Bram Houghton

October 14, 2025

Economy Commentary Monthly update Monthly commentaryMarket Update - September 8th - October 10th, 2025

MARKET UPDATE – September 8th – October 10th 2025

In a Nutshell: Global economic momentum moderates as U.S. labor demand remains steady, Canada faces a deepening trade imbalances, and Europe contends with uneven recovery and persistent inflation. Tight energy markets and rising oil prices add further complexity to the outlook for growth and policy decisions worldwide.

U.S. Labour Markets

Initial jobless claims rose slightly to 224,000 to end the month, up from the prior week, but still lower than the week previous of 233,000. Continuing claims fell modestly by 2,000 to 1.926 million, which signals limited rehiring despite historically low layoffs.

Job Openings and Labor Turnover Survey (JOLTS) increased to 7.227 million, above the 7.190 million forecast and slightly higher than 7.208 million previously, indicating stronger-than-expected labor demand.

Outlook: The latest labor market data suggest that the U.S. economy is entering a period of moderation rather than weakness. Jobless claims remain historically low, confirming that businesses are holding onto workers even as hiring momentum softens.

U.S. Economy

Consumer Price Index (CPI) accelerated to 2.9% year-over-year in August (vs. 2.7% in July) and 0.4% month-over-month, while core CPI remained at 3.1% YoY. This matched economists’ expectations, with shelter costs being the largest contributor to the monthly increase.

Manufacturing Purchasing Managers Index (PMI) Improved slightly to 49.1 from 48.7, marking the seventh straight month of contraction but showing tentative stabilization, while Services PMI held steady at 50.0, its weakest level since 2010, while the employment sub-index rose modestly to 47.2, still signaling job contraction.

Wholesale inventories Increased just 0.1% in July, while sales jumped 1.4%, suggesting firms remain cautious in restocking. Holiday sales are also expected to grow 5.3% YoY to $253.4B, though down from 8.7% rise last year.

Federal Budget deficit deepened to -$345B, wider than both the -$305.7B forecast and -$291B prior month. The current deficit figure, higher than both the forecast and the previous month’s number, could be taken as bearish for the USD as a growing deficit could lead to increased borrowing, potentially diluting the value of the currency.

Outlook: The latest economic data from the U.S. suggest a slowing but resilient economy, with modest inflation pressures, cautious business activity, and steady labor demand offset by a widening fiscal deficit—conditions that reinforce expectations for further Fed rate cuts to sustain growth amid trade and policy uncertainty.

Canadian Economy

Canada’s merchandise trade deficit widened to $6.32B in August vs. $3.82B prior in July and expectations of $5.55B, the second largest on record as exports fell 3% and imports rose 0.9%. Overall, exports dropped in eight of the 11 product sections in August with forestry, industrial machinery and metals leading the charge.

Shipments to the U.S. dropped 3.4% to $44.18B, while exports to other countries declined 2%; imports from non-U.S. nations surged 4.2%, lifting that deficit to a record $12.8B.

The Manufacturing PMI slipped to 47.7, the 8th month of contraction, while the Services PMI dropped to 46.3, the weakest since June, signaling broad-based contraction across sectors. Conversely, the Ivey PMI jumped to 59.8 (from 50.1), it’s strongest in 15 months, supported by a rebound in employment (50.2) and strong prices (63.2).

Outlook: The above data points to a divergent Canadian economy—with strong domestic business activity masked by deepening trade imbalances and contracting export sector, suggesting tariff pressures and weak external demand will weigh on growth, keeping the Bank of Canada cautious amid mixed economic signals.

Eurozone and UK Economy

The U.K. economy is slowing, with Services PMI at 50.8, Composite PMI at 50.1, and Manufacturing PMI at 46.2, all signaling minimal or contracting growth. Q2 GDP rose 0.3% quarterly (1.4% annualized), but momentum has softened.

U.K. headline CPI stayed at 3.8% annualized, nearly double the BoE’s target, with core CPI at 3.6%; the policy rate is 4.0% after a recent 25 bp cut. The unemployment rate in UK held at 4.7%, the highest since 2021, while wage growth eased to 4.8% from 5.0%.

Eurozone CPI increased to 2.2% annualized (core 2.3%), keeping inflation near the ECB’s 2% target; Germany’s inflation rose to 2.1%, Italy’s to 1.8%, while Spain’s inflation held at 2.7%.

