Bram Houghton

October 23, 2023

Economy CommentaryBi-Weekly Market Update - September 8th, 2023

Wicks Houghton Group Bi-Weekly Market Update

IN A NUTSHELL: A slackening labour market and GDP data led to a strong week for markets as investors saw a potential end to the rate hiking cycle, however some of the gains were returned this week as key inflation measures remained sticky while Canada showed weak GDP numbers.

The Bank of Canada (BoC) on Wednesday held its key overnight interest rate at 5%, noting that the economy had entered a period of weaker growth, but said it could raise borrowing costs again should inflationary pressures persist.

Canada's economy unexpectedly contracted in the second quarter at an annualized rate of 0.2% and growth was most likely flat in July. The weak GDP numbers from Q2 were cited as one of the reasons the BoC was able to hold interest rates steady.

Canada recorded a smaller-than-expected trade deficit in July, as a West Coast dock workers' strike weighed more heavily on imports than on exports. The deficit was much lower than analysts had forecast in a Reuters poll. Total exports rose 0.7% while imports decreased 5.4% in July.

US GDP growth in the second quarter grew at a slower 2.1% rate compared to the 2.4% rate estimated. This comes as businesses appear to liquidate inventory, but momentum appears to have picked up early this quarter as a tight labor market underpins consumer spending.

The pace of annual inflation in the U.S. accelerated last month, with the personal consumption expenditures (PCE) index estimated to have risen by 3.3% in the 12 months through July. This was higher than last month, and on a monthly basis, the number was unchanged as anticipated at 0.2%.

Key US jobs data began approaching pre-pandemic levels in July, a sign the labour market is cooling without a sharp rise in the unemployment rate. Job Openings and Labor Turnover Survey showed that non-farm worker quit rates have dropped to levels not seen since January 2021. The hiring rate last month hit its lowest point since April 2020.

US initial jobless claims fell the prior two weeks to their lowest level since February. Despite this, US private payrolls increased by less than expected in August, the latest indication that the labor market was losing steam, though it remains tight. The unemployment rate also rose to 3.8% from 3.5%.

The US services sector unexpectedly accelerated in August, a sign of resilient demand that may contribute to stickier inflation. The ISM non-manufacturing purchasing managers' index increased to 54.5 during the month, up from 52.7 in July. Economists had expected the figure to come in at 52.5.

Business activity in Britain's services sector fell last month for the first time since January as higher interest rates reduced consumer and corporate demand. The S&P Global Purchasing Managers' Index (PMI) for Britain's services sector dropped to 49.5 in August from 51.5 in July, however it was above an initial estimate which showed it matching January's two-year low of 48.7.

Retail sales in the euro zone declined in July, though only due to reduced automotive fuel purchases, while June registered an increase rather than the decline reported last month. Retail sales volumes fell for the month of July and the year despite not being down as much as analysts expected.

Growth in lending to euro zone companies slowed again in July, adding to already mounting evidence that sharply higher interest rates are putting a brake on credit creation and economic growth. Lending to firms across the 20 nations expanded by 2.2% year-on-year after a 3.0% reading a month earlier.

Major Chinese cities have said they will allow people to take preferential loans for first-home purchases regardless of their credit records, in the latest move to help revive an embattled property sector. A host of major cities have implemented an easing mortgage requirements in an attempt to stimulate a struggling Chinese Real Estate market.

U.S. crude oil stockpiles fell by 10.6 million barrels last week, a third straight week of such inventory declines as refiners maxed out fuel processing to prepare for this year’s last hurrah in summer travel. Exports of U.S. crude also remained solid as American energy firms found more demand overseas caused by Saudi and Russian production cuts.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -2.3% | -1.3% | -0.7% | -2.0% | -0.3% | +1.9% | -1.2% |

| Last Week | +3.6% | +2.5% | +1.4% | +3.2% | +1.2% | +7.2% | +1.4% |

Bank of Canada issues a warning, but not a speeding ticket by Avery Shenfeld Link to Article

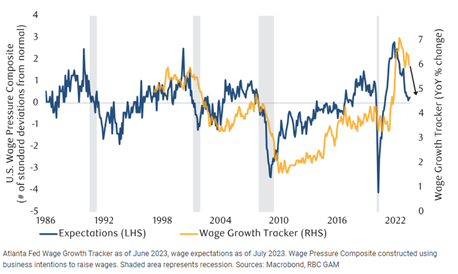

Despite not declaring a formal pause or announcing that rates had peaked, the Bank issued a warning instead of implementing further monetary tightening. This decision was influenced by signs of flagging demand growth and cooling labor markets, which indicated that the current overnight rate of 5% may be sufficient to control inflation. Previous arguments for additional rate hikes, such as tightness in the labor market and strong Q1 growth, have been undermined by recent data showing weaker GDP, consumption, and housing activity. The Bank acknowledges that current readings on prices and wages are still high, but it emphasizes the impact of soaring mortgage interest costs on inflation measures. Wage inflation, running at 4-5%, is considered too hot for the Bank's 2% inflation target. However, it anticipates a cooling in wage gains due to labor market slack and normalization of wage determinants. The Bank emphasizes the need for more evidence of economic cooling before definitively ruling out rate hikes or considering policy easing. It warns that it remains prepared to hike rates if necessary and expresses concern about current price pressures. Ultimately, the Bank's stance will depend on further easing in labor markets and continued sluggish growth in the second half of 2023.

