Bram Houghton

September 09, 2024

Commentary Weekly update Weekly commentaryMarket Update - September 6, 2024

MARKET UPDATE – August 26th – September 6th, 2024

In a Nutshell: Markets continued a broader sell off over the last two weeks after recovering rapidly from the volatility to end July as the latest job data continued to show that the robust U.S. economy had begun to weaken. This does however give the U.S. Fed a clear runway to start lower rates. The Canadian economy also showed some signs of stabilization though more rate cuts are highly likely to be on the agenda.

U.S. Labour Markets

The August jobs report showed labour markets continued to cool with employment rising by 142,000 well below the expectation of 165,000. The ADP job report also showed U.S. private companies added 99,000 workers to their payrolls in August, which is the fewest jobs since January 2021. U.S. Initial jobless claims dropped by 5,000 to 227,000 and slightly below expectations. This suggests a softening labour market, although it remains historically tight. The considerable softening to the labour market during July and August likely gives the Fed enough justification to lower rates with some investors even raising their expectations of a potential 50bps in September.

U.S. Economy

The U.S. core Personal Consumption Expenditures (PCE) index, rose 0.2% from the prior month during July, in line with expectations. Overall annual U.S. inflation was unchanged in July, largely cementing a cut in interest rates by the U.S. Federal Reserve in September.

U.S. durable goods orders advanced by 9.9%, the most since May 2020, and firmly above market expectations of 5%. The US ISM manufacturing index also came in roughly as expected, staying in contractionary territory. The headline manufacturing index came in at 47.2, a few notches shy of the 47.5 expected by consensus, but still an improvement from last month's reading of 46.8.

Canadian Economy

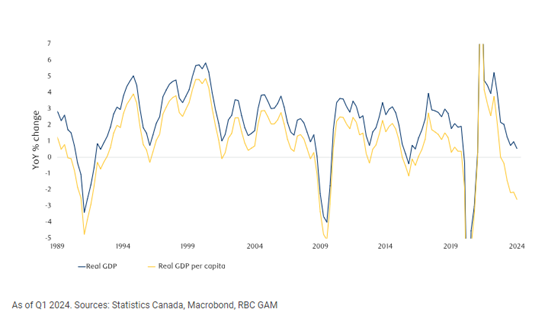

The Canadian GDP expanded by 2.1% annually in Q2 of 2024, the most since Q1 2023 and well above forecasts of 1.6%. However, on a per capita basis, it actually decreased 0.1% in the second quarter, marking the fifth consecutive quarterly decline.

Canadian manufacturing activity moved closer to stabilization in August as production and new orders fell at slower rates, but a decline in employment underscored an uncertain outlook. Canada's services economy however contracted for a third straight month in August as firms employed less workers and wildfires contributed to a slowdown in new business.

Eurozone and UK Economy

Eurozone inflation fell to its lowest level in three years, slowing to 2.2% in August on an annual basis, from 2.6% the prior month, moving closer to the ECB's 2% target after three years of above-target price growth.

Japan

Consumer price index inflation in Japan’s capital grew more than expected in August as stronger wages spurred further improvements in private spending. Core CPI grew by 2.4% year on year which was higher than expectations of 2.2% which sets the stage for more interest rate hikes by the Bank of Japan.

Energy

West Texas Intermediate crude oil weakened to start September as concerns about Chinese demand and fears of a broader economic slowdown, geopolitical tensions and a production halt in Libya and the weighed on OPEC+ planned output increase delay and falling U.S. inventories.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.3% | 0.2% | 0.9% | -0.9% | 1.3% | -1.7% | -0.7% |

| Last Week | -2.4% | -4.2% | -2.9% | -5.8% | -4.3% | -7.4% | -0.1% |

Market data taken from https://www.marketwatch.com/

CIBC Economics: Quick Take: Canadian employment (Aug) | US Non-farm payrolls (Aug) Andrew Grantham & Ali Jaffery

CAD - Canadian employment rebounded slightly following two soft months, but the job gain couldn't keep up with the pace of labour force growth and the jobless rate rose more than anticipated. The 22,000 increase in employment was close to the consensus forecast (+25,000) but was driven mainly by part-time (+65,000) as full time positions fell. The gain in jobs also fell well short of the rise in the labour force, which increased by 83,000 thanks to strong population growth and a one-tick rebound in the participation rate. Because of this the jobless rate continued to climb higher, with the 6.6% reading slightly worse than the consensus expectation (6.5%). Hourly wages for permanent employees rose 4.9% year-over-year, which was a deceleration relative to the prior month but still elevated. However, other measures of wages, including within the productivity data earlier in the week, have shown clearly signs of deceleration so this shouldn't be a concern for policymakers. Overall, this was a slightly softer than expected report consistent with continued steady interest rate cuts from the Bank of Canada.

