Bram Houghton

November 03, 2023

Economy CommentaryBi-Weekly Market Update - November 3, 2023

Wicks Houghton Group Bi-Weekly Market Update

In a Nutshell: The Canadian Economy is skirting the line of a recession with weak growth in Q3 while U.S. posted substantial growth. U.S. labour market continues to show signs of fading; though markets reacted positively to the fact that we are very likely at the end of the rate hiking cycle in North America.

The Canadian economy stalled in August and likely slipped into a shallow recession in the third quarter. September showed no change from August, while July GDP was revised to being marginally negative from an initial report of zero growth. As a result, analysts suggest there is no need to raise rates again a 22-year high.

In Canada, 17,500 jobs were added, this was below the 25,000 consensus. The unemployment rate rose to 5.7% from 5.5%.

The Bank of Canada last Wednesday held its key overnight rate at a 22-year high of 5.0% as expected but left the door open to more hikes, saying price risks were on the rise and inflation could exceed its target for another two years.

Canada's manufacturing PMI rose in October for the first time in three months, but the sector remained in contraction as output along with new orders declined. The S&P Canada PMI rose to a seasonally adjusted 48.6 in October from 47.5 in September.

The U.S. economy experienced a robust 4.9% inflation-adjusted annual growth rate in Q3, exceeding expectations and doubling the 2.1% growth seen in Q2. This notable performance is potentially at risk due to rising long-term interest rates, and the possibility of a U.S. government shutdown.

The number of Americans filing new claims for unemployment benefits increased moderately last week as the labor market continued to show few signs of a significant slowdown. The number of people continuing to receive benefits advanced to the highest level for continuing claims since mid-April.

The U.S. government on Friday posted a $1.695 trillion budget deficit in fiscal 2023, a 23% jump from the prior year as revenues fell and outlays for Social Security, Medicare and record-high interest costs on the federal debt rose. The Treasury Department said the deficit was the largest since a COVID-fueled $2.78 trillion gap in 2021.

U.S. manufacturing contracted sharply in October after showing signs of improvement in prior months as new orders and employment slumped, likely reflecting strikes by the United Auto Workers (UAW) union against Detroit's Big Three car makers. ISM manufacturing PMI dropped to 46.7 last month from 49.0 in September, which was the highest reading since November 2022.

A “flash” reading of the S&P U.S. Composite PMI tracking both the manufacturing and service sectors rose to 51.0 in October from a final September reading of 50.2. It was the highest level since July.

Britain's businesses reported another decline in activity this month, with the "flash" preliminary reading of the S&P UK PMI for the services sector fell in October to 49.2 from 49.3 in September, the lowest reading since January and below the 50 no-change mark for a third month.

In September, Eurozone annual headline inflation fell to 4.3%, down from 5.2% in August and significantly lower than the 9.9% recorded last September. This was largely driven by a reduction in energy prices, and a decrease in services inflation from 5.5% to 4.7%.

The European Central Bank left interest rates unchanged as expected on Thursday, snapping an unprecedented streak of 10 consecutive rate hikes while insisting that any talk of rate cuts was premature.

The number of property foreclosures in China rose 32.3% in the first nine months of the year, according to a private survey, as home owners grappled with debt amid a property market slump and shaky economic recovery.

Chinese manufacturing activity unexpectedly shrank in October, while non-manufacturing activity grew at a slower pace as domestic businesses faced continued pressure from worsening local and overseas demand.

West Texas Intermediate crude oil prices wavered as investors remained nervous the Israel-Hamas war drag on, involving other parties which could cause supply disruptions.

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Schwab Market Updates Podcasts - https://www.schwab.com/resource-center/insights/section/schwab-market-update

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | +5.81% | +5.85% | +5.07% | +6.61% | +2.37% | -5.44% | +0.07% |

| Last Week | -1.98% | -2.53% | -1.89% | -3.62% | -1.88% | -0.95% | FLAT |

Market data taken from https://www.marketwatch.com/

Fed announcement: Is it a bird? Is it a plane? No, it's the supply-side! by Ali Jaffery Link to Article

The Federal Reserve (Fed) decided to keep interest rates within the range of up to 5.50%, which was widely anticipated. While the official statement maintained a data-dependent approach, the Fed Chair, Jerome Powell, adopted a more dovish tone during the Q&A session.

