Bram Houghton

July 29, 2024

Commentary Weekly update Weekly commentaryMarket Update - July 26, 2024

FLASH Report – July 15th – July 26th, 2024

In a Nutshell: A rocky start to U.S. earnings season saw markets sell of this week investors weighed in some weak results from notable U.S. Large Cap companies. The sell off in markets was U.S. focused, though Canadian and International stocks were also somewhat impacted. Value and Small cap stocks showed some resistance to the sell off.

U.S. Labour Markets

U.S. initial jobless claims for last week feel by 10,000 after rising significantly by 20,000 the week before, which shows a continued trend of softer labour markets after touching a 10 month high in June. This higher reference point for jobless claims supports the cooler job market thesis and is the data the FED was hoping to see in order to cut rates at some point in 2024.

U.S. Economy

The U.S. economy grew more strongly than expected in the second quarter, and inflationary pressures also showed signs of cooling, raising the possibility of an interest rate cut in September. Gross Domestic Product (GDP) increased at a 2.8% annualized rate last quarter, above the 2.0% rate expected, and considerably above the 1.4% pace seen in the first three months of the year.

U.S. retail sales were unchanged in June which is somewhat a display of consumer resilience, while business activity climbed to a 27-month high in July, remaining in a strong state of expansion. U.S. trade deficit also contracted with an increase in U.S. exports closing the gap.

Canadian Economy

Canada’s Consumer Price Index (CPI) decelerated in June to an annual rate of 2.7%, down from 2.9% the previous month, but in line with expectations. Canada's retail sales also fell in May by more than expected by 0.8% on a monthly basis, reversing a 0.6% rise in April.

In light of lower inflation data, the Bank of Canada (BoC) cut interest rates by a quarter percentage point for a second consecutive meeting and signaled further easing ahead as inflation worries wane. BoC sees below-potential growth continuing to cool inflation, and said they’re spending more time discussing economic headwinds.

Eurozone and UK Economy

British retail sales volumes fell by more than expected in June, after unseasonably cooler weather put off shoppers, dropping by 1.2% after jumping 2.9% in May. British business activity also picked up this month seeing the strongest inflow of new orders since April 2023. This accompanied by inflation pressures falling to their lowest in more than three years, suggest there is further slack for the Bank of England to continue cutting rates.

The European Central Bank kept interest rates unchanged last Thursday, as widely expected, following on from reductions at its last meeting. Growth in Euro Zone business activity also stalled this month as a tepid expansion in the bloc's dominant services industry failed to offset a deeper downturn among manufacturers, with the index remaining just barely expansionary.

Energy

Oil is down over the last two weeks due to Chinese demand concerns, ceasefire talks in Gaza, and U.S. labour market weakness. This weighed on stronger than expected U.S. GDP data and falling inventories in the U.S.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.1% | -2.0% | 0.7% | -3.6% | -3.5% | -2.5% | -0.9% |

| Last Week | 0.5% | -0.8% | 0.7% | -2.1% | 0.7% | -4.2% | -0.6% |

Market data taken from https://www.marketwatch.com/

CIBC Economics: Quick Take: Bank of Canada rate announcement by Avery Shenfeld

Two in a row with more to go was the message from the Bank of Canada today, as economic slack, or “excess supply”, has the economy no longer in need of punitive interest rates to contain inflation. Today’s quarter point cut came as no surprise, and the June/July moves were consistent with our forecast for 2024’s easing pace. The statement highlights a pickup in economic growth ahead, but note that lower interest rates are cited as a driver of that growth, so there is clearly an intention to continue to trim rates this year and in 2025.

While the Bank cites a few pockets of inflation, including wages, it also notes that the breadth of inflation has diminished, and one of the sources of pressure is tied to mortgage interest, which will ease as the Bank lowers the policy rate. The press conference statement talks about downside risks taking more weight in their deliberations, and the Bank is now mentioning risks of inflation dropping too far alongside mentions of those areas that are still seeing price pressures. That opens the door to a further cut in September, so we’ll watch the press conference for further clues in that regard, as we might opt to move the one pause we had in our forecast to December rather than September. Note that the MPR forecast is fairly optimistic for Q3 growth (seeing an acceleration to 2.8%), so there’s certainly room for growth to come in below the Bank’s call and keep up the pressure for further easing, although the CPI results will be more telling.

