Bram Houghton

August 31, 2023

Economy CommentaryBi-Weekly Market Update - August 25th, 2023

Wicks Houghton Group Bi-Weekly Market Update

IN A NUTSHELL: Markets reacted negatively last week to the Federal Reserve alluding to more rate hikes. While US job markets continued to remain resilient, the Netherlands entered a recession, and mixed inflation data across the globe suggests some components of core inflation remain sticky.

The Canadian CPI rose to 3.3% in July vs. the 3% consensus estimate and from 2.8% in June. The annual core inflation rate stayed at a 2-year low of 3.2% in July vs. forecasts of 2.8%.

Canadian June retail sales grew by 0.1% from the previous month driven mostly by car sales, a sign of weak consumer spending that could convince the central bank hikes are working. The sales increase was driven by auto with sales dropping 0.8% excluding auto.

US retail sales data for July came in higher than expected at 0.7% month-over-month, following an upwardly revised 0.3% gain in June vs. forecasts of 0.4%, showing continued consumer strength.

US initial jobless claims declined by 11,000 to 239,000 last week falling by 10,000 again this week to 230,000 showing continued resilience of the labour market.

US existing home sales dropped to a six month-low in July as home owners who are locked into cheap mortgages refrained from selling their properties with the cost of new mortgages for another home at the highest levels in decades.

US crude stocks fell by just over six million barrels last week, more than double the level forecast. However, output of oil in the largest producing country hit new three-year highs, as supply-demand of the commodity remained volatile with attempts to squeeze supply due to the sluggish economy in top importing nation China.

A gauge of future US economic activity dropped for the 16th straight month in July, though the pace of decline slowed from earlier in the year. The Conference Board said its Leading Economic Index fell 0.4% last month after declining 0.7% in June. Last month's decrease was in line with economists' expectations.

Britain's economy gained unexpected growth in Q2, laying the ground for more interest rate hikes. However, Britain remains the only developed economy yet to return to pre-COVID, late-2019 growth level.

British manufacturing output dropped over the three months to August by the most in almost three years, according to an industry survey on Tuesday that pointed to a further drop in new orders.

Worries about persistently high inflation in Britain grew as key measures of price growth failed to ease in July, despite a sharp drop in the headline inflation rate. The annual consumer price inflation rate cooled to 6.8% from June's 7.9%, the drop in the headline rate reflected falling energy prices, while other core components such as food and housing persisted.

Bankruptcy declarations in the European Union reached the highest level since 2015 in the second quarter of this year, driven by increases in the accommodation and food services sectors. The number of wound up companies in the April-June period was 8% higher than the previous quarter, marking a sixth consecutive increase, Eurostat said.

The Dutch economy has entered a recession as it shrank 0.3% on a quarterly basis in the second quarter, a first estimate published by Statistics Netherlands on Wednesday showed. The euro zone's fifth largest economy shrank for the second consecutive quarter, after a 0.4% contraction in the first three months of the year.

China's new bank loans tumbled in July and other key credit gauges also weakened, even after policymakers cut interest rates and promised to roll out more support for the faltering economy.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | FLAT | +0.8% | -0.5% | +2.3% | +0.9% | -1.5% | +1.3% |

| Last Week | -2.8% | -2.1% | -2.2% | -2.6% | -2.2% | -2.3% | -1.5% |

ECONOMIC FLASH! Canadian retail sales are no match for US boom by Katherine Judge Link to Article

In the second quarter, Canadian consumers showed caution as retail sales in June rose by only 0.1%, driven solely by auto sales, indicating a lack of enthusiasm for spending. This was below the consensus expectation and there was also a downward revision to the previous month's sales figures.

In volume terms, sales were down by 0.2% in June and only up 0.6% year-on-year. This weak performance in retail sales suggests that Canadian consumers have pulled back on spending after a stronger first quarter.

Food and beverage store sales were also down. This decline in sales could reflect consumers choosing to eat at home rather than dining out due to higher prices and interest rates.

Despite this, Q2 GDP is tracking only slightly below the Bank of Canada's 1.5% forecast and CIBC Economics expect a 0.25% hike in the final quarter, but it’s tight and could be impacted if the flash estimate for July GDP looks weak enough.

THE WEEK AHEAD GDPnow…wow!? by Avery Shenfeld Link to Article

Atlanta Fed's forecasting model is projecting a 5.8% growth rate for the US economy in Q3.

The accuracy of the model is a subject of debate however, as it tends to have a large margin of error early in the quarter. The model initially predicts strong growth for Q3 based on limited data, but one strong data point, like the recent retail sales, can significantly change its estimate.

Further to this, an alternative measure called real gross domestic income (GDI) had diverged in Q4 2022 and Q1 2023 suggesting that the GDP might be overestimating reality.

