Andrew Pittet

September 16, 2025

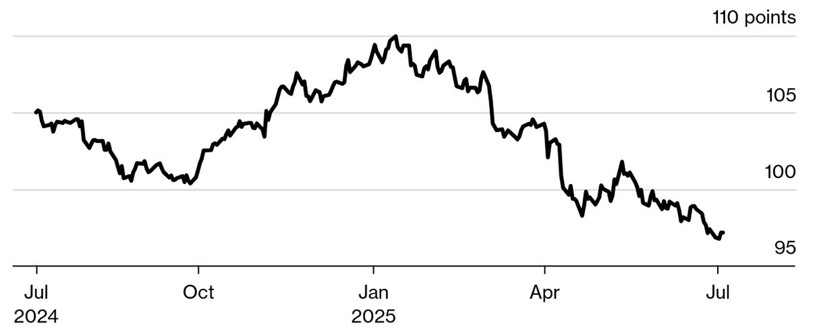

Greenback in retreat

The U.S. dollar, long considered the world’s financial anchor, is showing signs of weakness. At the start of the year, one Canadian dollar bought you $0.69 US. Now, it fetches about $0.72 US – a 4% gain. This isn’t just a Canada-US story. The Bloomberg US Dollar Spot Index, which measures the dollar against a basket of 12 major currencies, just posted its worst six-month stretch since 1973 and is down 11%.

Bloomberg US Dollar Spot Index1

Currencies, like markets, are driven by a mix of logic and emotion. The US dollar has long been considered a safe haven, but lately some cracks have appeared.

A series of trade disputes, sweeping tax cuts, ballooning government deficits, and questions about the Federal Reserve’s independence have all chipped away at investor confidence. From January to March, international investors poured $34 billion into US assets. But by April, with tariffs in the headlines and uncertainty rising, that flow slowed to a trickle—just $2 billion from April to July.2

When fewer people want U.S. assets, fewer need U.S. dollars, and the price falls.

History shows that US dollar cycles tend to last 8 to 10 years and we may be in the early innings of a longer shift. For Canadian investors, this matters and currency moves can have a big impact on your returns. Take the S&P 500, for example: it’s up 10.55% year-to-date in US dollars. But when you convert those gains back to Canadian dollars, the currency effect shrinks returns to 7.3%. Here’s one upside: a stronger Canadian dollar can help keep a lid on inflation. For example, Canada imports more than 60% of its fruits and vegetables from the US and the strengthening loonie could help offset some of those price hikes we’ve all experienced at the grocery store.3

The recent slide in the U.S. dollar is a reminder in the world of finance, nothing is constant and everything is cyclical. For Canadians, these shifts bring both challenges and opportunities—whether investing abroad or shopping at home.

Stay disciplined,

-Andrew

Sources: 1) Bloomberg. 2) EPFR Global. 3) Canadian Federation of Agriculture

CIBC Private Wealth consists of services provided by CIBC and certain of its subsidiaries, including CIBC Wood Gundy, a division of CIBC World Markets Inc. The CIBC logo and “CIBC Private Wealth” are trademarks of CIBC, used under license. “Wood Gundy” is a registered trademark of CIBC World Markets Inc.

This information, including any opinion, is based on various sources believed to be reliable, but its accuracy cannot be guaranteed and is subject to change.

If you are currently a CIBC Wood Gundy client, please contact your Investment Advisor.