Bram Houghton

October 07, 2024

Economy Commentary Weekly update Weekly commentaryMarket Update - October 4th, 2024

MARKET UPDATE – September 23rd October 4th

In a Nutshell: Markets continued a stable positive trend as more optimistic data came out of the U.S. after markets jumped on the back of the FED’s whopping 50bps rate cut two weeks ago. Global markets benefitted from the news and also continued this trend, while WTI saw significant gains from Middle Eastern tensions and Chinese markets skyrocketed at the news of substantial lending rate cuts.

U.S. Labour Markets

The U.S. ADP Employment Changes report for September came in at 143,000, an increase from 103,000 in August--- and beat the consensus estimate of 120,000. U.S. jobless claims rose by 6,000 to 225,000 above market expectations of 220,000 to mark a new three-week high in a tight labor market, after a drop of 4,000 to 218,000 (below expectations of 225,000). Data from the recruitment firm Challenger showed 72,821 job cuts in September, down 4% from August. This data shows that while the U.S. labour market has softened there is still a reasonable amount of stability and no drastic cause for concern in the slowing economy.

U.S. Economy

U.S. Gross Domestic Product (GDP) in August was unchanged vs. expectations of a 2.6% decrease. U.S. GDP rose at a 3% annualized rate in the second quarter in line with market expectations. The U.S. Personal Consumption Expenditures Index (PCE) increased 2.2% annually in August, below forecasts of 2.3% and up 0.1% from the previous month, in line with expectations. Durable goods orders, a key indicator of the economic health of the manufacturing sector, remained unchanged in the latest report. The actual number came in at 0.0%, a stark contrast to the forecasted decline of -2.8%. The above data further suggests that the slowing of the U.S. economy is of no great concern for the moment as interest rate cuts continue, with the U.S. consumer remaining as resilient as the U.S. employer.

Canadian Economy

Canadian economic activity rebounded in September after contracting in the prior month, and price increases cooled to its slowest in six months. The Ivey Purchasing Managers Index (PMI) rose to 53.1 from 48.2 in August. A reading above 50 indicates an increase in activity, and this is the first time it has been above 50 in 13 months. Services on the other hand showed further weakness, as firms shed jobs and new business dropped to a near four-year low, with headline business activity index falling to 46.4 from 47.8 in August. This is the lowest reading since March. Despite an improvement in Manufacturing activity, overall, the Canadian economy has weakened significantly, paving the way for more rate cuts.

Eurozone and U.K. Economy

Germany saw challenges in September with employment rising more than expected in September and the Manufacturing sector weakening further. Unemployment increased by 17,000 compared to expectations of 12,000 while the HCOB Germany Manufacturing PMI plummeted to 40.6 from 42.4 in August, the lowest reading in 12 months.

Eurozone business activity also slipped back into contraction last month although the downturn was not as steep as initially thought. HCOB's Composite PMI for the bloc, compiled by S&P Global and seen as a good gauge of overall economic health, dropped to 49.6 in September from August's 51.0. This decline is the fastest in pace all year for the Eurozone. Clear weakness is continuing in the EU despite having already begun the rate cutting cycle, which also opens the door for further rate cuts before year end.

China

China's central bank said on Sunday it would tell banks to lower mortgage rates for existing home loans before Oct. 31st, as part of sweeping policies to support the country's beleaguered property market and slowing economy. Rates will be cut on mortgages by no less than 30bps and it is expected to cut existing mortgage rates by about 50 bps on average. This is significant stimulus from China, having seen little expansion from beginning their rate cutting policy months ago. Markets reacted very positively to this news with the broader Chinese index up as much as 30% since the news.

Energy

Oil prices were on track for weekly gains of 9% as investors feared a wider Middle East conflict could disrupt crude flows, after President Joe Biden said the United States was in discussions with Israel regarding an attack on Iranian oil facilities.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data |

TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | 0.4% | 0.6% | 0.6% | 1.0% | 2.5% | -5.2% | 0.8% |

| This Week | 0.8% | 0.2% | 0.1% | 0.1% | -1.4% | 9.2% | 0.1% |

Market data taken from https://www.marketwatch.com/

Revisionist history by Avery Shenfeld Link to Article

Avery Shenfeld discusses the impact of revised economic data on the U.S. economy, particularly in relation to the soft landing scenario advocated by some economists. Revised figures show a brighter picture of U.S. GDP growth, with post-2020 recovery being stronger than initially thought, especially when you look at the following indicators:

- U.S. real GDP grew by 6.1% in 2021, with upward revisions for the following years.

