Bram Houghton

October 23, 2023

Economy CommentaryBi-Weekly Market Update - September 22, 2023

Wicks Houghton Group Bi-Weekly Market Update

“A wide range of estimates of lags suggest there may be significantly further drag in the pipeline.”, U.S. Fed Chair Powell.

“It appears that there is a longer transmission, that the lags are longer.” Bank of England Governor Bailey

Canada’s August Consumer Price Index (CPI) rose 4.0% annually vs. 3.8% expected. On a monthly basis, the CPI rose 0.4%, above the 0.3% forecast, as a rise in gasoline prices boosted inflation and follows a rise to 3.3% in July.

Canadian economic activity expanded in August, rebounding after a contraction in the previous month, Ivey Purchasing Managers Index (PMI) data showed on Thursday. The seasonally adjusted PMI rose to 53.5 from 48.6 in July. A reading above 50 indicates an increase in activity.

Canada’s August housing starts declined by 1% over a month earlier to 253,000 units vs. 247,000 forecast. That is 6% below year-ago levels.

August's U.S. consumer price index (CPI) rose 0.6% from 0.2% the previous month, while year over year the inflation rate edged up by 3.7% vs. the 3.6% expected. Gasoline prices were the largest contributor to the monthly rise, accounting for more than half of the jump.

Retail sales in the U.S. advanced 0.6% month-over-month in August, well above market forecasts of a 0.2% advance. A surge in gasoline prices boosted receipts at service stations, but the trend in underlying spending on goods slowed as Americans grappled with higher inflation and borrowing costs.

U.S. initial jobless claims rose to 220,000 vs. the 225,000 expected as labour market conditions remain tight.

U.S. homebuilding plunged to a more than three-year low in August as a resurgence in mortgage rates weighed on demand for housing, but a jump in permits suggested new construction remained supported by a dearth of homes on the market.

Britain's economy contracted in July at an unexpectedly sharp rate after strikes in hospitals and schools as well as unusually rainy weather weighed on output. The Office for National Statistics said gross domestic product shrank 0.5% in July from June, worse than most forecasts.

The Bank of England halted its long run of interest rate increases on Thursday as the British economy slowed. A day after a surprise slowing in Britain's fast pace of price growth, the BoE's decide to keep Bank Rate at 5.25%, for the first time since December 2021.

The euro zone swung to an unadjusted 6.5 billion euro trade surplus in July from a 36.3 billion euro deficit a year earlier as costs of energy imports plunged and exports of manufactured goods surged. A massive fall in the trade deficit in energy in the European Union had the biggest impact on the results.

The United Nations food agency's world price index fell in August to a new two-year low, as a decline in most food commodities offset increases for rice and sugar. The Food and Agriculture Organization's (FAO) price index, which tracks the most globally traded food commodities, averaged 121.4 points in August was the lowest since March 2021 and also 24% below an all-time high reached in March 2022.

Oil prices gained almost 1% to a nine-month high last Friday on rising U.S. diesel futures and worries about tight oil supplies after Saudi Arabia and Russia extended supply cuts this week.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -4.08% | -2.93% | -1.89% | -3.62% | -1.88% | -0.95% | FLAT |

| Last Week | +2.18% | -0.83% | -0.13% | -1.51% | +1.25% | +3.99% | FLAT |

Market data taken from https://www.marketwatch.com/

Will oil energize inflation again? by Avery Shenfeld Link to Article

The downward pull of oil and gasoline prices on inflation rates has started to diminish, leading to a slight increase in headline inflation in Canada. Gasoline prices in the US have also marginally risen compared to the previous year. The extension of production cuts by Saudi Arabia and Russia has lifted crude prices, but it may reflect a more pessimistic outlook for the global supply-demand balance rather than a sustained increase in prices. Factors such as China's economic slowdown and decelerated global growth have also affected oil demand. While an increase in crude prices could contribute to inflation through gasoline and fuel oil, the overall macro context suggests that it might not be inflationary and could even be deflationary for other components of the Consumer Price Index (CPI). Higher interest rates and diminished job vacancies have slowed job creation and wage growth, which could limit consumers' ability to afford higher prices. Inflation should be viewed in terms of the aggregate supply and demand for total goods and services in the economy, rather than focusing on individual items. Supply improvements and factors such as higher interest rates and slowing job growth are expected to cool inflation ahead, even if there is a slight increase in pump prices.

Ask not what your Fed will do for you by Avery Shenfeld Link to Article

Uncertainty surrounds the Federal Reserve's actions regarding interest rates as we head towards 2024. The Fed's decisions are largely data-dependent, making it difficult to predict their future actions. While individual projections from FOMC members can provide some insight, the wide divergence in these projections and their dependence on economic conditions make them less helpful. Clues can be found in the Fed's statements, particularly in their projections for the unemployment rate and inflation. A lower jobless rate forecast could indicate a more optimistic outlook, potentially leading to a pause in rate hikes. The inflation forecast, on the other hand, is more ambiguous and could signal either a hawkish or patient approach from the Fed. It is also important to monitor the actual text of the statements and speeches by FOMC members for further insights.

