Bram Houghton

September 10, 2025

Economy Monthly update Monthly commentaryMarket Update - August 2025 Edition

MARKET UPDATE – August 2025 Edition

In a Nutshell: Global trade tensions and persistent tariffs are fueling economic uncertainty, slowing growth across major economies. Signs of labour market softening and ongoing inflation raise the likelihood of central bank rate cuts to support stability.

Global Trade

In August, global trade negotiations were dominated by ongoing and increased U.S. tariffs on key partners like China, the European Union (EU), Canada, and the United Kingdom (UK), with new tariffs affecting sectors such as steel, autos, and aluminum.

While the United State-Mexico-Canada Agreement (USMCA) continues to shield most Canadian exports, European and British exporters have faced higher costs and weaker demand, especially in Germany, which remains in economic stagnation.

China is diversifying its export markets in response to persistent U.S. tariffs, but no major breakthroughs in U.S. - China talks occurred. The uncertainty from tariffs has disrupted supply chains, dampened business confidence, and slowed manufacturing growth in several regions.

Outlook: The continued use of tariffs as a negotiation tool is increasing economic headwinds, with governments considering policy support and ongoing dialogue to avoid further escalation.

U.S. Labour Markets

Recent U.S. labour market data show signs of softening economic conditions. Initial jobless claims rose to 237,000, surpassing both the forecasted 230,000 and the previous week's 229,000, signaling potential weakness in the job market.

The Automatic Data Processing (ADP) Report also disappointed, with only 54,000 private sector jobs added compared to the expected 73,000 and a sharp drop from last month’s 106,000, indicating a slowdown in job creation. Meanwhile, job openings declined by 176,000 to 7.181 million, below expectations, while hiring and layoff rates remained steady.

Outlook: This suggests growing caution among both employers and job seekers, raising concerns about a possible downturn in the labour market and increases the likelihood of the Federal Reserve cutting interest rates to support employment, as labour market stability appears to be a policy priority over inflation at this time.

U.S. Economy

Recent U.S. economic data present a mixed but cautious outlook. Headline inflation Consumer Price Index (CPI) rose 2.7% year-over-year in July, slightly below the 2.8% forecast, while core CPI increased 3.1%, just above expectations, signaling lingering inflationary pressures, partly due to tariffs.

Retail sales grew 0.5%—less than the forecasted 0.6% and down from 0.9% in June—indicating slowing consumer spending. Manufacturing data was mixed: the S&P Global Manufacturing Purchasing Managers Index (PMI) surprised on the upside at 53.3 (expansion), but the Institute for Supply Management (ISM) Manufacturing PMI remained in contraction at 48.7, though improving slightly.

Factory orders fell 1.3%, matching expectations, but improved from the previous month. The trade deficit widened sharply to $78.3 billion, driven by a surge in imports. The services sector showed resilience, with the ISM Non-Manufacturing PMI rising to 52.0, indicating expansion, but employment in services remains weak.

Outlook: Persistent inflation, slower job growth, and trade uncertainty are clouding the outlook, increasing the likelihood of a Federal Reserve rate cut in September as policymakers balance inflation risks with signs of economic cooling.

Canadian Economy

Canada’s services sector remained in contraction for the ninth consecutive month in August, with the S&P Global Services PMI falling to 48.6 from 49.3 in July, signaling a worsening decline in business activity.

New business and new export orders also dropped, with the export index hitting a low of 38.6 amid ongoing uncertainty over U.S. tariffs, which have increased to 35% for some Canadian goods.

Business confidence weakened, as reflected in the future activity index dipping to 58.2 from 60.9. However, employment in the sector stayed above 50, indicating ongoing job growth, and cost inflation eased to a seven-month low.

The Composite PMI Output Index also edged down to 48.4, marking a ninth straight month of overall economic contraction.

Outlook: This new data highlights the persistent weakness in Canada’s services and manufacturing sectors, largely driven by trade uncertainty, and suggests ongoing economic headwinds unless trade relations improve.

Eurozone and UK Economy

Eurozone economic data for August signal modest but improving growth, with the composite PMI rising to 51.0, the highest in a year, supported by a rebound in manufacturing and continued though slower services expansion.

Inflation remains contained. German inflation was 1.8% in July but ticked up to 2.1% in August, while France’s harmonized inflation rate slowed to 0.8% and Spain’s held steady at 2.7%. Core Eurozone inflation was 2.3%.

