Bram Houghton

August 14, 2025

Commentary Weekly update Weekly commentaryMarket Update– July 30th – August 8th, 2025

MARKET UPDATE – July 30th – august 8th, 2025

In a Nutshell: Tariffs have returned as a central macroeconomic disruptor, with the U.S. launching the most sweeping trade actions in decades. While headline inflation has moderated, core prices remain sticky and above target. However, softening economic data means that there is a heightened opportunity for the Federal Reserve (FED) to lower rates in the upcoming committee meeting.

Global Trade Data

The U.S. announced broad-based tariff hikes, with new duties affecting over 60 countries, including the European Union (EU), Japan, Canada, and Switzerland. Average tariff levels rose to 18% - 19 %, with some goods (e.g., Swiss watches) facing duties as high as 39 %—levels unseen since the 1930s.

While companies have thus far largely refrained from passing on the cost to the consumer, some estimates have cost increasing on U.S. households by $2,400 per year. Global shipping and trade volumes have begun to soften as businesses brace for cost pressures and regulatory friction.

Outlook: While there have been some productive and significant deals made recently (EU, UK, Japan and others), global trade tensions are high with speculation of significant implications for inflation, corporate margins, and monetary policy.

U.S. Labour Markets

July job growth came in at just 73,000, well below expectations. Prior months were revised downward, and hiring slowed across manufacturing, hospitality, and retail. Unemployment held near 4.2 %, but broader measures of underemployment ticked up.

Jobless claims steadily rose over the last two weeks, though more concerning is the number of people continuing to receive unemployment benefits climbed to 1.974 million, the highest since November 2021.

Outlook: Initial claims remain moderate, but the uptick suggests that hiring momentum is fading. Job creation has weakened, and prior months’ figures were revised sharply downward. With tariff uncertainty, slower hiring, and tighter labour supply, businesses may hesitate to expand payrolls further suggesting a gradual cooling rather than a disorderly downturn.

U.S. Economy

Q2 GDP growth registered an annualized 3% growth rate, significantly reversing the 0.5% annualized Q1 contraction.

Inflation remains above the Fed target of 2.0%, having increased slightly in June to 2.67% from 2.31% in May, however this is still lower than last year’s 2.97%, the long term average of 3.28%, and many economists’ inflation forecasts from earlier in the year. Some speculate that the impact of tariffs on inflation has not yet been seen.

The latest ISM Services Purchasing Mangers Index (PMI) showed borderline expansion at 50.1.

Outlook: While U.S. GDP was strong for Q2, there is indication of possible underlying weakness including slowing job gains and an inflation uptick. The silver lining is that the FED hasn’t even begun to lower rates so there is plenty of room for expansionary policy, despite lingering inflation concerns.

Canadian Economy

S&P Global Canada Services PMI improved to 49.3 in July (from 44.3 in June). Manufacturing PMI remained weak at 46.1, however the Ivey PMI which conducts its own survey jumped to 55.8, its strongest in a year, indicating a rebound in private-sector activity.

Labour market expectations have cooled—shedding 41,000 jobs in July, down sharply from June’s 83,100, while the unemployment rate remained steady at 6.9%.

The Composite Leading Indicator (CLI) rose again in June to 100.93, consistent with a slow but positive economic trajectory.

Outlook: Canada shows cautious signs of recovery, particularly in services and business confidence, but manufacturing remains weak.

Eurozone and UK Economy

The Bank of England cut its key rate by 25 bps to 4 %, the lowest since early 2023. The vote was split 5–4, highlighting internal disagreement about inflation risk.

The UK PMI data released earlier this month suggests that services remain in modest expansion, while manufacturing is under pressure.

Eurozone GDP was flat in Q2 at 0.1 %, with France showing +0.3 % and Germany shrinking 0.1 %.

Energy cost pressures persist, and the eurozone’s recovery is being dampened by weaker external demand and tariff spillovers. Firms continue to report squeezed margins and input cost inflation, especially in manufacturing.

Outlook: The UK is navigating stagflation risks, cutting rates amid persistent inflation. Europe is fragile, with stagnating growth and high input costs, especially in energy-intensive sectors.

Energy

Brent traded around $67.50 and WTI around $65.00, supported by a 3 million-barrel draw in U.S. inventories.

Energy remains a persistent inflation driver in Europe and Japan, where reliance on imports keeps price levels high.

Natural gas prices have held, supported by seasonal demand but capped by high storage levels and strong supply. Futures markets have softened to multi-week lows as ample inventories outweigh short-term demand drivers.

