Bram Houghton

February 26, 2024

Economy CommentaryMarket Update - February 23, 2024

WICKS QUINN HOUGHTON GROUP BI-WEEKLY MARKET UPDATE

In a Nutshell: Markets continued to hum along over the past two weeks, despite numerous indicators suggesting that interest rates may not be cut in accordance with the U.S. Fed’s mid-year guidance. AI sweetheart Nvidia single handedly moved global markets on Thursday exceeding earnings expectations. Weakness globally continued with a UK recession confirmed in Q4 2023.

Canadian Economy

Some good news for Canadian borrowers as inflation slowed beyond expectation for January which bolsters the potential for an interest rate cut as early as the Spring. Data for sales over the holiday season also showed a spike season which suggests some resilience for the consumer.

Canada's annual inflation rate slowed significantly more than expected to 2.9% in January and core price measures also eased, bringing forward bets for an early interest rate cut. It was the first time in seven months that headline inflation has dipped below 3%.

Canadian December retail sales slightly beat expectations, increasing 0.9% from the previous month, with Core retail sales up 0.5%. This comes after a flat reading in November, which was upwardly revised from -0.2% previously. People spent more on cars, food and beverages, and at supermarkets during the holiday season.

Canadian factory sales fell by 0.7% in December from November on lower sales of motor vehicles, as well as chemical products. Excluding motor vehicles and parts, manufacturing sales were up 0.4%.

U.S. Economy

The U.S. Economy continued on it’s merry way in 2024, despite and inflation blip this month, which suggests that the U.S. Fed may not be able to lower rates mid-year as outlined. Despite this, the S&P hit new highs on the back of Nvidia’s Q4 results and continued optimism in the AI boom.

The January U.S. annual inflation rate fell to 3.1% from 3.4% in December, but was higher than forecasts of 2.9%. This was a key economic release that could impact how Federal Reserve officials view the timing of potential interest rate cuts.

In a speech by Fed Vice Chair, Philip Jefferson yesterday, The Fed wants to see more progress bringing inflation down and is in no rush to ease given the strength of the economy. While remaining cautiously optimistic, he also pointed to the fact that the history suggests that we should not be surprised if some kind of unanticipated shock occurs, that alters the current course for the Fed.

The Labor Department report showed that the producer price index (PPI) gained 0.3% in January, up from forecasts of a 0.1% rise. On a year-on-year basis, the PPI increased 0.9%, compared with expectations of a 0.6% rise.

Eurozone and U.K. Economy

While the Eurozone overall saw signs of economic recovery, a second quarter of negative growth for marked a technical recession for the U.K., while Germany’s woes deepened. With inflation also regulating across the Bloc, rate cuts in the near future seem probable.

Britain's economy fell into a recession in the second half of 2023, a tough backdrop ahead of this year's expected election for Prime Minister Rishi Sunak who has promised to boost growth. Gross domestic product (GDP) contracted by 0.3% in December, having shrunk by 0.1% in September. The fourth-quarter contraction was deeper than all economists' estimates, which had pointed to a 0.1% decline.

The downturn in Eurozone business activity eased in February, suggesting signs of recovery, as the dominant services sector broke a six-month streak of contraction and offset a deterioration in manufacturing. The S&P Global preliminary composite PMI rose to 48.9 this month from January's 47.9 – while still in contraction territory, this is a significant improvement.

In contrast, the downturn in the Eurozone manufacturing industry deepened this month with the S&P Global preliminary composite PMI dropping to 46.1 from 46.6, confounding expectations of a rise to 47.0. It has been signaling contraction at sub-50 since July 2022.

German inflation eased in January to 3.1%, the federal statistics office said on Friday, confirming preliminary data. German consumer prices, harmonised to compare with other European Union countries, had risen by 3.8% year-on-year in December.

Germany's economic downturn deepened in February as a slight improvement in services activity was unable to compensate for a surprisingly sharp deterioration in manufacturing. The HCOB German Flash Composite Purchasing Managers' Index (PMI), compiled by S&P Global, fell to 46.1 in February from 47.0 the month before.

Energy Sector

Oil futures steadied over the two weeks as geopolitical and supply issues out-weighted potential demand issues. Hostilities continued in the Red Sea with the Houthis stepping up attacks near Yemen, but an increase in U.S. crude inventories as well as Japan and UK showing signs of a recession weighed on gains.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 1.2% | -0.4% | -0.1% | -1.3% | 1.2% | 3.1% | -0.7% |

| Last Week | 0.1% | 1.7% | 1.3% | 1.4% | 1.0% | -3.3% | 1.1% |

Market data taken from https://www.marketwatch.com/

Economics in Focus: The housing crisis is a planning crisis by Benjamin Tal Link to Article

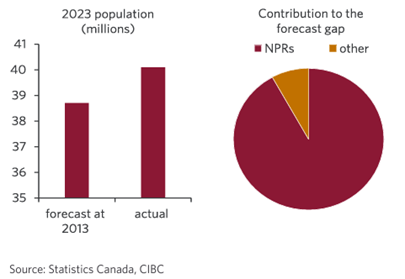

There are challenges in accurately forecasting population growth in Canada and its impact on housing supply planning. Past population projections have significantly underestimated the actual population growth, leading to a shortage of housing supply. The current projections for future population growth are also deemed inadequate, with estimates continually falling short actual growth.