Economic forecast — CIBC Economics see overnight rates at a plateau at current levels through Q1 of next year. By Q2 of 2024, we should have spent enough time with some slack in the labour market to have wage gains cooling off, allowing the Bank of Canada to begin paring interest rates in the spring. Still, if the economy achieves a soft landing, that also implies that it won't need rescuing with very stimulative monetary policy any time soon. Our end--of-2024 forecast for a 3.5% overnight rate would still be twice the rate that marked the peak of the prior business cycle, and not particularly low in real terms if at that point inflation is near the 2% target

CIBC Economics Quick Take: Canadian employment (Aug) by Andrew Grantham

Following a slight decline in the prior month, employment in Canada rebounded by a better than expected in August (double consensus), led by gains in the professional & scientific and construction sectors. The headline gain could have been even better were it not for a decline in education employment, which could be the result of seasonal adjustment issues during summer months. However, despite the strong headline figure, the increase in employment still fell short of the rapid growth in the population, with the unemployment rate only holding steady at 5.5% because of a slight drop in participation during the month. With estimates of the output gap having been revised heavily over recent years as policymakers have struggled to calculate the impact of supply shocks, the unemployment rate has become an even more important gauge of slack in the economy. At its current rate, unemployment is still modestly below levels which brought wage growth consistent with a 2% inflation target pre-pandemic. That was evident by the still strong wage inflation in today's report, with an acceleration to 5.2% annual, from 5.0%, coming in contrast to consensus expectations for a slight deceleration. As such, even though the Bank is still likely done with its interest rate hiking cycle, today's data is consistent with the notion that rate cuts are not yet on the horizon.

CIBC Economics Quick Take: US Non-farm payrolls (Aug) by Ali Jaffery

Much like the transition from summer’s end to the fall, the August jobs report suggests the labour market too is showing a shift to even cooler temperatures, and it’s one we’d do well to heed. The unemployment rate ticked up three full notches to 3.8%, well above consensus expectations of 3.5%, and its highest rate since early 2022. Nominal wage growth slowed to 0.2% monthly, below expectations of 0.3% gain. Job gains rose from the previous month, but negative revisions over the previous two-month job tally continue to suggest hiring is cooling. The participation rate ticked up two notches to 62.8% indicating that labour supply continues to gradually heal. Overall, today’s report underscores that rebalancing in the labour is picking up pace and softening in labour demand could translate into even weaker income and spending ahead.

Wage pressure easing in U.S.

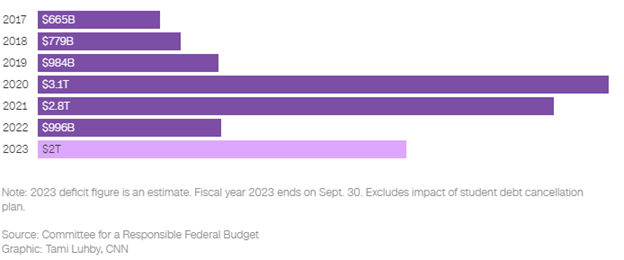

Fiscal Madness Brian S. Wesbury, First Trust Chief Economist Link to Article

First Trust Economics estimates the deficit to be $1.74 trillion, which is 6.5% of the GDP. This deficit is larger relative to GDP than any budget deficit under Reagan, who took considerable heat for being ‘fiscally irresponsible’.

The budget situation is even worse than these numbers suggest. Last year's deficit of $1.375 trillion was artificially boosted by government accounting due to President Biden's plan to forgive student loans. Without this plan, the deficit would have been around $996 billion, or 4.0% of GDP. However, the Supreme Court struck down most of the loan forgiveness plan, resulting in extra future loan repayments being added back into the budget. This change artificially reduces the deficit by $330 billion. Without the Supreme Court ruling, the estimated budget gap for this year would be around $2.07 trillion, or 7.8% of GDP.

These government accounting rules are leading to a misleading representation of the deficit and that running a budget deficit this high in peacetime with low unemployment is concerning. The authors express their belief in supply-side economics and emphasize the importance of removing barriers and disincentives to work, save, and invest for long-term economic growth. Both parties have contributed to the current deficit bubble through various policies and failures to address entitlements. The surge in the deficit may artificially maintain short-term growth but warns of a future economic hangover due to higher interest rates on government debt.

Federal deficit on the rise again – Deficit reaches double that of pre-pandemic levels again

NOTABLE NEWS

Soccer superstar Lionel Messi’s move to Major League Soccer has made an impact on ticket sales, as prices for late-season games in the U.S. have surged by over 1,700% on the secondary market, compared with last year.

Rapid advances in artificial intelligence (AI) such as Microsoft-backed OpenAI's ChatGPT are complicating governments' efforts to agree laws governing the use of the technology.

Beijing's widening curbs on iPhone use by government staff raised concerns among U.S. lawmakers on Thursday and fanned fears that American tech companies heavily exposed to China could take a hit from rising tensions between the countries.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.