Bram Houghton

July 16, 2024

Commentary Weekly update Weekly commentaryMarket Update - July 12, 2024

FLASH Report – July 1st – July 12th, 2024

In a Nutshell: Global markets had a strong start to July with the U.S. market continuing on its merry bull market way, though some weak inflation data on Thursday this week threatened to derail that. Despite this, global markets recovered strongly today. More data for July also supports the case for ate cuts in both Canada and the U.S.

U.S. Labour Markets

Labour market data from the U.S is showing much clearer signs of cooling despite Job openings being higher in May and non-farming payrolls jumping 200,000 in June. Employment claims rose to a 2 ½ year high while both job openings and non-farm payrolls were revised down for previous months. This is just the sort of gradual cooling that the Fed would be looking to see in order to have a clear path to cut rates.

U.S. Economy

The U.S saw some positive signs with inflation declining by 0.1% in June, which was the first drop in inflation since May 2020. Excluding food and energy, inflation did rise by 0.1% however. There were further signs of cooling with the Services sector contracting to a 4 year low as well as new orders for U.S.-manufactured goods unexpectedly fell in May suggesting the pressure from higher interest rates is starting to show with a softening demand for goods. This further supports the Fed in their quest to see the “right data” to cut rates.

Canadian Economy

Canada's unemployment rate in June rose to 6.4% from 6.2% in May, the highest reading since January 2022 and exceeding market expectations of 6.3%. Employment in Canada also decreased in June well below expectations after adding jobs in May. Canada's services economy also moved back into contraction in June as a decline in new business weighed on the sector's performance even as inflation pressures cooled, which all supports the BoC’s rate cut decision and supports the case for further cuts as early as July.

Eurozone and UK Economy

UK services growth slowed to a 7 month low in June which points to modest economic growth for the incoming government and support for rate cuts while the Eurozone slowed sharply last month as a solid expansion in the bloc's dominant services industry failed to offset a further deterioration in manufacturing also supporting the case for further rate cuts.

Energy

Oil prices recovered and stabilized this week after falling last week on demand worries as Hurricane Beryl shut U.S. refineries and ports along the Gulf of Mexico as well as hopes of a possible ceasefire deal in Gaza reducing worries about global crude supply disruptions.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.8% | 2.0% | 0.7% | 3.5% | 0.6% | 2.0% | 2.5% |

| Last Week | 2.8% | 0.9% | 1.6% | 0.2% | 1.3% | -1.2% | 0.8% |

Market data taken from https://www.marketwatch.com/

How Strong is the Labor Market? by Brian S. Wesbury and The First Trust Economics team Link to Article

Payroll numbers in the US were released last Friday and it was solid, with payrolls up 200,000 in June. However, downward revisions occurred in the last 2 months bringing down the net gain to 95,000.

There are however some notable discrepancies in the payroll data we are seeing – for example, non-farm payrolls are up 2.6 million over 12 months, however, civilian employment, an alternative measure of employment (which includes small business start-ups) is up only 195,000.

Another significant observation is negative revision to payroll numbers – for instance, in 2023, negative revisions averaged -30,000, whereas this year so far it has averaged -49,000.

The final gap to note is between full-time and part-time employment as the civilian employment report shows full-time jobs down 1.6 million in the past year while part-time is up 1.8 million.

These discrepancies are worth noting as you would typically link them with economic weakness as opposed to economic strength. The silver lining is that the Fed has employment data that can accommodate the Rate Cuts markets are looking for.

2024 Mid Year Themes by Carl Tannenbaum, Vaibhav Tandon, and Ryan Boyle, Northern Trust Link to Article

The New World Disorder

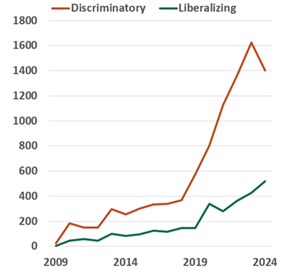

Trade and investment dynamics around the world are increasingly being increasingly challenged by geopolitical alliances, altering the business landscape. Public support for economic openness and free markets is in decline.

Buzz words like reshoring, nearshoring, and deglobalization are more commonly mentioned in earnings’ calls. Tensions between the world’s largest economies are prompting new tariffs and foreign investment flows are segmenting along geopolitical lines.

Weakened alliances will diminish the world’s economy and its ability to respond to a growing array of threats. Tail risks are rising, and will need to be monitored.

New policy interventions implemented each year

Source: Global Trade Alert

Heaven and Earth

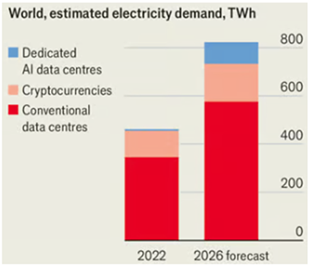

Artificial Intelligence (AI) has been a dominant theme during the first half of the year. The one them less talked about is the infrastructure needed to enable to continued expansion of this industry – namely through energy requirements and data centers. Data center construction is rising rapidly, and all of those servers will need to be powered and cooled. There is also the requirement of very specific rare earth minerals that need to be mined

Sources: IEA, The Economist

AI promises to increase productivity growth, which will be essential to offset less-favorable demographics. Productivity raises potential economic growth, which can make debt for governments, business and the general public more sustainable.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

The views of the commentator and/or guest speaker(s), do not necessarily reflect those of CIBC World Markets Inc. This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed. The commentary is for informational purposes only and is not being provided in the context of an offering of any security, sector, or financial instrument, and is not a recommendation or solicitation to buy, hold or sell any security.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.