Andrew Pittet

November 13, 2025

Gold rush

Every man now worships gold, all other reverence being done away. — Sextus Propertius, 50 BC

Gold has captivated investors for thousands of years. Recently, this age-old asset has returned to the spotlight, with prices climbing to new heights—even after adjusting for inflation. This surge has many asking: what is gold like as an investment and what’s fueling its current rise?

3-year gold price: $CAD / oz1

To understand gold’s appeal, it helps to recognize its unique qualities. Unlike most investments, gold doesn’t depend on anyone else to deliver returns. If you own a bond, you rely on a borrower to pay interest. If you own shares in a company, your fortunes are tied to its profits and dividends. Gold, however, stands apart—it simply exists, and its value is intrinsic. You can even hold it yourself, without relying on any intermediary to protect your investment. It has also maintained stable purchasing power for centuries. Historical accounts show that an ounce of gold could buy a fine tunic in ancient Rome and a tailored suit in Victorian London. In 2025, it would still get you a men’s business suit - although at current gold prices, it would be more likely from a designer like Armani than something off the rack at Moore’s Clothing…

So, why has gold been on such a tear lately? I think several factors are at play. Geopolitical uncertainty has rattled markets, and gold often performs well during such turbulent periods. After Russia’s invasion of Ukraine, Western countries froze over $300 billion USD in Russian state assets held overseas.2 This has made other countries more cautious about holding foreign currency reserves, as they could be vulnerable to seizure. Instead, they’re buying gold – China’s central bank has been adding to its gold reserves for nine straight months.3

Inflation is the second key driver. Gold has long been seen as a hedge against inflation, and recent figures suggest that inflation is still running hotter than central banks would like. In September 2025, U.S. inflation stood at 3.0%, marking more than 40 consecutive months above the Federal Reserve’s 2% target. With central banks lowering interest rates to address concerns about slowing economic growth, gold has become a more appealing option for some investors. Unlike bonds or savings accounts, gold doesn’t pay interest—but when rates are low, that’s less of a disadvantage.

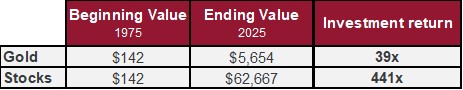

Gold can potentially play a defensive role in portfolios, but one of its drawbacks is that it isn’t productive and doesn’t generate income or growth. Fifty years ago, the price of an ounce of gold was $142 CAD. The table below compares the value of an investment in gold with an investment in the U.S. S&P 500 index.4

Not only is the value of your investment higher with stocks, but you also own a share of productive assets. An ounce of gold purchased 50 years ago remains just an ounce of gold, whereas your investment in stocks represents partial ownership in hundreds of companies with millions of employees working on your behalf. Ultimately, the most appropriate investment strategy is a diversified portfolio tailored to your unique goals, risk tolerance, and financial situation

Stay disciplined,

-Andrew

Sources: 1) Sprott 2,3,4) Bloomberg.