Bram Houghton

August 26, 2024

Economy Commentary Weekly commentaryMarket Update - August 9, 2024

MARKET UPDATE – July 29th – August 9th, 2024

In a Nutshell: Global Markets sold off sharply to begin the month with the S&P 500 approaching correction territory after weaker than expected job numbers in the U.S. sparking recession fears. Improving jobless claims for last week gave investors comfort that the U.S. labour market hadn’t fallen off a cliff and an equally swift recovery followed to end the week.

U.S. Labour Markets

The U.S. economy added significantly fewer jobs than anticipated in July, in another sign of cooling in labour demand in the world's largest economy. Non-farm payrolls came in at 114,000 last month, down from a revised 179,000 in June and well below the expected 177,000, which was one of the catalysts for the market sell off. Markets saw some comfort in the jobless claims for last week however, where initial claims for state unemployment benefits fell 17,000 to a seasonally adjusted 233,000 for the week from a revised 250,000 the previous week, which was the highest level since August last year. The improved jobless claims numbers saw markets recover quite significantly to end the week.

U.S. Economy

U.S. inflation cooled as expected in June, adding to expectations that the U.S. Federal Reserve will start cutting interest rates in September. The Personal Consumption Expenditures (PCE) price index slipped to 2.5% in June, from 2.6% the prior month. Economists had expected the figure to climb to 2.5%. This as well as the labour market softness should provide the FED the needed breathing space to begin cutting rates in September.

Canadian Economy

Canada’s economy did marginally better than expected in the closing months of the second quarter, with economic growth slowing to 0.2% in May of this year following a 0.3% increase recorded in April. Canadian economic activity expanded at a slower pace in July as a measure of inflation fell to a four-month low, Ivey Purchasing Managers Index (PMI) data showed on Wednesday. The seasonally adjusted index fell to 57.6 from 62.5 in June. With modest growth and cooling inflation and labour markets the BoC also has enough breathing room to continue cutting rates.

Eurozone and U.K. Economy

British business activity picked up this month after a lull in the run-up to a July 4 election, bolstered by the fastest manufacturing growth in two years and the strongest inflow of new orders since April 2023.

The result was also stronger than the same survey for the Eurozone, which fell to 50.1 from 50.9, below all economists' forecasts and within a whisker of recessionary territory. With modest expansion and inflation pressures at 3-year lows, it’s likely BoE has the capacity to lower rates at their next meeting.

Japan

Japan's central bank has raised the cost of borrowing for only the second time in 17 years as it tries to normalise monetary policy and the Yen has been sinking against the USD. The Bank of Japan (BoJ) increased its key interest rate to “around 0.25%” from the previous range of 0% to 0.1%. It also outlined a plan to unwind its massive bond buying programme as it eases back from a decade of stimulus measures. Consumer Price Index inflation in Japan was muted with Headline CPI inflation growing at an annualized 2.2% in July, slightly lower than expectations it would remain steady at 2.3%. With the hike in rates and reduced money supply, the Japanese Yen rose in value rapidly and causing shockwaves in global markets (explained further below).

Energy

After U.S. payrolls and weak Chinese data caused fear in the markets earlier this week, Oil prices steadied as lower U.S. stockpiles, improved U.S. jobless claims and Middle East tensions weighed in to end the week.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | -2.6% | -2.1% | -2.1% | -3.4% | -2.9% | -4.7% | 3.7% |

| Last Week | 0.2% | 0.0% | -0.6% | -0.2% | 0.7% | 4.8% | -0.1% |

Market data taken from https://www.marketwatch.com/

Quick Take by NBI Investments CIO Office Link to Article

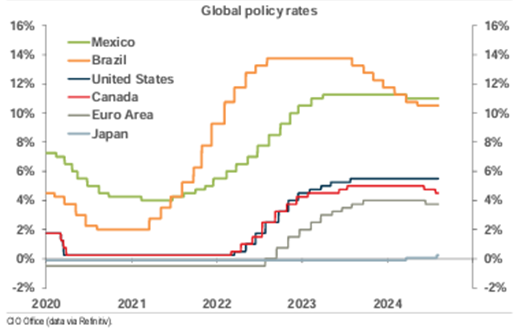

Japan was at the epicentre of Monday’s market turmoil, with the Japanese Yen skyrocketing against other major currencies. This story begins in 2021-2022 where most major economies had to hike interest rates rapidly to manage their inflation issues. All except Japan. This caused many investors to implement a “carry trade”, where they would borrow in a low-rate currency and then purchase securities in a higher interest rate currency. The rising rate in Japan along with the climbing value of the Yen caused many to unwind this trade as it became less feasible. This along with the weaker job numbers in the U.S. caused rapid trading and it appears a large proportion of these “carry trade” positions were closed out Monday.

Japan Stands Apart – an intriguing view of the disparity of global interest rates compared to Japan

The NBI Investment team also raise the point that we have seen a very low volatility and strong growth in equity markets over the last 17 months - Since 2014, there have been an average of 9 days with a daily decline of 2% for the S&P 500 per calendar year. We haven't had one in 17 months, the longest period since 2007.

S&P 500 - 370 consecutive days without a loss of 2% or more

MacroMemo - May 28 - June 10, 2024 by Eric Lascelles Link to Article

Market mayhem

Financial markets have tumbled in early August. At its worst, the U.S. S&P 500 was down by as much as 9% relative to its mid-July high, and similar things were observed in equity markets of other countries also. But what were some of the causes of this volatility?

RBC Economics address some of the notable market weakness that have appeared recently in the U.S.:

- Economic surprises begun to turn negative turn negative

- U.S. jobless claims have been inching higher

- Unemployment increases approaching recession triggering levels

- U.S. manufacturing sectors is in contraction territory

However, there are some positive stories that offset the above weakening data:

- U.S. business lending standards are reversing helpfully

- ISM Service PMI Index re-enters expansion territory

It is still the view of RBC Economics that a soft landing is most likely, despite recession chances have risen for the following reasons:

- The latest data argues that the overall economy is still growing, even if it is slowing. Q2 gross domestic product was recently reported at a robust +2.8% annualized. Consumer spending also remained resilient.

- There is a fair amount of room for a further economic deceleration – which we anticipate and are factoring into our updated forecasts – without GDP shrinking outright.

- It was be a strange scenario if the U.S went into a recession in 2024 with other developed nations cruising to a soft landing given the U.S is yet to lower rates and has greater capacity for economic growth than others.

- Bond yields have fallen significantly and central banks are beginning to ease. It seems highly likely the FED will cut rates, and with the last two weeks of volatility and weakness may see the FED ease more quickly than previously anticipated.

- While lags usually occur between interest rate changes and the economic effect, rate cuts should hit the economy faster than rate hikes.

- The recent decline in oil prices also helps to boost the economy and creates more room for rate cuts via lower inflation.

NOTABLE NEWS

Right now, it looks like you might be able to make a solid argument that Paris will turn out as the best Summer Olympics in Canadian history. With three days of competition to go, Canada has 21 medals and is guaranteed a 22nd in women's beach volleyball on Friday. The record in a non-boycotted Olympics was 24, set three years ago in Tokyo. Based on the schedule, Canada has a very good chance of tying or beating that mark.