Bram Houghton

December 09, 2024

Economy Commentary Weekly update Weekly commentaryMarket Update - December 6th, 2024

MARKET UPDATE – November 25th – december 6th

In a Nutshell: Continued robust economic data and corporate earnings releases in the U.S. has continued the risk-on sentiment that has seen markets advance strongly since the U.S. presidential election. Despite the talk of tariffs, Canadian and International markets have seen continued growth throughout November as well.

U.S. Labour Markets

U.S. private payrolls growth slowed in November, increasing hopes of another interest rate cut by the Fed in December. Private payrolls rose by 146,000 jobs last month, which was less than October, and below economists’ forecasts of 166,000.

Job openings however, increased solidly in October though layoffs dropped by the most in 18 months, suggesting the labour market is continuing to slow in an orderly fashion. The Job Openings and Labour Turnover Survey (JOLTS) report showed employers were hesitant to hire and the low level of layoffs is anchoring the labour market and the broader economy through higher wages which drives consumer spending.

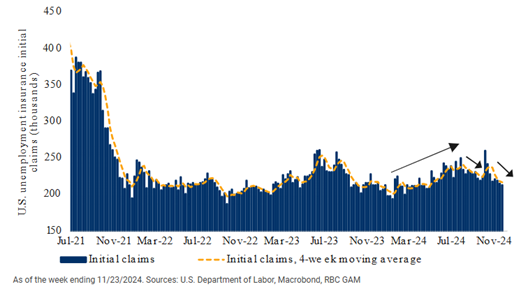

Initial claims for state unemployment benefits were up slightly over the past two weeks after dropping last week. Claims rose to 224,000 for the week ended Nov. 30 which was above economists’ forecast of 215,000 claims. While claims rose this week, they have remained quite stable over the past quarter.

U.S. Economy

The U.S. economy grew solidly in Q3 amid robust consumer spending. Gross Domestic Product (GDP) increased at an unrevised estimate of 2.8% annualized rate, well above what FED officials regard as the non-inflationary growth rate of around 1.8%, with consumer spending (which is 2/3 of the U.S. economy) grew at 3.5%.

Personal Consumption Expenditures (PCE), an inflation metric closely monitored by the Federal Reserve climbed higher in the year to October, potentially offering a reason for the central bank to pause its rate-cutting cycle next month. PCE index accelerated to a 2.3% annual increase during the month, from a reading of 2.1% in September, though the figure was in line with economists' estimates.

Durable Goods Orders in the U.S. rose 0.2, which was a boost to the U.S. economy and a stark contrast to forecasts. Durable Goods is a key indicator of manufacturing sector trends and is closely monitored as it provides insight into the health of the U.S. economy and potential future production levels. This represents a significant swing and possible resurgence in the U.S. manufacturing sector.

Canadian Economy

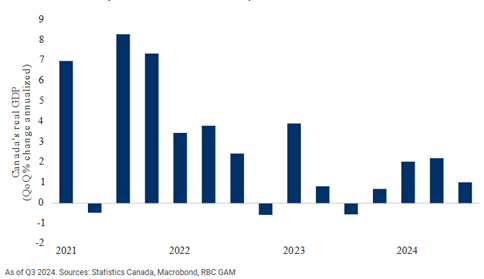

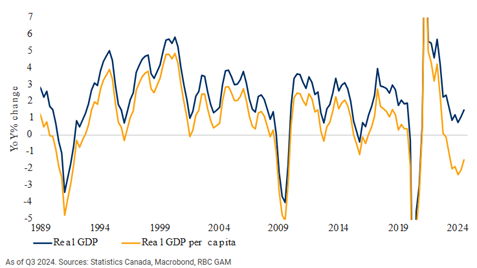

Canada's economy grew at an annualized rate of just 1% in the third quarter, less than what the Bank of Canada (BoC) had predicted. The data from Statistics Canada were in line with market expectations but less than the 1.5% forecast by the BoC, which has in recent months fretted about sluggish growth. GDP per person, a measure of standard of living, shrunk by 0.4% in the third quarter, its sixth consecutive quarterly decline.

Canada's services economy expanded for a second straight month in November as firms added staff, but incoming new work was subdued, and the threat of U.S. tariffs could yet hurt sentiment. The headline Business Activity Index rose to 51.2 from 50.4 in October, the highest level since April 2023.

Canada's retail sales grew 0.4% in September as consumers spent more at grocery stores and supermarkets – this was the first quarterly increase in sales this year. For the third quarter as a whole, sales rose 0.9% and the robust October number suggests that Q4 started strong, economic growth is recovering, and the recent rate cuts are doing their job.

Eurozone and U.K. Economy

Eurozone inflation accelerated in November and its most closely watched components remained high, adding to the case for a more cautious European Central Bank (ECB) with rate cuts next month. Consumer Price Index (CPI) stood at 2.3% in November, higher than the 2.0% a month earlier though in line with expectations.

British retail sales fell by much more than expected in October with volumes dropping by 0.7% from September, below the forecasted 0.3% drop. The drop was the sharpest since June and is likely a loss of momentum in the economy in the run-up to the first budget of Prime Minister Keir Starmer's new government.

Business activity in the zone fell sharply last month as the bloc's dominant services sector joined the manufacturing sector in contracting. Hamburg Commercial Bank’s final composite Purchasing Manager’s Index (PMI) sank to 48.3 in November from October's 50 reading. That was slightly ahead of estimates but still firmly below the 50 mark separating growth from contraction.

Energy

There was a significant decrease in U.S. crude oil inventories, surpassing expectations and indicating a strong demand for crude oil. The reported decrease was 1.8 million barrels, well below the forecasted decrease of 1.3 million barrels. The decrease in crude oil inventories is a bullish indicator for crude prices, suggesting a heightened demand.