- Consumer spending and capital investment have been key drivers of this growth, supported by a stronger income picture.

- Personal incomes were revised up, particularly for asset owners, which boosted savings rates and household spending power.

- Corporate profits also saw upward revisions, providing optimism for continued capital spending.

However, there may be one potential challenge for this fairly optimistic landscape for the U.S. economy: With higher productivity and slower employment growth, GDP growth may need to outpace previous expectations to maintain full employment. This could mean that the Fed's projected 2% growth may not be enough to reduce unemployment. Still, the improved savings rates and corporate profitability offer hope for the economy, especially as the Fed eases interest burdens.

MacroMemo - September 24 – October 14, 2024 by Eric Lascelles Link to Article

Recession risk drops

The recession risk for the U.S. over the next 12 months has been downgraded from 40% to 30% due to several positive developments

- The U.S. Federal Reserve cut its policy rate by 50 basis points, which supports the economy and indicates readiness to act if needed.

- Recent economic data shows improvement, with the ISM Services index rising above 50, a lower unemployment rate, decreasing jobless claims, and unexpectedly strong retail sales.

- Third-quarter GDP is projected to grow at an annualized rate of 2.9%.

- Credit markets show little stress, with narrow credit spreads, falling mortgage rates, and easing bank lending standards.

- Additionally, lower oil prices support economic growth and mitigate inflation risks.

While the recession risk has significantly decreased, it remains above normal levels, with typical annual recession risk at 10-15%. Some recession indicators still signal caution, and the effects of high interest rates are expected to persist.

Recession risk in Canada remains incrementally higher though unemployment rate has now risen by a large 1.8 percentage points. Every time Canada’s unemployment rate has risen by 1.5% or more in the last 50 years a recession has resulted, except for in the late 1960’s early 70’s where it increased by 3.7%.

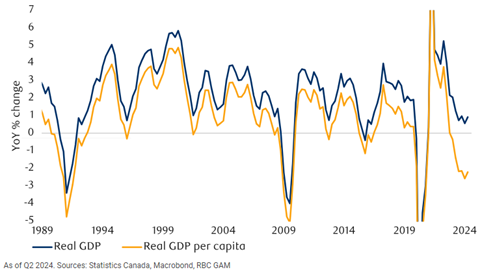

Canadian growth has slowed significantly

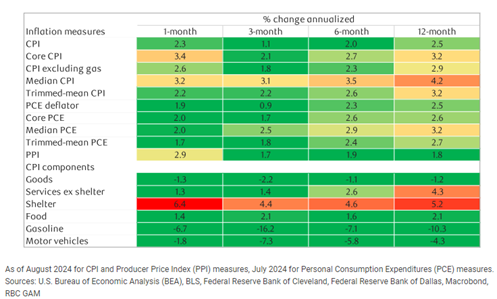

Update on key inflation metrics

Only housing was a significant contributor to inflation in August and the headline print dropped from 2.9% to 2.5%

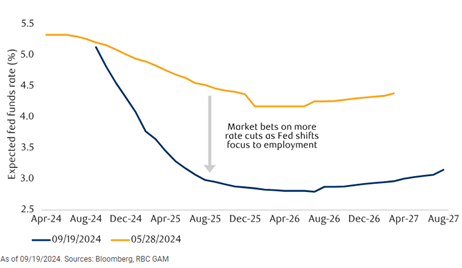

The U.S. Fed goes 50

The Fed eased by 50 bps at their September 18 meeting, somewhat making up for their late start catching up to the EU’s two rate cut easing. The risk of doing so is that markets panic in the context of a deceleration in the economy, however, it was received with positivity, despite the 50bps cut being somewhat priced in. Markets also price in an additional 75bps of rate cuts by year end in the U.S. (which Wicks Quinn Houghton Group feels is overly optimistic).

Rate cut expectations have shifted substantially since last year

For 2025, markets are pricing rates at 3% while the Fed forecasts 3.4%. RBC GAM’s perspective is that rates will likely land somewhere between those two forecasts.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.