There is a need for more accurate population forecasts to ensure sufficient housing supply for the growing population, especially for non-permanent residents who have a higher need for housing. Without correcting the base populations used in forecasting, agencies may reach their 2030 population projections much earlier than anticipated, necessitating sustained high levels of immigration to meet housing demands.

Chart: A Big Miss largely attributable to the National Population Register (NPR)

With a projected 2% annual population growth through 2030, the "business as usual construction level" gap is estimated to be around 5 million housing units higher than current forecasts of 3.5 million.

This gap is attributed to the lack of credible forecasts, targets, and capacity plans for non-permanent residents, who contribute significantly to the planning shortfall. The government should regulate and plan for non-permanent resident arrivals similar to how it does for permanent residents, and ensure their inclusion in Statistics Canada and CMHC forecasts.

Leading Indicator Still Misleading Dr Ed Yardeni Link to Article

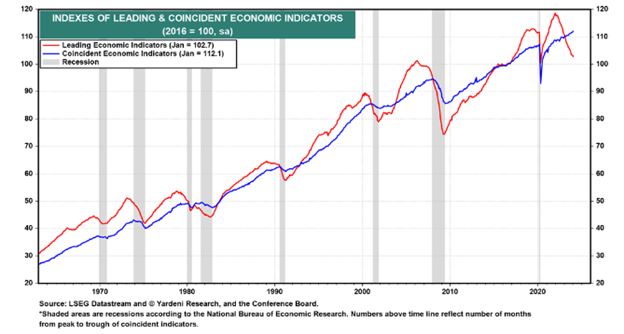

January's Index of Leading Economic Indicators (LEI) was down again, one month short of the record-long slump that began in April 2007 and ran through March 2009 during the Great Financial Crisis. A declining LEI suggests a recession is looming. However, the Coincident Economic indicators (CEI) rose to a record high, confounding the LEI forecast.

Chart: The indexes are moving in different directions…

The Conference Board, who compiles economic indexes, has revised its recession forecast. Despite the Leading Economic Index (LEI) indicating headwinds to economic activity, six out of its 10 components showed positive contributions over the past six months, leading to the conclusion that a recession is not imminent. The group now expects real GDP growth to slow to near zero percent in the second and third quarters of 2024.

The CEI on the other hand is highly correlated to real GDP growth which was confirmed to be growing in January, thereby validating the CEI’s current position.

How to avoid another lost decade in equities by Richard Bernstein Advisors Link to Article

Note: In light of Nvidia strong results this week, and singlehandedly moving global equity markets, this article is another great reminder of the need for portfolio management and diversification as well as managing your participation in such market evolutions carefully.

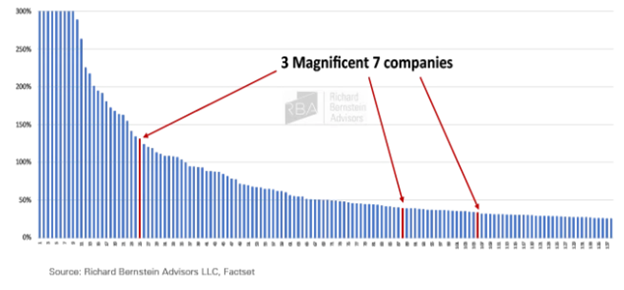

The speculative environment for Artificial Intelligence (AI) is reminiscent of the Technology Bubble of 1999/2000: narrow leadership, massive valuation dispersions, a focus on relative strength, and momentum driving performance. Investors are eschewing diversification in favor of high-risk, impulsive portfolio strategies. The current market concentration on a few key stocks raises concerns about potential subpar performance in equities when the speculative bubble ends.

There is a common perception that the current speculative period is vastly different from the Tech Bubble because the companies involved are considered "real companies" as opposed to the worthless IPOs issued during the Tech Bubble. However, the Tech Bubble was also led by real companies, Microsoft, Cisco, Intel, IBM, Oracle and Qualcomm. These companies had strong balance sheets and cash flow, yet the quickest stock to post positive returns took roughly 7 years to recover, with the longest recovery period exceeding 20 years.

Chart: Companies with One Year Earnings Per Share (EPS) Growth greater than 25% as at February 2024

While some of these 7 stocks show strong fundamental growth, this growth is not consistent across all seven stocks and is not necessarily unique compared to other companies. There are approximately 140 stocks within the G-7 equity markets projected to grow earnings by 25% or more in the next year. Interestingly, only three of the Magnificent 7 stocks meet this criteria, with the fastest-growing stock among them ranking 25th in terms of growth rate.

NOTABLE NEWS

President Joe Biden's administration said on Wednesday it is cancelling $1.2 billion worth of student loans for some 153,000 people who are eligible under a program used to make good on promises to increase loan forgiveness.

Biden last year pledged to find other avenues for tackling debt relief after the Supreme Court in June blocked a broader plan to forgive $430 billion in student loan debt.

Air Canada has been ordered to pay compensation to a grieving grandchild who claimed they were misled into purchasing full-price flight tickets by an ill-informed chatbot.

In an argument that appeared to flabbergast a small claims adjudicator in British Columbia, the airline attempted to distance itself from its own chatbot's bad advice by claiming the online tool was "a separate legal entity that is responsible for its own actions."

When you read the content we share and it causes you to think of others in your life who would benefit from seeing it, please don’t hesitate to share it with them.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc.

"CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.