Bram Houghton

August 26, 2024

Economy Commentary Weekly commentaryMarket Update - August 23, 2024

MARKET UPDATE – August 12th – August 23rd, 2024

In a Nutshell: Markets continued recovery and gains as the recession fears to start the month were left behind with Q2 earnings season for the S&P 500 posting exceptional results for investors. The downward revision to the jobs growth data for the past year is something to monitor closely in the months to come.

U.S. Labour Markets

A significant downward revision in jobs added for the year through March puts the labour markets firmly on notice. Total payroll employment for the period from April 2023 to March 2024 was lowered by 818,000. This means monthly job gains over that year were approximately 174,000 per month compared to the previously reported 242,000. U.S. Initial Jobless Claims did remain stable over the two weeks however, hovering around the 230,000 mark. The latest job market weakness, coupled with the broader economic softening in the U.S. should be all the fuel required to cut rates in September.

U.S. Economy

U.S. CPI increased 0.2% for the month in July, in line with market expectations and compared to a 0.1% fall in June. Annualized CPI was down to 2.9%, which is the lowest since March 2021. U.S. retail sales also rose by a larger than expected amount in July, pointing to resilience in consumer spending activity ahead of next month’s Federal Reserve meeting. With Q2 earnings season nearly complete for S&P 500 companies, operating earnings per share (EPS) rose 10.9% during the quarter for a record high annual EPS figure.

Canadian Economy

Canada's annual inflation rate cooled to a 40-month low of 2.5% in July, matching forecasts, and core inflation measures eased as well, keeping the Bank of Canada on track to cut interest rates again in September. The further inflation cooling was in line with expectations. Canada's retail sales also cooled in June, as consumers continued to feel the impact of high interest rates and cut back on discretionary purchases. Retail sales dropped 0.3% on a monthly basis, less than last month's 0.8% decline.

Eurozone and UK Economy

Eurozone business activity showed surprising strength in August despite firms raising prices, which has the potential to weaken expectations for two more rate cuts from the European Central Bank this year. However there were signs the upswing may be temporary, with readings flattered by a sharp rise in French services activity due to the Olympic Games.

Sterling climbed to a more than two-year high on the dollar, on recent signs of strength in the UK economy and dovish comments from Federal Reserve Chair Jerome Powell that sent the dollar sliding against several global currencies. Britain's pound jumped 0.7% to $1.3185, touching its highest since late March 2022.

Japan

Japanese manufacturing activity shrank in early August as the country’s biggest automakers struggled with disruptions in output, while services activity grew further on improving local demand. The Japan Manufacturing Purchasing Managers Index read 49.5 for August, which means that though there was a slight improvement from the 49.1 seen in July, it is still in contraction territory.

Energy

A rough two weeks for oil, down nearly 7% on concerns of waning global demand due to continuing weak data coming from China, the largest crude importer, and the downwardly revised employment numbers in the U.S.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 3.3% | 3.9% | 2.9% | 5.3% | 2.4% | -0.2% | 2.6% |

| Last Week | 0.9% | 1.4% | 1.3% | 1.4% | 0.9% | -2.3% | 0.3% |

Market data taken from https://www.marketwatch.com/

Canadian rail dispute: A temporary derailment for the economy by Avery Shenfeld Link to Article

Short-lived labour disputes in Canada's rail sector have occurred before, but the current disruption is notable because both CPKC and CN workers are locked out simultaneously, where typically the two companies negotiate contracts a year apart.

The direct economic impact of a one-week rail transportation shutdown is minimal, but the indirect economic effects of a labour dispute would be significantly greater if it extends beyond a week. A short shutdown would lead to increased inventory accumulation and decreased final sales, with a return to normal once operations resume. However, a longer disruption could halt some production due to input shortages and limit retailers' ability to stock goods. Consequently, the negative impact of a four-week dispute would be disproportionately larger than that of four one-week shutdowns.

Rail disputes have historically been short-lived due to their widespread second order negative effects on the economy, which increase pressure on negotiators and the federal government to resolve issues quickly. There have been two that have lasted more than a week, while most others have lasted less. A one-week lockout could reduce annualized Q3 GDP by nearly half a percent, while a month-long disruption could lead to negative growth in Q3.

The rail dispute is expected to exert some upward pressure on certain components of the Consumer Price Index (CPI), particularly as shipments of fresh and frozen foods have already been halted. However, the inflationary impact will be much less significant than the negative effect on GDP, as current inventory-shipment ratios are above pre-pandemic levels, unlike previous supply disruptions. Consequently, the Bank of Canada is likely to overlook any short-term price impacts, maintaining its plan for rate cuts at the remaining three decision dates this year.

U.S. Economy: Anatomy of a Recession by ClearBridge Investments

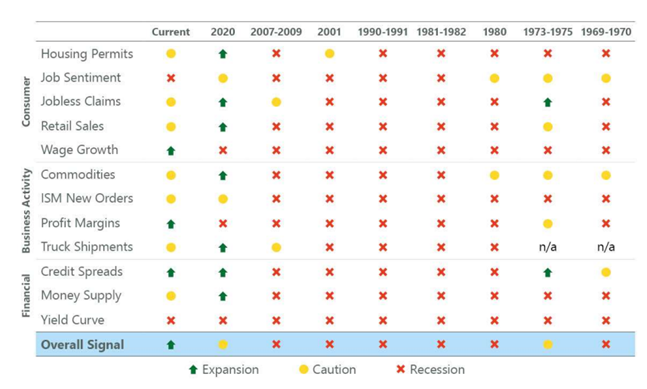

US Recession Risk Indicator

Fears of a recession increased rapidly to start August, and cracks certainly began looming, most notably in the previously evergreen labour markets. There are 12 variables that have historically foreshadowed a looming recession. While the current dashboard points to proceed with caution, there are still some signs of expansion.

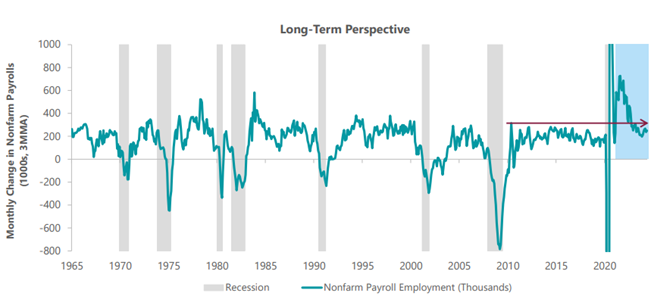

It’s all about Perspective: Employment

The pace of job creation has slowed substantially over the past few years, but has settled in line with the pace experienced during the previous economic expansion. It will be important to monitor new jobless claims and payrolls for the coming months to see if this deteriorates further.

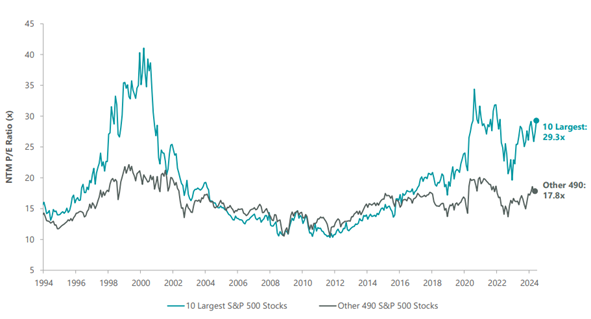

The Largest Stocks are Distorting Valuations

The top 10 largest stocks in the S&P 500 trade at a significant premium, which is distorting the broader benchmark valuation. When you exclude the top 10 companies from the calculation and only focus on the bottom 490, the valuation multiples are much closer to historical averages (historical average is 15.4x).