Germany’s economy shrank by 0.3% in Q2, and retail sales fell 1.5% in July, reflecting weak domestic demand, though manufacturing showed resilience with rising output and new orders. In contrast, Spain’s economy continues to outperform with 0.7% Q2 growth, strong services and robust manufacturing.

UK economic data reveal a mixed outlook. The unemployment rate held at a near four-year high of 4.7% in June, with pay growth excluding bonuses steady at 5.0%. Job vacancies have fallen for three years, and business hiring intentions are at their weakest since early 2021. Inflation remains elevated, with headline CPI at 3.6% and core inflation rising to 3.7%.

Gross Domestic Product (GDP) grew 0.3% in Q2, above expectations, but business investment fell by 4% and retail sales declined for the 11th consecutive month. The services sector showed strength, with the highest showing in over a year, while manufacturing remained in contraction at 47.0.

Outlook: The Eurozone is seeing tentative recovery, but Germany’s persistent weakness and external risks pose headwinds to sustained expansion. The Bank of England faces a challenge; while economic growth and services activity are resilient, persistent inflation and labour market softness complicate the case for further interest rate cuts. The European Central Bank (ECB) is expected to keep rates unchanged as inflation hovers near its 2% target and growth remains fragile.

Energy

The latest Energy Information Administration (EIA) data showed a surprise increase in U.S. crude oil inventories, rising by 2.415 million barrels versus an expected decrease of 2 million barrels.

This reversal from the previous week’s drawdown of 2.392 million barrels suggests a potential slowdown in crude oil demand, which is typically bearish for oil prices and could ease inflationary pressures.

Similarly, natural gas storage rose by 55 billion cubic feet, slightly above the 54 Bcf forecast and sharply higher than the prior week’s 18 Bcf increase, further indicating weaker demand. These developments may put downward pressure on energy prices and, in the case of natural gas, could negatively impact the Canadian dollar due to Canada’s large energy sector.

Outlook: Overall, the data point to softer demand in the energy market, influencing both commodity prices and related currencies.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

Keeping Cool in Volatile Markets—The Upside of Defensive Equity Strategies by Kent Hargis, Chief Investment Officer—Strategic Core Equities, AllianceBernstein Link to Article

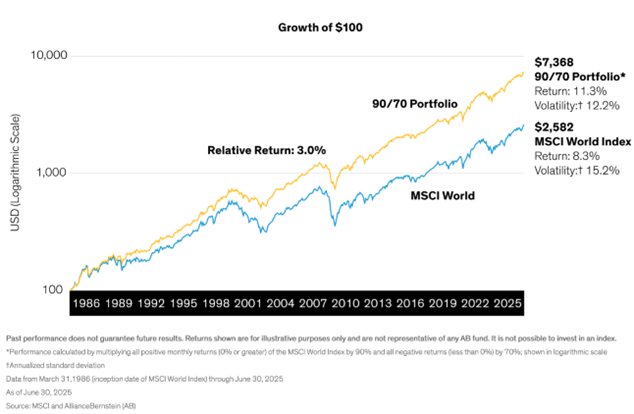

The 90/70 portfolio is designed to capture 90% of market upside while limiting downside losses to just 70% of broader declines. Back-tested from 1986 to 2025, it achieved 11.3% annualized returns, far outperforming the MSCI World Index’s 8.3%, thanks to the compounding benefit of losing less during downturns and needing less recovery in rebounds. A $100 investment in 1986 would have grown to nearly $7,400, almost triple the benchmark.

Can investors reduce losses in downturns and still beat the Market?

This performance relies on selecting stocks with strong quality, stability, and price (QSP) characteristics, alongside active adjustments to manage risks. For investors facing today’s volatility from tariffs, inflation, and concentrated market leadership, the 90/70 approach offers a resilient way to stay invested, reducing drawdowns while still delivering long-term equity-like growth.

We use upside / downside capture as a measure of the health of our portfolios and target a ratio of 90/70 or better. As tariff policies, inflation, and concentrated market risks heighten volatility, the 90/70 framework offers a compelling way for investors to stay invested while mitigating drawdowns, making it well-suited for long-term goals like retirement or institutional funding stability.