Despite the uncertainties, incoming data is causing many analysts to increase their Q3 growth forecasts. Further, while the market is placing a low probability of a rate hike by the Fed in September and the CPI data is indicating less urgency for one overall, CIBC expects a 0.25% rate hike in September.

MacroMemo – August 22 - September 10, 2023 by Eric Lascelles Link to Article

A recession leading indicator

The central banks of some emerging markets, which were the first to raise interest rates during this cycle, are now seeing their economies underperform compared to the rest – these markets have been seen as a leading indicator for developed markets.

A study by The Economist found that economies, such as Chile and Brazil, that hiked rates most aggressively are now experiencing rising unemployment rates.

This development is seen as positive as it could lead to lower inflation, and it also suggests that monetary policy is not completely disconnected from the economy. However, it highlights the long lag between policy action and economic reaction.

Inflation hiccup

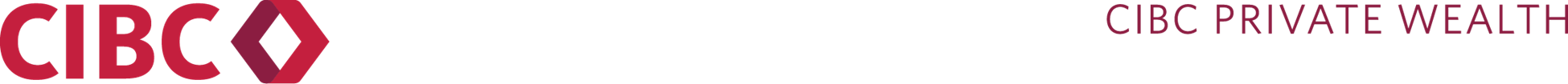

The US Consumer Price Index (CPI) rose from 3.0% to 3.2% year-over-year in July, which was expected due to a weak reading in the same month last year. Canadian CPI also increased from 2.9% to 3.3% in July.

Despite this, core inflation in the US decreased, with both headline and core CPI rising by a manageable 0.2% on a month-over-month basis. Housing inflation is decelerating, while food inflation is improving.

The "true" inflation rate, considering core inflation, CPI excluding falling gas prices, or median CPI, is estimated to be about 0.5-2 percentage points higher than the target inflation rate, rather than the previously believed 2-4 percentage points higher. There is more work to be done to address inflation, but less than initially thought.

Food and Housing the most significant drivers of inflation in the US.

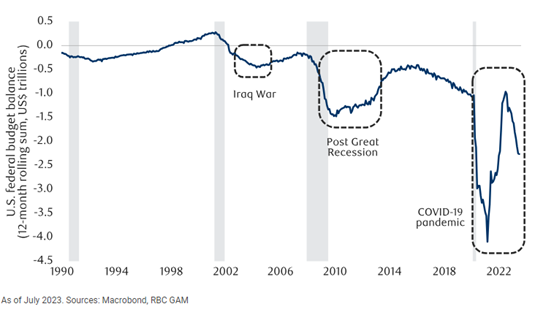

US debt downgrade

Fitch has downgraded the US sovereign debt rating from AAA to AA+, with two out of the three largest ratings agencies now believing that US debt is less trustworthy.

This has led to debate among bond market participants. Some argue that the downgrade could increase risk aversion and increase demand for US Treasuries, ultimately lowering yields. Others believe that the rating downgrade signifies increased risk, leading to higher yields. While there may be some forced selling due to institutional investor mandates, the overall impact of the downgrade is mostly symbolic.

The US government needs to address fiscal issues, but it is uncertain whether this will happen. It is important to note that there are countries with lower ratings than the US that remain economically viable, and a AAA rating does not guarantee economic success. However, having a fiscally sound economy improves the chances of long-term economic growth.

The US fiscal deficit has begun to expand again

China stimulus

Chinese policymakers are currently employing several stimulus policies.

Rate Cuts: China delivered its second rate cut in three months, though once again the magnitude of the move was just 15 basis points. The People’s Bank of China also failed to fully pass the rate cut along.

Currency weakness: The government has told state-owned banks to increase their interventions, and the central banks indicated it will endeavour to prevent further large moves. Given the country’s currency reserves, it’s likely Yuan depreciation will slow from here

Hukou Reform: In contrast to most countries, Chinese people do not really have national citizenship so much as local citizenship. If they move they can lose their rights to health care, education and even land ownership. China plans to eliminate these restrictions altogether for cities of fewer than 3 million people, and relax them for cities of 3-5 million people.

NOTABLE NEWS

Japan started releasing treated radioactive water from the wrecked Fukushima nuclear power plant into the Pacific Ocean on Thursday, a polarizing move that prompted China to announce an immediate blanket ban on all aquatic products from Japan.

China is "highly concerned about the risk of radioactive contamination brought by... Japan's food and agricultural products," the customs bureau said in a statement.

The BRICS bloc of developing nations agreed on Thursday to admit Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates in a move aimed at accelerating its push to reshuffle a world order it sees as outdated.

In deciding in favour of an expansion - the bloc's first in 13 years - BRICS leaders left the door open to future enlargement as dozens more countries voiced interest in joining a grouping they hope can level the global playing field.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.