The key takeaway was Powell's explanation of the recent strength in the economy, which he attributed to improvements on the supply side and the unwinding of pandemic effects. He suggested that the stronger labor market and GDP might imply a higher potential GDP, but he downplayed the implications for future inflation.

The dovish tone was partly needed to justify the decision to pause and that the bar for the Fed to make another move has slightly increased. Powell outlined the criteria he would be looking at for a potential December decision, including labor reports, CPI data, activity data, and the durability of financial conditions tightening.

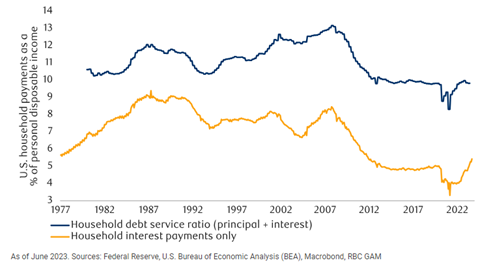

U.S Household debt service costs are rising

ECONOMIC FLASH! Canadian GDP (Aug, Sep/Q3 adv): Skirting recession by Andrew Grantham Link to Article

Canada's economy may contract slightly further in Q3, according to preliminary industry figures. Q2 showed a surprise decline in activity, with five consecutive months of drop-offs from goods-producing industries.

In August, crop production decreased 6.7% YoY, according to Statistics Canada. September is expected to have demonstrated ongoing stagnation, with full details yet to be released.

Despite the possibility that expenditure data for Q3 could keep Canada out of recession for this year, the results suggest rate hikes are impacting economic activity too much, and increasing interest rates could cause even lower outcomes next year, results suggest.

THE WEEK AHEAD All good things... by Avery Shenfeld Link to Article

While the US keeps posting impressive growth numbers whole seeing inflation edge lower, there are scattered signs of that cooling ahead.

Consumer spending has relied on a declining savings rate, which is unsustainable in the long term. Business investment also plateaued in Q3 and while government spending has been a significant driver of growth in the third quarter, there is uncertainty due to the possibility of a government shutdown, and a fiscally conservative speaker may limit room for compromise with Senate Democrats and the White House.

The strong Q3 growth for the US will likely give way to more modest gains in 2024 as the Federal Reserve may need to raise rates further to cool prices and wages, leading to a slowdown in economic growth. This may also push back the timeline for the first Fed rate cut later into 2024.

MacroMemo - October 31 - November 20, 2023 by Eric Lascelles Link to Article

Canada wobbles

The Canadian economy is facing challenges, with quarterly GDP falling in two of the last three quarters. Although there was one quarter of growth, it was not enough to be called a recession, primarily due to the absence of significant job losses. However, the risk of a recession is increasing.

In August, Canadian retail sales declined and September is expected to show flat performance when adjusted for inflation. This suggests a notable decline in real terms, which forms the basis for GDP. Additionally, when considering Canada's population growth, Canadian shoppers are cutting back on their spending.

The labor market in Canada has generated new jobs in three out of the past five months, but there have been two months of job losses in close succession. The new workers do not appear to be boosting economic output due to ongoing productivity challenges. In the latest jobs report, only 1,000 new private sector jobs were added out of a total of 40,000 positions.

In summary, the Canadian economic environment is deteriorating, raising the likelihood of a near-term recession in Canada.

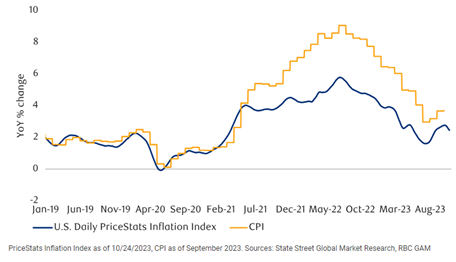

Inflation cools?