Outlook: Oil prices face downward pressure toward the low-$60s by year-end as OPEC+ boosts supply, though geopolitical risks could still trigger sharp spikes. Near-term natural gas prices may ease on high inventories, but strong Liquid Natural Gas (LNG) demand and weather risks leave room for volatility and potential surges later in the year.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | -1.5% | -1.1% | -0.6% | -2.3% | 1.3% | 8.6% | -5.8% |

| This Week | 0.1% | 1.3% | 2.2% | 1.1% | -0.7% | -4.6% | 1.8% |

Market data taken from https://www.marketwatch.com/

Canada Stays Steady Amid Rising Global Tariff Tensions Link

Canada remains largely exempt from the latest round of U.S. tariff hikes, thanks to its continued participation in the CUSMA agreement, even while the official tariff rate increased to 35% on August 1st.

While other countries face sharply higher duties, Canadian CUSMA goods still benefit from duty-free access to the U.S. market. As a result, Canada is expected to have one of the lowest effective tariff rates among all major U.S. trading partners.

Export performance is improving—but mostly due to higher oil prices. Canada’s export values for June are expected to show growth, but that’s largely because oil prices jumped by about 10%. When adjusting for price, the actual volume of goods exported likely fell. This points to underlying weakness in trade, even if the headline numbers look better.

The overall economic outlook is stable but subdued. RBC economists project that growth will remain soft but positive in the coming months. With inflation cooling and trade risks contained for now, the Bank of Canada is not expected to lower interest rates further in the short term.

The Great Unwind – What’s Changing in the Global Economy by Cark Tannebaum, Chief Economist, Northern Trust Link

The world economy is undergoing a significant shift, with globalization slowing down, and artificial intelligence advancing faster than expected. This transition - referred to as "The Great Unwind" - is introducing deep uncertainty across global trade, finance, and labour markets, with potential long-term consequences for growth and stability.

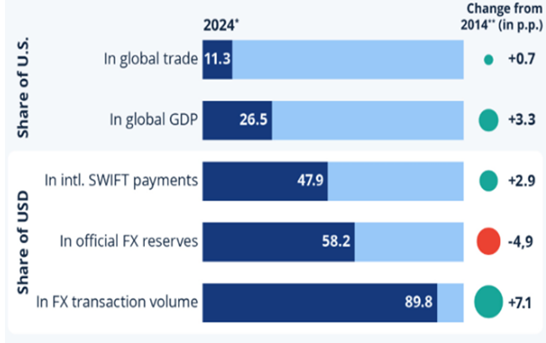

There is growing skepticism about the long-term dominance of the U.S. dollar. As American debt grows and political interference with institutions like the Federal Reserve increases, some investors and policymakers are questioning whether the dollar will remain the world’s primary safe-haven currency. Although the euro has emerged as a potential alternative, it still lacks several core foundations—like unified tax systems and deep capital markets—that are necessary for it to truly compete with the dollar at a global level.

While questions have been raised, there is no heir-apparent when it comes to the USD and its status as the world’s reserve currency.

Share of U.S. and USD in the global economy and a percentage of global financial transactions

Source: IMF, SWIFT, WTO, New York Fed

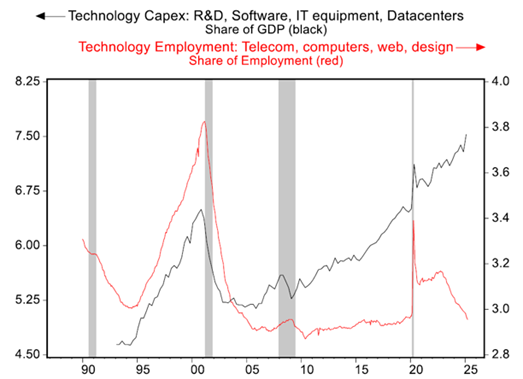

Artificial intelligence is advancing faster than many had predicted, moving from helping humans with tasks to replacing them entirely in some areas. Companies are already slowing down hiring in response to AI’s growing capabilities. While this may improve productivity, it raises concerns about the availability and quality of jobs in the future. Some even speculate that college degrees may lose value, or that we could see a drastically shorter workweek. These shifts will likely force societies to rethink education, employment, and economic support systems.

Source: Haver Analytics / Capital Strategy Research, CG

What It All Means Economically

- We are entering a period of economic uncertainty and transition that may affect trade, jobs, and investment flows.

- Global cooperation is weakening, which may slow growth and increase volatility across regions.

- Emerging markets are at risk, particularly those that rely heavily on trade to sustain their growing middle class.

- Technology is disrupting labor markets faster than policy can keep up, creating risks for workers and institutions.