RBC GAM Macro Memo – August 19 – September 8, 2025 by Eric Lascelles, Chief Economist Link to Article

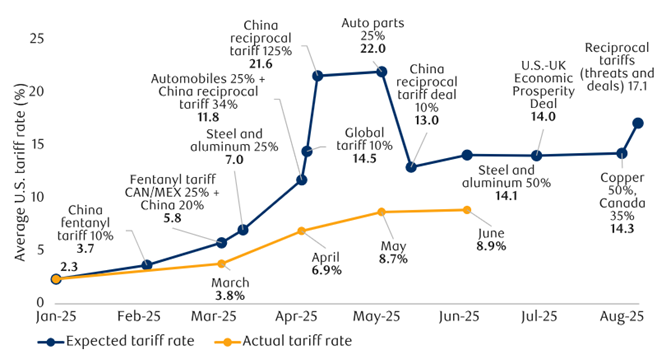

Tariff hike in August

The average U.S. tariff rate climbed from 14% to 17% in August 2025, marking a notable increase but one smaller than earlier feared. While countries like Mexico and China secured temporary extensions to delay further hikes, others saw new tariffs implemented.

Importantly, actual tariff revenues collected remain well below theoretical projections—by about five percentage points—because of factors like substitution away from tariffed goods, exemptions for goods already in transit, higher-than-expected USMCA compliance, and shifts toward duty-free imports. This means that while tariffs are economically disruptive, the realized impact on revenues and effective trade costs has been less severe than headline rates suggest.

Average U.S. tariff rate continues to run lower than theoretical rate

Effective tariff rates estimated based on tariffs in effect as at the specified date and up to August 7, 2025; threatened rates no included. Excludes de minimis effect. All UK steel exports to U.S. are assumed to be covered under the quota system. Expected tariffs rate assumes instantaneous and complete implementation (i.e. does not account for shipping delays, implementation lags, etc.) Sources: Evercore ISI Tariff Tracker; IMF, Macrobond, RBC GAM

If the realized tariff rate continues to lag behind theoretical levels, the economic drag from tariffs could be somewhat smaller than currently forecast. However, as exemptions expire and compliance rules tighten, convergence toward higher effective rates is likely, increasing pressure on trade, prices, and growth later in 2025.

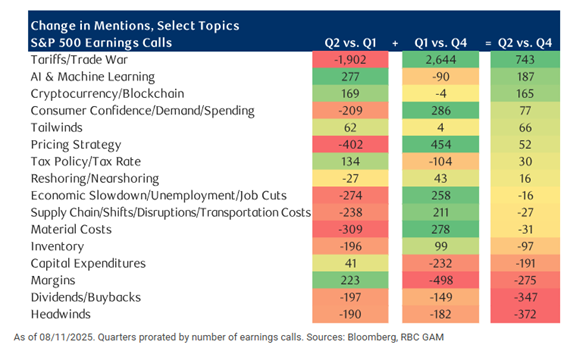

Earnings calls show relaxing tariff concerns

With over 90% of S&P 500 firms having reported Q2 results, earnings calls showed a shift back to normalcy as mentions of tariffs, pricing strategies, and slowdown fears declined from Q1, while AI and crypto surged as new focal points.

Companies noted fewer headwinds, modest consumer resilience, and new tax-related discussions, though tariffs remain a drag on margins in several sectors, particularly autos and industrials.

Overall, the tone was more optimistic, reflecting easing recession fears and stronger business sentiment, but persistent margin pressures suggest companies may eventually pass more tariff costs to consumers.

Changes in topics on S&P 500 earnings calls

The U.S. business cycle scorecard update

The U.S. business cycle scorecard continues to suggest the economy is in the “end of cycle” phase, though “late cycle” and even “mid cycle” readings still attract meaningful weight, reflecting a lack of conviction. While no near-term recession is expected, the models point to slower growth in the coming quarters. However, the scorecard’s usefulness is limited at present since outcomes are heavily shaped by policy decisions such as tariffs and tax changes rather than the natural rhythm of the cycle. Encouragingly, separate recession models show the odds of the U.S. already being in recession have dropped substantially and now remain fairly low.

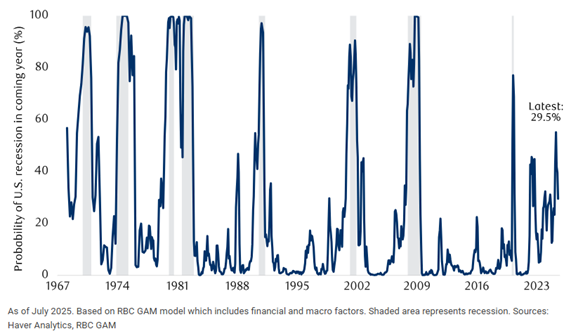

The probability of U.S. recession within a year has fallen