Bram Houghton

July 08, 2024

Commentary Quarterly commentary Weekly update Weekly commentaryMarket Update - June 28, 2024

MARKET UPDATE – June 17 – June 28, 2024

In a Nutshell: The U.S and other major global markets eeked out returns after a relatively volatile two weeks as investors reacted positively to more data supporting of inflation being under control.

U.S. Labour Markets

U.S labour markets remain stable with initial jobless claims with a substantial drop last week exceeding market expectations. While labour markets are stable, it is important to note that reporting has been falling fairly consistently within the 230,000s whereas in Q4 2023 we were reporting consistently in the 210,000s.

U.S. Economy

Continued mixed signals prevail within the U.S. economy with retail sales increasing at a slower-than-anticipated rate on a monthly basis in May, pointing to lingering headwinds to momentum in consumer spending activity despite inflationary pressures showing signs of cooling. Despite this production at U.S. factories increased more than expected in May, recouping all the declines in the prior two months, and business activity crept up to a 26-month high in June amid a rebound in employment, producer prices cooling considerably offering hope that a recent slowdown in inflation can be sustained.

Canadian Economy

Canadian Economy showed positive signs of turning around after gross domestic product increased 0.3% in April, matching market expectations, as growth rebounded in sectors including wholesale trade and manufacturing, and the economy likely expanded further in May. Retail sales also rose in April after a declining trend in Q1 2024 largely boosted by gasoline sales. However, there an uptick in Inflation in May beyond market expectations with grocery prices and air transportation prices being the primary contributors.

Eurozone and U.K. Economy

The U.K. saw continued support for interest rate cuts in August with grocery inflation falling for a sixteenth month in a row in June and headline inflation falling back to the Bank of England’s target of 2.0% for the first time in nearly three years. Retail sales also recovered in May after a rainy April kept shoppers away, though a rainy June appears to be keeping shoppers away again.

Euro zone on the other hand saw business activity stall with demand falling for the first time since February.

Asia and Far East

Japan's core inflation accelerated in May due to energy levies complicating the central bank's decision on how soon to raise interest rates.

Business activity in India expanded at a faster clip this month from May thanks to gains in manufacturing and services also showing that the pace of job creation was at its strongest in over 18 years. Further to this, foreign investors have bought more than $10 billion of Indian government bonds that will be included in a widely-followed JPMorgan debt index on June 28th, which is a huge capital in flow of foreign investment to

China's May industrial output lagged expectations and a slowdown in the property sector showed no signs of easing despite central bank support, adding pressure on policy makers to shore up growth.

Energy

WTI saw steady gains over the last two weeks as positive inflation data from the U.S. and easing demand concerns in China offsetting the geopolitical situation in the Middle East, and output curbs from the Organization of the Petroleum Exporting Countries (OPEC+).

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -0.4% | 0.6% | 1.5% | 0.0% | 0.9% | 2.9% | -0.8% |

| Last Week | 1.3% | -0.1% | -0.1% | 0.2% | -0.5% | 0.9% | 0.2% |

Market data taken from https://www.marketwatch.com/

John Lynch: Earnings Preview by John Lynch, CIO, & Team, Comerica Wealth Management Link to Article

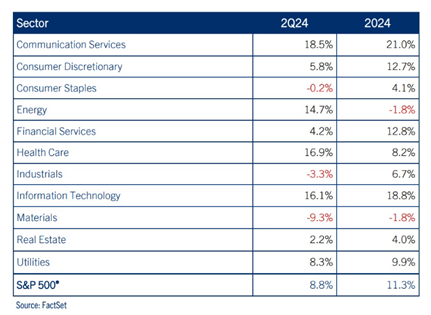

S&P 500® profit growth appears solid, with eight of the 11 sectors expected to grow Earning per Share (EPS) Year on Year (YoY). A deeper look into profitability reveals the rather weighty impact that the Magnificent Seven is having on profitability, too.

The above stellar growth rates look less attractive across the index when you focus in on certain large cap companies in the Communication Services and Technology sectors. FactSet reports that excluding the EPS growth from Meta Platforms and Alphabet would significantly reduce the Communication Services sector's year-over-year profit growth from +18.5% to 3.3%. Similarly, excluding Nvidia's contribution would lower the Technology sector's estimated EPS growth from 16.1% to 6.6% year-over-year.

Despite a consensus projection of 11.3% profit growth in the S&P 500 Index, Comerica believes that 8.0% is a more reasonable range for profit growth this year. There are concerns about the fourth-quarter projection of ~+17.0% EPS year-over-year being too optimistic, but strong guidance during second-quarter earnings calls could potentially impact the overall projection for the S&P 500 Index to generate $237.50 in Index EPS for 2024.

Using this forecast and a trailing Price to Earnings ratio of 22, it is reasonable to the S&P 500 reach a range of 5,200 – 5,250.