MacroMemo - September 12 - October 2, 2023 by Eric Lascelles Link to Article

Mixed signals from U.S. economy

The Institute for Supply Management (ISM) Services Index increased from 52.7 to 54.5, indicating a positive trend in the services sector. The ISM Manufacturing Index also saw a slight improvement, rising from 46.4 to 47.6. The Atlanta Fed's nowcast suggests that the U.S. third-quarter GDP is expected to grow by 5.6% on an annualized basis, which could have a significant impact on the overall GDP for 2023. Additionally, personal spending increased by 0.8% in July, but personal incomes only rose by 0.2%, suggesting that consumers may be approaching their spending limits.

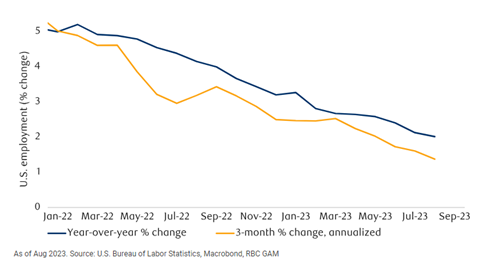

On the other side, labour market signals are mostly negative:

- Temporary employment continues to decline, a powerful leading indicator historically. However, some pundits note that this decline could be partially for benign reasons if the temporary workers are taking advantage of low unemployment to trade up to permanent jobs rather than being laid off.

- The ADP survey estimated just 177,000 new jobs in August, the weakest print in five months.

- Job openings continue to fall briskly, though they are still elevated.

- Layoff announcements have also been rising.

The latest U.S. Beige Book gives off powerful “end of cycle” vibes. The Beige Book is a qualitative encapsulation of economic conditions as reported by businesses across the country to the 12 District Fed offices. Lowlights included:

- Most contacts viewed the surge of tourism as the last stage of pent-up demand for leisure travel from the pandemic era.

- Other retail spending continued to slow, especially on non-essential items.

- Some districts indicated consumers may have exhausted their savings.

- Demand for manufacturing goods waned.

- Job growth was subdued across the nation.

- Most districts reported price growth slowed.

- Profit margins reportedly fell in several districts.

U.S. employment still growing but slowing

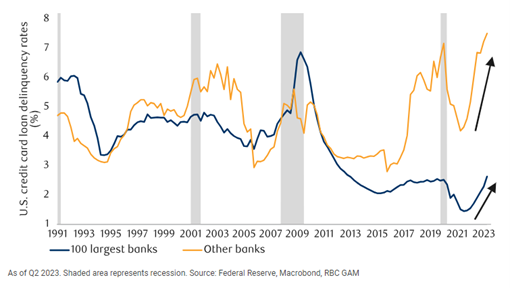

Consumer distress

There’s been a surge in the 30-day credit card delinquency rate in the United States, particularly among customers of smaller banks, reaching a three-decade high. The rate is also increasing for the largest 100 banks, reaching a decade high. However, the 90-day delinquency rates for credit cards, auto loans, and mortgages do not show the same level of financial distress. One possible explanation is that those who are 30 days delinquent may become 90 days delinquent in the next 60 days. However, this doesn't fully explain the continuous rise in the 30-day delinquency rate. A more plausible explanation is that people are falling slightly behind on payments, but not significantly. They receive their next paycheck in time to avoid further delinquency. Despite this, the 30-day delinquency rate continues to increase, and the 90-day delinquency rates for credit card loans and mortgages are slightly higher than previous quarters, indicating growing financial distress.

Credit card delinquency rates at smaller U.S. banks hit record high

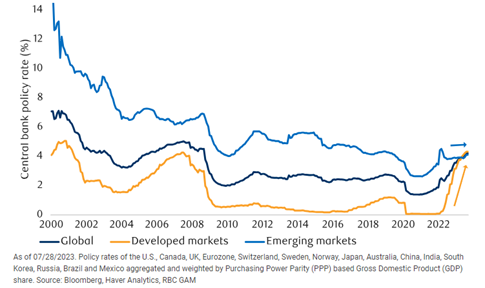

Central banks

Recently the Bank of Canada kept interest rates unchanged at 5.00%. The governing council expressed concerns about inflation and stated their readiness to increase the policy rate if necessary. However, the current economic weakness and cooperating inflation in Canada make further rate hikes seem unnecessary at the moment.

The next rate decision by the Federal Reserve is still a week away, and the market assigns a low probability for a rate increase (no rate increase as at September 20th), despite indications from the Fed's dot plots of a potential hike in 2023.

There is a possibility that central banks may tighten policy more than expected, and the European Central Bank's upcoming rate decision is awaited with a 40% chance of a 25bps increase.

Another emerging market central bank has joined the rate cutting party: Poland. It cut rates substantially more than had been expected, by 75bps rather than the consensus -25bps forecast. However, unlike in Chile, this appears to be motivated primarily by political considerations as an election looms. Despite this aspect, we continue to view most emerging market central banks as a leading indicator for where developed-world central banks may go next.

Global central bank policy convergence: end of tightening by developed markets may be in sight

NOTABLE NEWS

The United Auto Workers launched a strike against all three major automakers on Friday with an initial walkout of around 13,000 employees at three plants, but those numbers could grow. Federal elected officials have only until Sept. 30, when current spending authorizations expire, to come up with a deal or federal agencies will have to shutter.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.