The Energy Information Administration (EIA) recently released its Natural Gas Storage report, indicating a significant drop in natural gas held in underground storage. The report shows a decrease of 30 billion cubic feet, which has taken both market analysts and energy sector stakeholders by surprise. This implies a stronger demand for natural gas, which could potentially influence natural gas prices in the near future.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| This Week | 0.7% | 2.7% | 0.7% | 4.2% | 1.9% | 0.9% | -2.8% |

| Last Week | -0.1% | 0.5% | 1.1% | 1.4% | -1.0% | -6.9% | -1.6% |

Market data taken from https://www.marketwatch.com/

Trump’s tariffs: the first shot in a trade war Sadiq S. Adatia, Chief Investment Officer BMO GAM Link to Article

Tariffs

Given Trump's reputation as a dealmaker, this may be a negotiation tactic, and a final tariff is expected to be lower, around 10% on specific items.

The focus on Canada and Mexico likely stems from the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA. Canadian leaders are highlighting differences between the two countries, particularly in border security, which may help mitigate the impact.

Canada has leverage due to its status as the U.S.'s largest goods purchaser and energy supplier. Despite concerns, markets showed little reaction, indicating disbelief that a 25% tariff will be enacted. If implemented, such a tariff would severely impact the Canadian economy.

Bottom Line: While it’s unlikely that Trump will implement a 25% tariff on Canadian goods, we do think Canadians should brace themselves for a tariff on certain goods in the 10% range.

Geopolitical Conflict

The global geopolitical situation is showing mixed signals: France’s minority government faces a no-confidence motion, potentially leading to another election. In Russia and Ukraine, a ceasefire may be possible, but it’s unclear if it will end the nearly three-year-old war, especially given Trump’s stance against proposals by President Biden. While there are positive developments regarding a potential ceasefire in Lebanon, this may not extend to the West Bank or Gaza. Overall, 2025 is expected to bring heightened geopolitical risks and increased political volatility, with newly-elected leaders testing their negotiating power with Trump, particularly on trade issues.

Bottom Line: Geopolitical risk is likely to rise in 2025, and despite some positive signs, it remains unclear when ongoing conflicts may be resolved.

MacroMemo - December 3 – December 16, 2024 by Eric Lascelles Link to Article

Economic developments

There have been many recent positive indicators in the U.S. economy, particularly in the labour market, which suggest a soft landing. Weekly jobless claims have decreased since August, indicating strength in the job market. November payrolls are expected to improve after a weak October, potentially exceeding the forecast of +215,000 jobs due to catch-up hiring.

U.S Jobless claims declining post-hurricanes

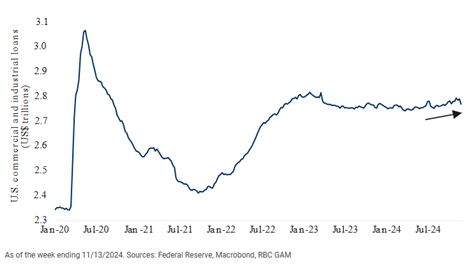

Bank lending standards for businesses have eased, leading to an increase in bank lending. The ISM manufacturing index showed a rebound in December, suggesting improvement despite still being below the expansion threshold. The U.S. GDP for the fourth quarter is tracking at +2.7%, indicating a healthy economy. As for consumer behavior during Thanksgiving, online sales were strong, while in-store sales remained flat, making interpretations of spending trends complex.

U.S. credit has started to rise

There is debate however whether Federal Reserve will pause or cut rates by 25 basis points at their meeting on December 18, with a slight market preference for the latter. While inflation is rising and the economy is resilient, the Fed may start assessing rate cuts more seriously in 2025, targeting a terminal fed funds rate of around 3.5% by then (currently sitting at 4.50-4.75%).

Canadian corner

Canadian growth for the third quarter of 2023 was disappointing, increasing by only 1.0% annualized, which fell short of the Bank of Canada's forecast of 1.5%. However, the year-over-year growth rate improved from a particularly weak Q3 in 2022 dropping out of the calculation.

Canadian economy lost steam in the third quarter of 2024

Looking ahead, economic conditions appear to be improving slightly, with falling interest rates contributing to a more optimistic outlook among businesses. The CFIB Business Barometer reached its highest level since mid-2022, and the Business Outlook Survey shows less pessimism.

Canadian growth differential: GDP versus GDP per capita

The Bank of Canada is set to make a rate decision on December 11, with discussions around a potential 25-basis-point versus a 50-basis-point cut. The preference leans towards a 25-basis-point cut due to concerns regarding the overnight rate's current level and its impact on the Canadian dollar.

Wicks Quinn Houghton Group are Investment Advisors with CIBC Wood Gundy in Calgary, Alberta, Canada. The views of Wicks Quinn Houghton Group do not necessarily reflect those of CIBC World Markets Inc.

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. "CIBC Private Wealth" is a registered trademark of CIBC, used under license. "Wood Gundy" is a registered trademark of CIBC World Markets Inc.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change. CIBC and CIBC World Markets Inc., their affiliates, directors, officers and employees may buy, sell, or hold a position in securities of a company mentioned herein, its affiliates or subsidiaries, and may also perform financial advisory services, investment banking or other services for, or have lending or other credit relationships with the same. CIBC World Markets Inc. and its representatives will receive sales commissions and/or a spread between bid and ask prices if you purchase, sell or hold the securities referred to above. © CIBC World Markets Inc. 2024.

Clients are advised to seek advice regarding their particular circumstances from their personal tax and legal advisors.