US - The August jobs report showed the labor market continuing to cool. Employment rose by 142,000, below consensus expectations of a 165,000 increase, and there were material downward revisions over the period two months, with -86,000 net revisions over the prior two months and July payroll gains registering at just 89,000. Three month-average payroll gains now stand at 116,000 as of August, modestly above estimates of long-run break-even rates. However, the good news is the unemployment rate ticked down to 4.2%, in line with expectations, and the participation rate stood firm at 62.7%. Prime-age participation was also very strong again at 83.9%, indicating a robust supply of workers. Wage growth also accelerated to 0.4% monthly, one notch above expectations. There were many mixed elements in today’s report that leaves the Fed call up in the air, and upcoming Fed speakers insights will provide some clues into how they are reading today's report.

Macro Memo - August 27 - September 9, 2024 by RBC Gam & Eric Lascelles Link to Article

Business cycle update

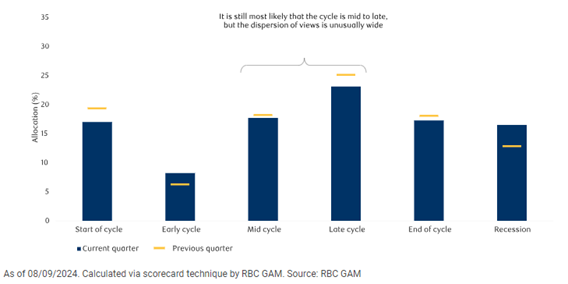

RBC GAM’s business cycle scorecard suggests we are mid to late cycle, which is in line with Q2. However the underlying variables are unusually dispersed across the different cycles and as such, is not communicating with much conviction at present.

RBC GAM’s business scorecard points to mid-to-late cycle

Fed rate cut nears

The U.S Fed has signalled rate cuts are very much on the horizon which is important to not only the largest economy in the world, but there are flow on implications for the rest of the world:

- The USD has already materially fallen in value against other major currencies, while the U.S. 10 year yield ahs dropped from 4.70% to 3.80%.

- Emerging Market economies will typically gauge their ability to cut their own policy rates on the U.S. Fed actions as they typically borrow in USD. Their currency depreciating against the USD would be detrimental to their debt repayments

- This also has implications for Canada who cut rates again on September 4th.

RBC GAM believes that markets may have priced in a little too much easing from the U.S. as very few Americans have floating or short term mortgage rates. Most have 30 year mortgages and are far less sensitive to interest rate changes than borrowers in other countries.

U.S. Economy Check Up

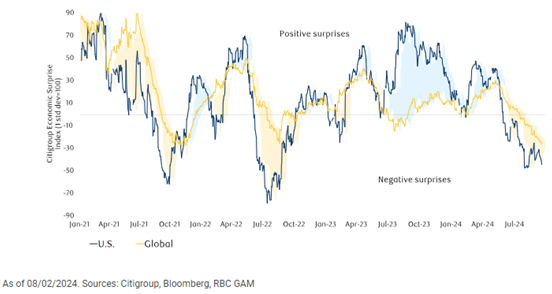

The broad economic theme is that growth is decelerating, which can be witnessed through economic surprises beginning to turn negative.

However, the most severe economic fears have waned with the following data emerging in August:

- U.S. jobless claim stabilized after rising steeply in July,

- Rate of hiring new employees is still good,

- Retail sales were up % in July, and

- U.S. consumer expectations have begun to improve.

Canadian Corner

The Canadian economy has certainly softened and GDP has decelerated. This is a reversion to the mean from unsustainable pace of growth post-pandemic. The average person is consuming and producing less in Canada.

Canadian growth has slowed markedly

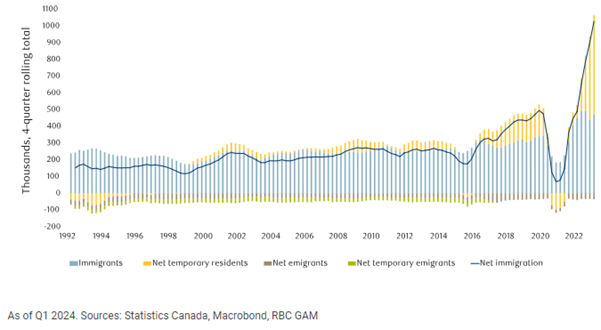

Immigration changes likely

In response to Canada’s recent productivity, housing market and youth unemployment challenges, it appears that major immigration changes appear to be coming to Canada very soon. This includes changes to foreign student admissions and reducing the number of temporary residents. There will also very likely be changes to the temporary foreign worker’s low-wage stream reverting it back o pre-pandemic settings.

Canadian Net Immigration

Notable News

The union representing thousands of railroaders has appealed the moves that ended the rail shutdown last week — a work stoppage that halted freight and commuter traffic across the country.

In filings to the Federal Court of Appeal, the Teamsters union is challenging a directive for binding arbitration issued to a labour board by Labour Minister Steven MacKinnon following a lockout of 9,300 railroaders from Canadian National Railway Co. and Canadian Pacific Kansas City Ltd.