Eurozone unemployment ticked up to 6.3%, while German industrial production plunged 4.3% MoM, and German retail sales fell 0.2%, highlighting weakness in Europe’s largest economy.

The Eurozone Composite PMI rose slightly to 51.2, marking a 16-month high and mild expansion, led by Services PMI at 51.3 while Manufacturing PMI fell to 49.8, showing renewed contraction. Regionally, France remained in contraction (PMI 48.1) while Spain led growth (53.8).

Outlook: The U.K. faces slowing growth and stubborn inflation, leaving the Bank of England cautious about further rate cuts despite rising fiscal and consumer headwinds. The Eurozone on the other hand is showing tentative recovery but uneven momentum, with inflation near target allowing the ECB to hold policy steady, though Germany’s weakness and rising unemployment could justify a rate cut later this year.

Energy

OPEC+ is expected to increase oil production by at least 137,000 barrels per day, adding to the 2.5 million bpd (≈2.4% of global demand) already raised since April, as it seeks to regain market share and respond to U.S. pressure for lower prices.

Crude Oil inventories fell by 3.821 million barrels, exceeding both forecasts and the previous week’s 3.420-million-barrel draw, signaling stronger-than-expected demand and supporting higher oil prices.

Natural Gas Inventories rose by 53 billion cubic feet (Bcf), below the forecast of 66Bcf and the previous week’s 75Bcf, implying increased demand and a bullish signal for gas prices.

Outlook: Energy markets remain tight and demand-resilient, with OPEC+ supply increases and U.S. inventory drawdowns suggesting continued upward pressure on oil and gas prices, potentially complicating inflation dynamics for major economies heading into year-end.

Reuters Market Updates http://www.reuters.com

Bloomberg Market Updates - https://www.bnnbloomberg.ca/markets

| Market Data | S&P/TSX | S&P 500 | DOW | NASDAQ | STOXX EU | WTI | GOLD |

| Last Week | 0.4% | 0.3% | -0.4% | 0.7% | -0.5% | 1.3% | 3.5% |

| This Week | 1.4% | 1.6% | 1.0% | 2.2% | 3.8% | -6.9% | 2.1% |

US government shutdown: What’s the impact on the economy and markets? Published by JPMorgan Link to Article

The October 2025 U.S. government shutdown—triggered by a budget stalemate between Republicans and Democrats has furloughed hundreds of thousands of federal workers and halted the release of key economic data such as CPI and jobs reports. Economists estimate the shutdown reduces GDP growth by about 0.1% per week, while the lack of data complicates Federal Reserve rate-cut decisions, potentially affecting expectations beyond December.

Markets have so far remained largely stable, with stocks rising modestly, gold extending gains, and the U.S. dollar slipping slightly. Bond market effects are expected to be limited since the shutdown does not affect Treasury operations, though lower T-bill issuance and delays to inflation data could temporarily distort pricing in TIPS and inflation swaps markets. Overall, a short shutdown poses minimal risk, but a prolonged one could weigh on sentiment, data visibility, and near-term economic momentum.

Top Client Questions: Q3 2025 – BMO Global Asset Management by Brittany Baumann Link to Article (excerpt 2 of 6 questions)

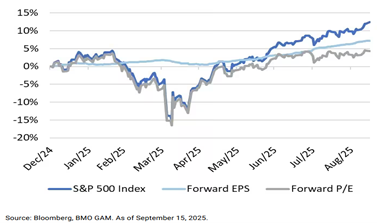

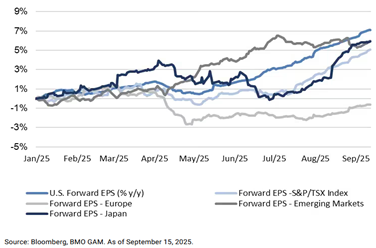

- What has been driving equities to record highs in 2025? Is this the early innings of another bull market? Global equities surged to record highs in Q3 2025, driven primarily by strong earnings growth, particularly in the U.S., while valuation expansion was more pronounced in EAFE and emerging markets. Despite policy headwinds from tariffs and spending cuts, large-cap U.S. stocks benefited from the “One Big Beautiful Bill Act,” which lowered effective corporate taxes to about 12% and boosted investment. Looking ahead, easing labor conditions and potential Fed rate cuts could further support valuations even if growth moderates.

