revising a previous reading of a 0.1% quarter-on-quarter contraction.

Lending to euro zone companies slowed again last month, adding to already mounting evidence that sharply higher interest rates are putting a brake on credit creation and economic growth.

British manufacturing orders declined in July at the weakest rate this year, while expectations for increases in selling prices cooled further, an industry survey showed on Tuesday.

China's economy anemic growth in the second quarter, as domestic and foreign demand faltered. GDP grew just 0.8% in April-June from the previous quarter, compared with a 2.2% expansion in the first quarter.

Crude oil prices on course for a fifth straight week of gains on growing optimism for global economic growth and tightening supplies. Investors weighed the optimism and a possible tightening of US crude supplies against weaker-than-expected Chinese economic growth.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | FLAT | +1.0% | +0.6% | +2.0% | +1.0% | +4.5% | -0.5% |

| Last Week | +1.4% | +0.6% | +2.1% | -0.6% | +0.8% | +2.1% | FLAT |

CIBC Economics: Quick Take: Canadian CPI (June) by Andrew Grantham

Canadian inflation decelerated to 2.8% year-over-year in June, from 3.4% in the prior month and two ticks below the consensus estimate (3.0%). While the deceleration was largely due to gasoline prices today being compared to the very peaks seen in 2022, there were also some encouraging signs of weakening price pressures elsewhere as well. Seasonally adjusted prices excluding food/energy rose by a mere 0.1% for a second successive month, while the monthly increase in food prices was weaker than in May (although food price inflation remains a strong 8.3% on a year-over-year basis). However, despite some of these encouraging signs, the Bank of Canada's core trim and median measures printed slightly above consensus expectations and were little changed on a three-month annualized basis.

Headline inflation will likely creep back further above 3% in the coming months, as base effects from lower gasoline prices become less generous. However, it was the stickiness of core inflation measures which was a concern for the Bank of Canada, and with CPI-trim and median showing little further progress towards the target band there remains a very real risk that interest rates could be raised again after the summer.

THE WEEK AHEAD - A biased bank? by Benjamin Tal Link to Article

The Bank of Canada is currently biased towards managing the risk of inflation and is more inclined to accept a recession than allow inflation to rise unchecked. The Bank is strategically positioning itself by upgrading its GDP growth forecasts and deferring the timing to reach the inflation target. This approach allows the Bank to be less reactive to strong economic indicators in the short term and gives time for disinflationary forces to take effect.

There several disinflationary forces at play, including the ongoing improvement in supply chain conditions, which is reducing inflationary pressures. Retailers' gross margins are decreasing, contributing to lower inflation. Additionally, the labor market, often a driver of inflation, is not showing strong wage growth despite a decline in job vacancies.

While the Bank of Canada might consider raising interest rates in September, prevailing disinflationary forces will become more apparent over time, leading the Bank to be cautious about further rate hikes in the future.

MacroMemo - July 18 – 31, 2023 by Eric Lascelles Link to Article

Economic weakness continues in China

China's weak second-quarter GDP growth, which increased by only 0.8% compared to the previous quarter, is evidenced by various economic indicators trending downward or remain soft.

As a response to the economic challenges, more stimulus measures from China are expected. While the country's economic situation is not favorable, the low inflation and weak economy provide a unified case for implementing policy solutions.

The anticipated policy support is expected to be targeted and may involve rule changes rather than significant monetary outlays. Examples of potential measures include extending repayment timelines for struggling property developers and easing the process of implementing initial public offerings (IPOs).

Economic data weakens slightly

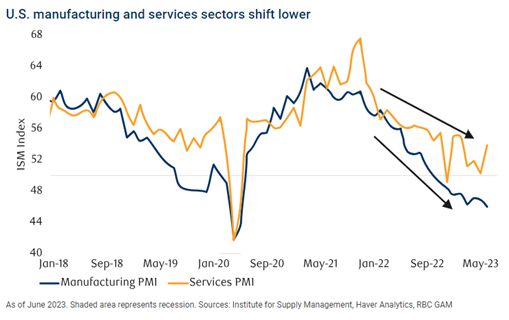

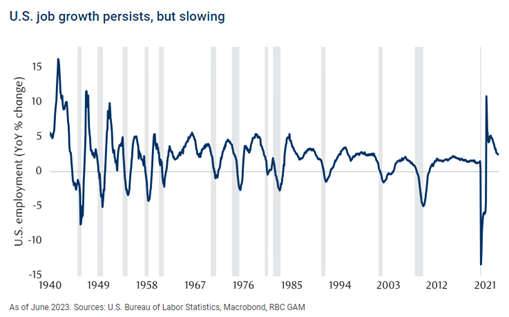

Recent economic data in the United States and Canada for the month of June showed slightly negative trends, with the Institute for Supply Management (ISM) Services index remaining choppy, and the ISM Manufacturing index indicating a contracting manufacturing sector. Job numbers in the U.S. were weaker, with 209,000 new jobs created, below expectations, and the softest single month of job creation in two and a half years. The types of jobs created suggested that business confidence in the future was not strong.

Overall, the economic data in both countries continues to suggest a mixed picture, with some indicators showing weaknesses and others showing moderate improvements, which may impact future monetary policies and business sentiments.

Recession musings lead to shift in our forecast

RBC Economics has downgraded the probability of a recession from 80% to 70% due to the economy holding on for an extended period and certain headwinds, like inflation and energy shocks subsiding.

The recession call is based on three main factors: the magnitude and speed of the interest rate shock, recession heuristics indicating a high probability, and the belief that it is an "end of cycle" moment in the business cycle.

While some regions, including Germany, the Eurozone, and New Zealand, have already experienced recessions, the timing of a global recession remains uncertain. The original forecast of a recession in the third and fourth quarters of 2023 is shifted to the final quarter of 2023 and the first quarter of 2024, with the possibility of it arriving sooner still being acknowledged. Economic data lag and uncertainty contribute to the difficulty in pinpointing the exact timing of the recession.

ECONOMIC FLASH! Fed announcement: on the fence by Katherine Judge Link to Article

The US Federal Reserve raised interest rates by a 0.25% on Wednesday, bringing the ceiling on the fed funds range to 5.50%. The Fed's statement was somewhat hawkish, not softening language around robust job gains or elevated inflation, despite recent cooling indicators. The Fed still maintains the possibility of further policy firming without mentioning a pause.

Another 0.25 percentage point rate hike is predicted in September, but if job gains and inflation signals continue to cool, it could be the last hike for this cycle, with the first easing not likely until Q2 2024, to allow inflation pressures to abate sufficiently.

Fed Chairman Powell expressed less certainty about the need for further tightening during his press conference, emphasizing a data-dependent approach and live consideration of each meeting. The Fed wants to see more sustained evidence of cooling inflation and better balance in the labor market before making further decisions.

NOTABLE NEWS

An unusually public claim by a Chinese professor the country's youth jobless rate might have hit close to 50% in March has stoked a debate about official data and a soft labour market, despite curbs on negative portrayals of the economy.

The National Bureau of Statistics said that month's jobless rate for people between the ages of 16 and 24 was 19.7%, less than half of what Peking University professor Zhang Dandan estimated.

July 2023 is set to upend previous heat benchmarks, U.N. Secretary-general António Guterres said on Thursday after scientists said it was on track to be the world's hottest month on record. The U.N. World Meteorological Organization (WMO) and European Union's Copernicus Climate Change Service also said in a joint statement it was "extremely likely" July 2023 would break the record.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.