Bram Houghton

November 25, 2024

Economy CommentaryMarket Update - November 22nd, 2024

MARKET UPDATE – November 11th – November 22nd

In a Nutshell: Markets stabilized after volatility arose last week as investors tried to grasp what the election outcome meant for equity markets. The Canadian market roared as oil hit a two week high while European and Asian markets stagnated as uncertainty remains over U.S. tariffs to be implemented in 2025.

U.S. Labour Markets

U.S. job growth almost stalled in October as strikes in the aerospace industry and hurricanes depressed employment figures for the month. Nonetheless, the labor market is cooling, with employment gains for August and September being revised down by 112,000 jobs. The unemployment rate held steady at 4.1% in October, because more people left the labor force.

In contrast this week, the number of Americans filing new applications for unemployment benefits fell to a seven-month low last week, suggesting a rebound post hurricane and strikes hurricanes and strikes. Initial claims for state unemployment benefits dropped again for the week ended November 16th to the lowest reading since April.

U.S. Economy

U.S. retail sales increased slightly more than expected in October as households boosted purchases of motor vehicles and electronic goods, a strong start to the 4th quarter. Retail sales rose 0.4% last month after an upwardly revised 0.8% advance in September.

U.S. business inventories, a key component of gross domestic product increased less than expected in September as a rise in stocks at retailers was partially offset by declines at manufacturers and wholesalers.

The Non-Manufacturing Purchasing Managers' Index (PMI), a key indicator of the economic health was stronger than expected, showing a reading of 56.0, an impressive figure that not only surpassed the forecasts, but also showed an improvement over the previous month's 54.9.

However, new orders for U.S.-manufactured goods fell for a second straight month in September, and business spending on equipment appears to have pulled back in the third quarter.

Canadian Economy

Canada's annual inflation rate accelerated more than expected to 2.0% in October as gas prices fell less than the previous month. This likely dilutes the chances of another large rate cut in December.

Canada's retail sales grew 0.4% in September as consumers spent more at grocery stores and supermarkets. This is the first quarterly increase in sales this year and on pace with August and an expected rise in October.

Canada's economy added 14,500 jobs in October and the jobless rate held at 6.5% from September, Statistics Canada data showed on Friday.

Canada's services economy expanded for the first time in five months in October as the Services PMI index rose to 50.4 from 46.4 in September, moving above the 50 threshold for the first time since May. A reading above 50 shows expansion in the sector.

Eurozone and UK Economy

Euro zone business activity took a surprising sharp turn as the preliminary composite euro zone Purchasing Managers' Index sank to a 10-month low of 48.1 in November, below the 50 mark separating growth from contraction.

British retail sales fell by much more than expected in October, showing signs of a loss of momentum in the economy. Sales volumes dropped by 0.7% from September, well below forecast in a Reuters poll of economists.

French business activity contracted in November at its sharpest pace since early this year, while Germany's economy grew less than previously estimated in the third quarter - Germany has lagged the European Union average since 2021 and is expected to shrink for the second year running in 2024.

Energy

Oil hit a two-week high this week as the intensifying war in Ukraine adds to the geopolitical risk premium ahead of OPEC+ policy meeting in December.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | 0.5% | -2.1% | -1.2% | -3.1% | -0.5% | -4.8% | -4.6% |

| This Week | 2.2% | 1.7% | 2.0% | 1.7% | 1.0% | 6.2% | 5.8% |

Market data taken from https://www.marketwatch.com/

MacroMemo - November 18th – December 2nd, 2024 by Eric Lascelles Link to Article

Favourable economic trends

There have been positive trends in U.S. economic data, with an above-consensus increase in retail sales for October, with revisions to September's data enhancing the outlook. Small business optimism is expected to rise, particularly with forthcoming post-election data from the NFIB Small Business Confidence Index.

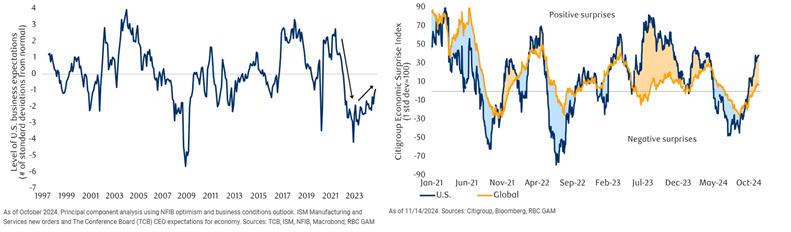

Consumer confidence is also increasing, and general business expectations are improving, as indicated by a robust ISM Services Index. Overall, economic surprises are trending positively both in the U.S. and globally, contributing to a favorable economic environment.

U.S. business expectations rising steadily (left); and Economic surprises have been rebounding (right)

Peak Canadian pessimism?

There have been many reasons to be pessimistic on the outlook for the Canadian economy in recent years due to factors such as high interest rates, slow growth compared to the U.S., elevated unemployment at 6.5%, poor productivity, and potential U.S. tariffs.

However, is this pessimism overstated? There are several positive developments:

- Falling Interest Rates: This is beneficial for Canada’s interest-sensitive economy.

- Stable Inflation: Inflation has reached target levels, allowing for further rate cuts.

- Stabilized Economic Data: Business sentiment is improving, and economic activity is stabilizing.

- Currency Weakness: A weaker Canadian dollar offers a competitive edge.

- Manageable Fiscal Deficit: Canada’s deficit is relatively small, suggesting less austerity is needed compared to other countries.

- Modest Tariffs Likely: Any tariffs from the U.S. are expected to be limited due to trade agreements and similarities in economic structures.

But the big question for 2025 is whether the expected collapse in population growth will be offset by (hopefully) rising productivity growth.

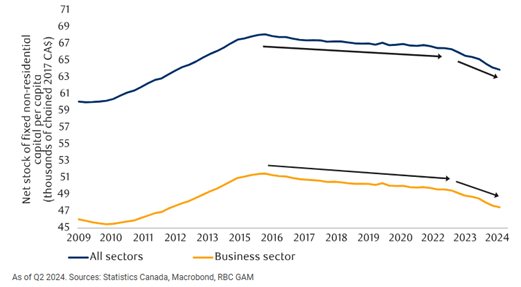

The two are interestingly related as the influx of immigrants mainly consisted of international students and temporary foreign workers filling low-skill jobs, which contributed to a decrease in GDP per capita and overall productivity. Additionally, the capital stock (physical capital/assets used for production) in Canada has not kept pace with population growth, leading to a decline in capital per capita.

Canadian capital stock per capita has been falling

However, there is optimism for a rebound in productivity by 2025, as the number of temporary foreign workers and international students is expected to decrease. This shift may lead to an increase in output per capita and productivity, despite it being a compositional effect rather than a direct improvement in individual productivity. Slower population growth will also provide an opportunity for the capital stock to catch up, potentially resulting in higher capital intensity.

It is the authors view that Canada is more likely to manage growth than not in 2025, and the aforementioned set of factors supporting the Canadian economy will likely begin to bloom with greater visibility thereafter, with the beneficial effect of falling interest rates most important of all.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.