RBC GAM Macro Memo – June 17th – July 7th by Eric Lascelles, Chief Economist Link to Article

Tariff Threats Ease, But Uncertainty Remains

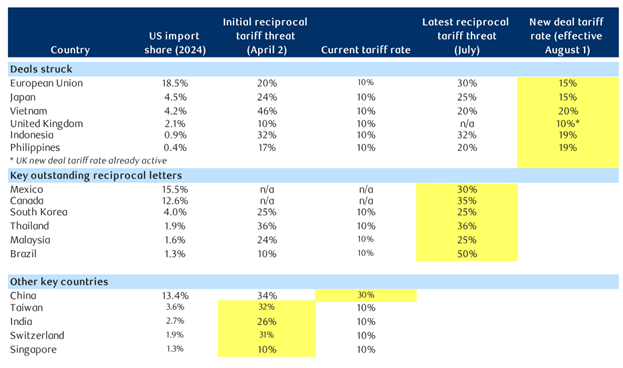

Many U.S. trading partners have secured trade deals, softening the blow of the August 1 tariff deadline. About 44% of U.S. imports are now covered by agreements or temporary extensions, with several more countries likely to receive reduced tariffs. The U.S. has largely “won” these negotiations in the short term, but will likely face longer-term economic costs from higher prices and strained supply chains.

Present U.S. tariff landscape

As of 07/28/2025. Highlighted numbers indicate tariff set for Aug 1. Sources: International Monetary Fund (IMF), U.S. Census Bureau, Macrobond, RBC GAM

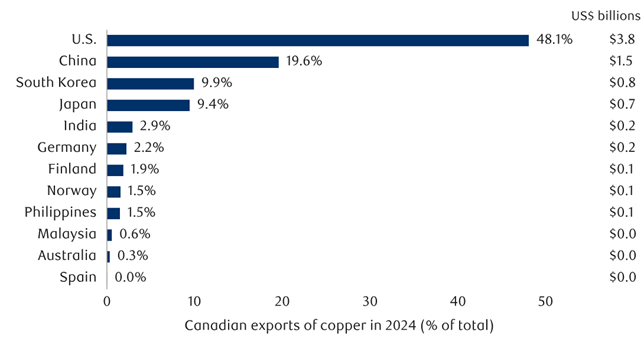

New tariffs on copper could be significant, with Canada among the top exporters of copper to the U.S. A proposed 50% tariff could increase costs for U.S. industries like construction and electronics, as copper supplies are difficult to replace quickly. For Canada, while copper isn’t the largest export to the U.S., the impact could still be meaningful for specific sectors.

U.S. leads Canada’s exports of copper

Export share calculated based on value of total exports of copper ores and concentrates, and articles. Sources: United Nations International Trade Statistics Database (UN COMTRADE), Macrobond, RBC GAM

U.S. Economy Remains Resilient Despite Tariff Fears

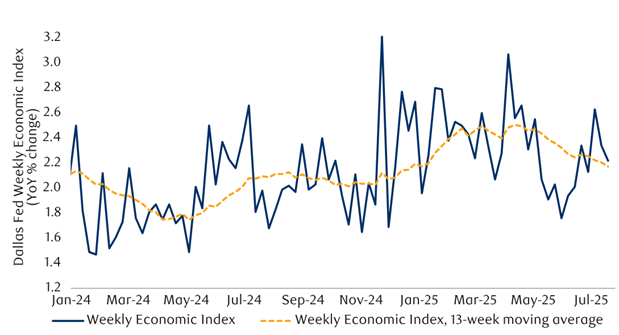

Overall U.S. economic activity continues to look stable, with no signs of a sharp slowdown linked to tariffs. The Federal Reserve Bank of Dallas’s Weekly Economic Index—a composite of high-frequency data—has dipped only slightly but remains within a normal range. This suggests economic momentum is intact, even as policy risks mount.

Dallas Fed’s Weekly Economic Index remains fairly normal

As of the week ended 07/19/2025. The Weekly Economic Index is an index of 10 indicators of real economic activity scaled to align with the four-quarter gross domestic product (GDP) growth rate. Sources: Federal Reserve Bank of Dallas, Macrobond, RBC GAM

Retail sales remained solid in June, and the Q2 GDP print of 3% beat the Atlanta Fed’s projected 2.4%. That’s a healthy clip for an economy supposedly at risk from trade frictions, implying consumer spending is still doing much of the heavy lifting.

Business sentiment is showing mild improvement, according to the Federal Reserve’s Beige Book survey. While company feedback still reflects caution and concerns in some sectors, the overall tone has become slightly more upbeat. This reinforces the picture of an economy that remains durable, despite global uncertainty and rising trade barriers.

If you think others may benefit from reading our content, please don’t hesitate to share it with them.