Wes Taylor

February 27, 2024

February 2024 Market Update

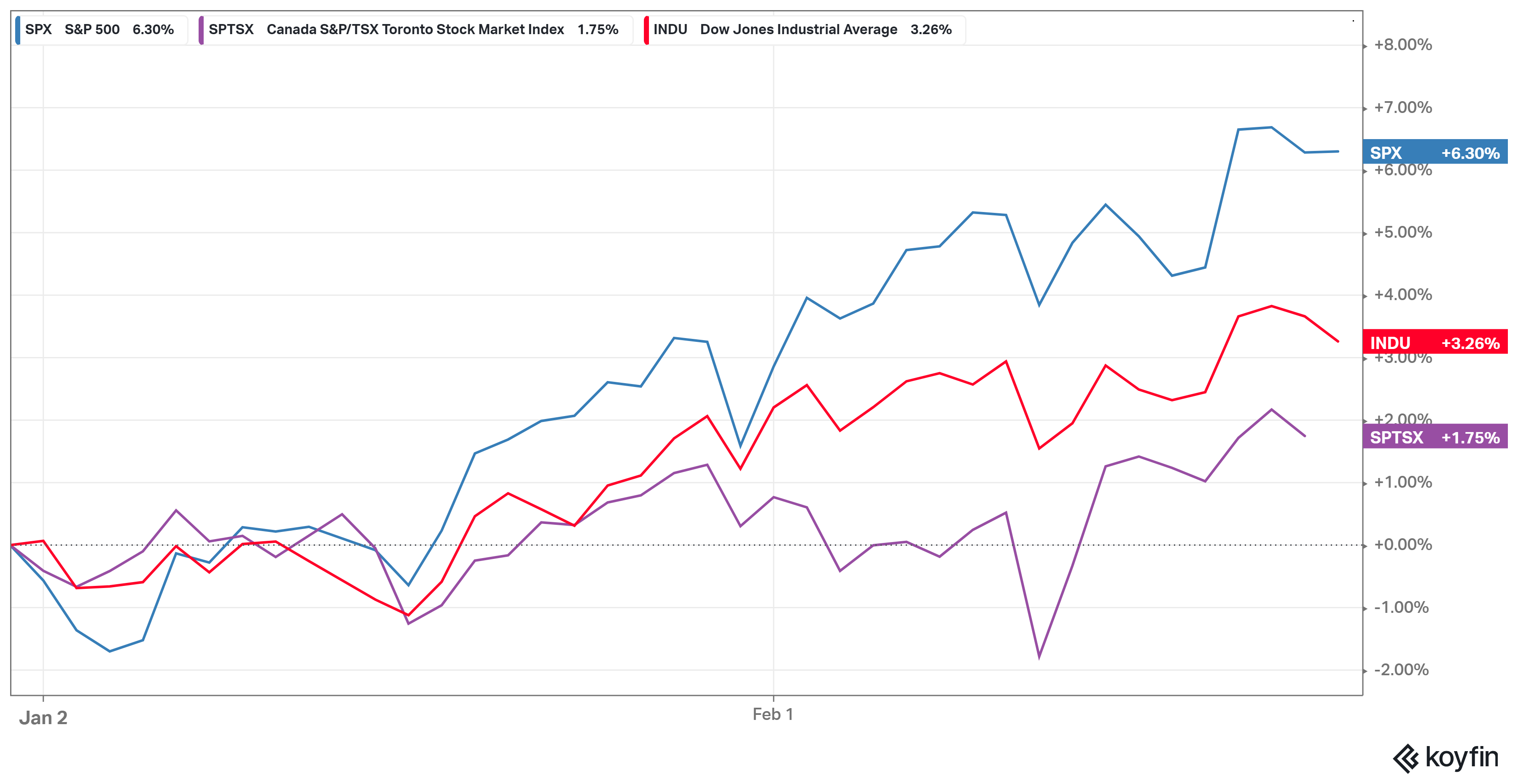

In February, North American stock markets continued moving generally higher. After hitting a recent all time high, the S&P 500 is up 6.35% on the year, while the Dow Jones has risen 3.31% and the S&P TSX in Canada is up 1.75%. In the US, 9 of 11 sectors are in positive territory on the year with Communications, Health Care, and Technology companies leading the pack.

Corresponding Image Description: Line Graph Plotting SPX- The S&P 500, SPTSX- Canada S&P/TSX Toronto Stock Market, INDU- Dow Jones Industrial Average. Date Range on the X-Axis is January 2 to middle of February. Y-Axis shows percent ranging from -2.00% to +8.00%. Chart shows a slight decline then rising up, with a quick dip then back up, ending on a slight dip. Starting numbers at 0.00% ending at SPTSX +1.90%, INDU +3.10% and SPX +6.10%.

In Canada, January's inflation number came in at 2.86% which is the lowest level since March of 2021. This is encouraging as it eases the pressure on the Bank of Canada to keep interest rates higher for longer. Canadian interest rate expectations currently assign a 94% probability of a first rate cut in June.

In the US, current interest rate expectations also show rate cuts this spring, but a bit behind Canada's pace. There is a 53% probability of a cut in June, which rises to 84% by July.

Bond markets have been relatively flat this year, as the big rally in bonds from late 2023 has flatlined - this is to be expected as the short term decline in interest rates has largely been priced into the market already.

Sources:

Koyfin (market return data)

TMX - Montreal Exchange (Canadian Interest Rate Expectations)

CME FedWatch Tool (US Interest Rate Expectations)