Recent inflation trends saw an acceleration in August and September, primarily due to rising oil prices. However, oil prices have since decreased, which may lead to milder inflation in October and beyond. The St. Louis Fed's model suggests an increased probability that inflation will remain above 2.5% over the next year.

The housing component of the Consumer Price Index (CPI), a significant contributor to the September price increase, is expected to slow down due to delays and evidence of a cooling interest rate-sensitive housing market. The base-case scenario is for housing inflation to gradually decline and possibly even surprise positively compared to consensus expectations.

However, it is unlikely that inflation will fully return to normal in the next year, and there is a risk of persistently high inflation if a recession does not occur.

Price Stats Inflation Index reflects a cooling trend

U.S. economic data weakens

The upcoming American payrolls report will be closely examined, considering the surprising strength in the September’s report. However, certain signs of fragility are evident in the job market:

Job openings and the quits rate have declined significantly from their peaks.

Temporary employment continues to decrease, which is historically a negative signal.

Unemployment has risen from its low point, and continuing jobless claims are on a steady upward trend.

While the headline hiring number for September was strong, other less closely monitored indicators, such as the ADP survey and the household survey, showed substantially weaker results. Anecdotally, it is becoming more challenging to find jobs in the U.S., and there are reports of companies offering lower wages to new hires than before. The labor market appears to be cooling off compared to its previous strong performance.

There is also evidence that the U.S. housing market is beginning to cool again, with evidence ranging from our composite of housing sentiment to a broader collection of real estate indicators.

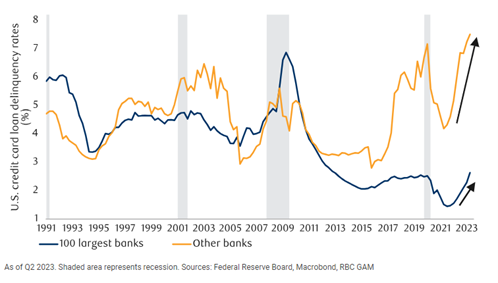

Credit Card delinquencies in the U.S. surge

Recession probability rises

The article discusses the probability of a recession in the United States over the next 12 months. It has been upgraded from 65% to 70%. Some arguments for an increased probability of a recession:

Inflation is higher than previously expected, reducing the scope for rate cuts and increasing the risk of further rate increases.

The geopolitical environment has become more complex, potentially leading to downside scenarios that could impact the likelihood of a recession.

Unemployment rates have stopped falling and have even begun to rise, historically signaling a recession.

There is evidence that higher interest rates take a longer time to fully affect economic activity.

Arguments against a recession:

Initial jobless claims have returned to normal after an earlier increase, reducing the immediate recession signal.

The U.S. economy has shown resilience and has not succumbed to a recession.

The yield curve is less inverted than before, though doubts remain about whether this truly indicates a reduced risk of recession.

In summary, the negative factors presently outweigh the positive ones, leading to an increased likelihood

of a recession.

NOTABLE NEWS

If governments follow through with spending plans for 2024, it would mean "government spending is starting to get in the way of getting inflation back to target" of 2%, Macklem told members of a Senate committee.

Inflation was clocked at 3.8% in September, but the BoC said last week it may not come down to target until the second half of 2025.

Bank of Canada's Governor, Tiff Macklem, informed the House of Commons finance committee that removing the federal carbon tax could lead to a significant, albeit temporary, drop in Canadian inflation. Abandoning the tax could result in a one-time decrease of 0.6 percentage points, bringing the rate down to 3.2%. However, he clarified that this effect would only last for a year.

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Aurie Wicks, CA, CPA, CFP Bram Houghton, CFA, CFP

Wealth Advisor Wealth Advisor

(403) 835 – 4785 (403) 690 – 9376

Aurie.Wicks@CIBC.com Bram.Houghton@CIBC.com

Wicks Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2023.