Figure 1: Earnings a key driver of U.S. equity returns in 2025

- Does U.S. policy under the Trump administration worsen Canadian competitiveness? What are the implications for Canadian equities? Canada faces deepening competitiveness challenges as Trump’s trade, tax, and deregulation policies make the U.S. a more attractive destination for investment, pushing Canada’s foreign direct investment and capital spending into stagnation. Highly integrated industries like autos and EVs are struggling, though Canadian energy and financial sectors remain resilient under modest tariffs and Carney’s deregulation. For investors, Canadian equities continue to offer appeal as a low-beta, inflation-hedging play driven by energy, gold, and financial strength, even amid structural productivity headwinds.

Figure 3: Despite growth challenges, S&P/TSX Index has seen strong earnings momentum

RBC GAM Macro Memo – August 19 – September 8, 2025 by Eric Lascelles, Chief Economist Link to Article

Tariffs and inflation

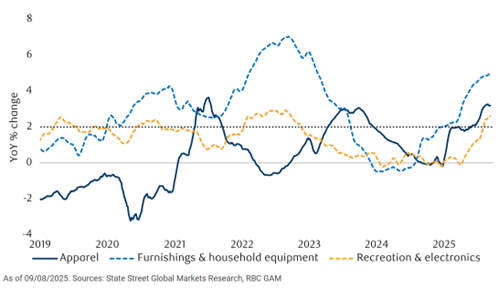

Recent inflation data indicates that tariff-driven price increases are showing up in several categories of the U.S. Consumer Price Index, particularly in goods with high import shares such as apparel, furnishings, and electronics. Although the average tariff rate on imports is 18.6%, the actual effect on consumer prices is much lower because wholesalers and retailers add markups, and various supply chain participants absorb a portion of the tariff costs.

Since only about one-third of consumer goods are imported and just one-third of the CPI basket consists of goods, the total impact of tariffs is estimated to be around a 1.1% increase in overall consumer prices. While this inflationary effect is less than the headline tariff rate might suggest, it remains a significant and potentially damaging factor for U.S. consumers.

U.S. Daily PriceStats Inflation Index shows prices of tariff-sensitive goods are rising

U.S. payroll revisions mix good with bad

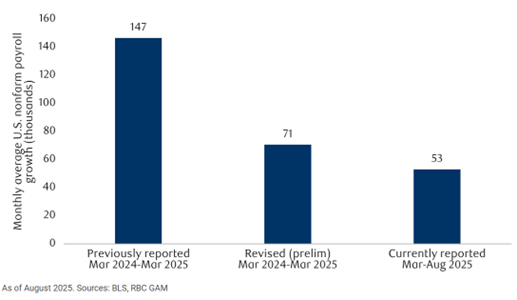

The U.S. Bureau of Labor Statistics’ preliminary benchmark revision indicates that the U.S. economy created 911,000 fewer jobs between March 2024 and March 2025 than previously reported, marking a 0.6% downward adjustment—three times the average revision of the past decade. The revised monthly job growth rate is now 71,000, less than half the previous estimate, with notable reductions in leisure and hospitality, retail, and business services.

While these revisions raise concerns about the reliability of U.S. economic data and may fuel political controversy, they also suggest slightly faster productivity growth and reveal that the unemployment rate has only modestly increased. Overall, expectations for future job gains should be recalibrated lower, and analysts are advised to focus more on the unemployment rate as a measure of labor market health, which, despite recent softening, remains historically solid.

Payroll revisions suggest lower breakeven rate, less slowdown

Canadian infrastructure push

The Canadian government is adopting pro-growth public policies, including modest tax cuts, a shift toward more government investment, and an emphasis on boosting housing construction.

The main economic focus is accelerating infrastructure and resource projects by streamlining regulations, with five major projects recently fast-tracked, such as LNG expansion in BC, new copper mines, modular nuclear reactors, and port expansions.

While the government is mainly reducing regulatory barriers rather than providing direct funding, many initial projects were already well-advanced, so the true impact of regulatory changes will be clearer with future projects.

If successful, these initiatives could enhance GDP growth, capital investment, job creation, and productivity, potentially increasing Canada's economic growth rate for years to come.