This is clearly now a dovish central bank that is looking to ease up on rates and get the economy moving again, so a further 50 bps of easing this year, and our projection for a 2.75% rate at the end of 2025, seem fully consistent with that stance. The final gap to note is between full-time and part-time employment, as the civilian employment report shows full-time jobs down 1.6 million in the past year while part-time is up 1.8 million.

MacroMemo - July 25 – August 6, 2024 by Eric Lascelles, RBC GAM Link to Article

Improving inflation

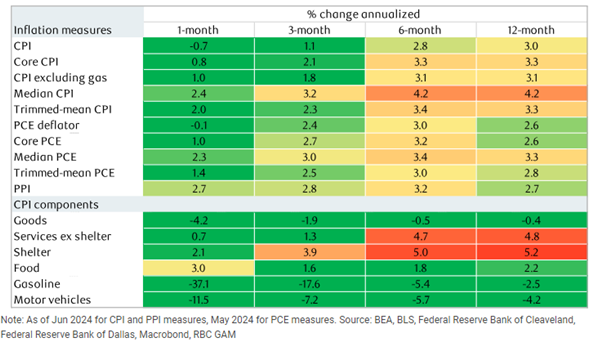

Inflation fears are starting to diminish, although the issue is not completely resolved due to ongoing factors such as elevated inflation readings and various upward forces. Despite this, there is a clear downward trend in inflation, particularly in the U.S. economy, which could lead to potential rate cuts in the near future.

Inflation moving closer to the Federal Reserve’s 2% target

The recent data shows improvements in the Consumer Price Index (CPI), with headline prices falling slightly and core inflation remaining low. Rent and owner's equivalent rent costs have also decelerated, which is a positive sign as shelter costs have been a major driver of inflation. Additionally, car prices are decreasing, and certain service costs are showing a slowdown in inflation rates. While there is room for further improvement in inflation over the next few quarters, the initial July data suggests a slight increase on a month-over-month basis.

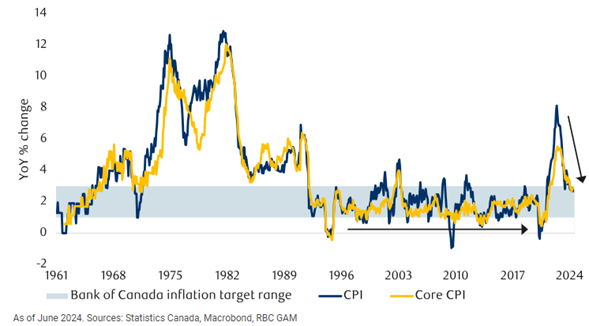

Canada check-up

Bank of Canada decided to cut its overnight rate by 25 basis points for the second consecutive meeting, reducing the rate from 5.00% to 4.50% on July 24. Governor Macklem mentioned that downside risks are becoming more significant in their monetary policy considerations, leading to market expectations of a possible rate cut in September and later in the year.

Canadian headline CPI and core CPI have declined

Another notable statistic in Canada is that 1,400 jobs were lost in June. While this number is not particularly significant given the country's history of employment data volatility, there are two concerning trends.

Firstly, the unemployment rate has increased from 6.2% in May to 6.4% in June, and significantly higher than the low of 4.8% in July 2022. This suggests that Canada may be approaching a point where there is excess economic slack.

Second, despite this, wage growth for permanent workers has remained strong, increasing by 5.6% year-over-year and accelerating from the previous month. With inflation under 3% and chronically negative productivity, this poses a threat to price stability. However, it is expected that wage growth will slow down as the labor market cools and intentions to increase wages diminish.

NOTABLE NEWS

U.S. Secret Service Director Kimberly Cheatle resigned after the agency came under harsh scrutiny for its failure to stop a would-be assassin from making an attempt on the life of former U.S. President Donald Trump during a campaign rally.

Novo Nordisk's (NOVOb.CO), opens new tab weight-loss drug Wegovy secured the UK regulator's approval for its use to reduce the risk of serious heart problems or strokes in overweight and obese adults, the agency said on Tuesday.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

The views of the commentator and/or guest speaker(s), do not necessarily reflect those of CIBC World Markets Inc. This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed. The commentary is for informational purposes only and is not being provided in the context of an offering of any security, sector, or financial instrument, and is not a recommendation or solicitation to buy, hold or sell any security.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.