MacroMemo - June 25 - July 15, 2024 by Eric Lascelles Link to Article

Inflation fears ease

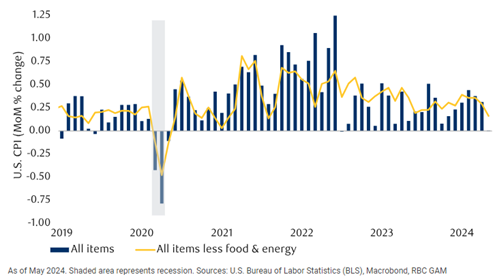

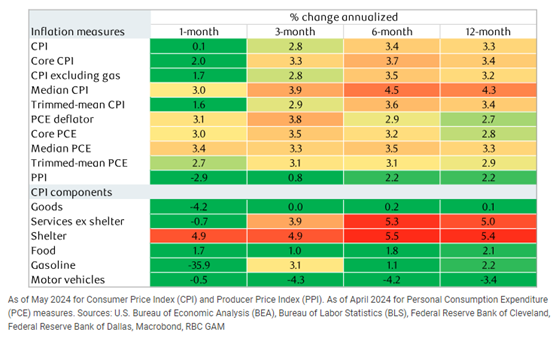

Inflation concerns were prevalent in the first three months of 2024 but are now diminishing. In May, the U.S. consumer price index (CPI) showed a significant slowdown, falling below expectations. Both the headline and core prices decreased in May compared to April. Overall, the cost of living decreased for the average person in May. The data also showed positive trends, such as lower gas prices, minimal increases in food prices, and decreases in new vehicle prices, apparel prices, and motor vehicle insurance prices.

U.S consumer prices ease further

U.S Inflation data improves in May

Consumer vignettes show rising worries

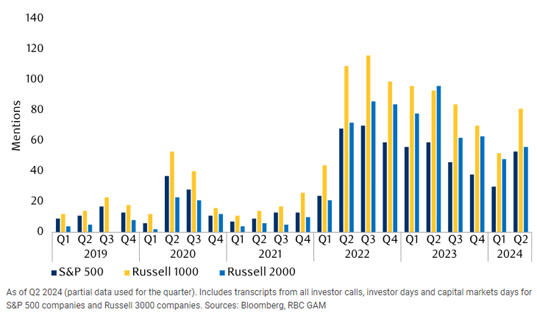

There is evidence of increased stress, with S&P 500 companies showing a heightened focus on lower-income consumers who have been particularly impacted by higher interest rates. Companies are also paying attention to the trend of "trading down," where consumers opt for lower quality or cheaper goods to manage their budgets. While some consumers are facing financial strain due to higher interest rates and lingering effects of inflation, not all are experiencing distress, and not all activities are being scaled back. Air travel, for example, continues to see a surge, with current U.S. passenger throughput surpassing pre-pandemic levels.

Mentions of “Trading Down” in company transcripts has begun to rise

Navigating Global Markets with Five Important Trends by Christopher Gannatti, CFA Global Head of Research, WisdomTree (extract from an interview with Philippe Gijsels, Chief Strategy Officer at BNP Paribas Fortis) Link to Article

- Global Economic Outlook Geopolitics have been volatile, but this can lead to opportunities in global markets. Phillipe made particular note of European markets resilience amidst political changes and economic policies

- Higher Inflationary Waves for Longer A combination of ageing, debt, and the energy transition could extend inflationary pressures for longer with “reshoring” or “deglobalization” also being an inflationary force.

- The Role Metals in Current Market Conditions With the U.S. being ‘weaponized’ amidst serval conflicts, there are many central banks that have turn to precious metals as a store of wealth instead of the conventional USD.

- Technological Innovations and Market Impact Innovations in fintech and sustainable technologies are creating new investment opportunities and driving market sectors toward more maintainable practices.

- Technology Stocks and Historical Analogies Investment excitement in new and groundbreaking technologies has been compared to the 1990’s which became bubble like around a decade later. While Phillip believes we are more progressed than a decade away from bubble territory (more akin 1998-1999) these companies are largely continuing to deliver on the ‘premium’ valuations.

NOTABLE NEWS

Congestion at Singapore's container port is at its worst since the COVID-19 pandemic, a sign of how prolonged vessel re-routing to avoid Red Sea attacks has disrupted global ocean shipping - with bottlenecks also appearing in other Asian and European ports.

Retailers, manufacturers and other industries that rely on massive box ships are again battling surging rates, port backups and shortages of empty containers, even as many consumer-oriented firms look to build inventories heading into the peak year-end shopping season.

Spain's government passed an inflation relief package worth nearly 3 billion euros ($3.21 billion) on Tuesday, including measures such as a lower income tax for minimum wage workers and an extension of zero value-added tax on basic food items.

Zero VAT on food staples was one of the measures introduced in December 2022 to head off a cost-of-living crisis exacerbated by a surge in energy prices triggered by the war in Ukraine.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.