Dean Colling

January 26, 2022

Changes in Monetary Policy Creating Rough Waters

The U.S. Federal Rerserve made a very impactful pivot on monetary policy recently. They went from believing that inflation was transitory, to believing it may be a serious problem. A problem that in their view may need several interest rate increases and a reduction of their balance sheet to effectively combat. The issue is that investors had been accustomed to very accomodative central bank policy for many years. While it was generally accepted that this level of emergency accomodation would eventually be dialed back, they were not prepared for the very strong hawkisk tone that is now in play.

As I've written many times in the past, the market hates changes or uncertainty and most certaingly didn't appreciate this pivot. Like an adolescent hosting a party at home, this move felt like the equivalent of mom and dad scratching the needle across the record player and kicking everyone out. Add in some geopolitical stress, such as in Ukraine, and both equity and bond markets are in the red to start the year. Yet, it is important to remember that this is merely a moment in a long journey and no time to dismantle well-structured investment plans. Let's have a look at a few key factors to consider right now:

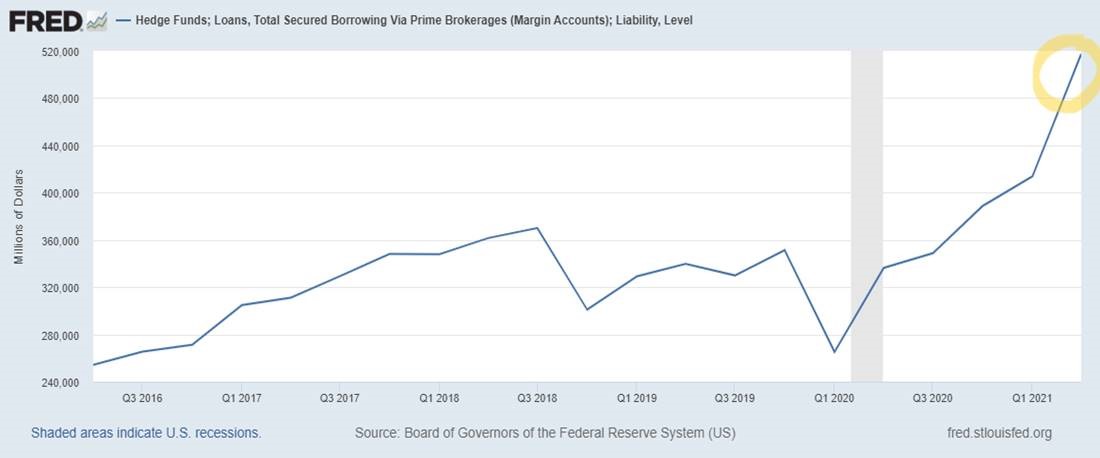

Margin and Delveraging

Cheap and plentiful credit was snapped up by many investors (individual and institutional) over the past two years and found its way into the market. The capital often flowed into companies exhibiting the highest growth metrics. Without supportive monetary policy, at least in the near-term, it is our opinion that a lot of that capital is looking for a way out of the market in order to de-risk which causes near-term selling pressure.

Interest Rates, Inflation, and Corporate Earnings

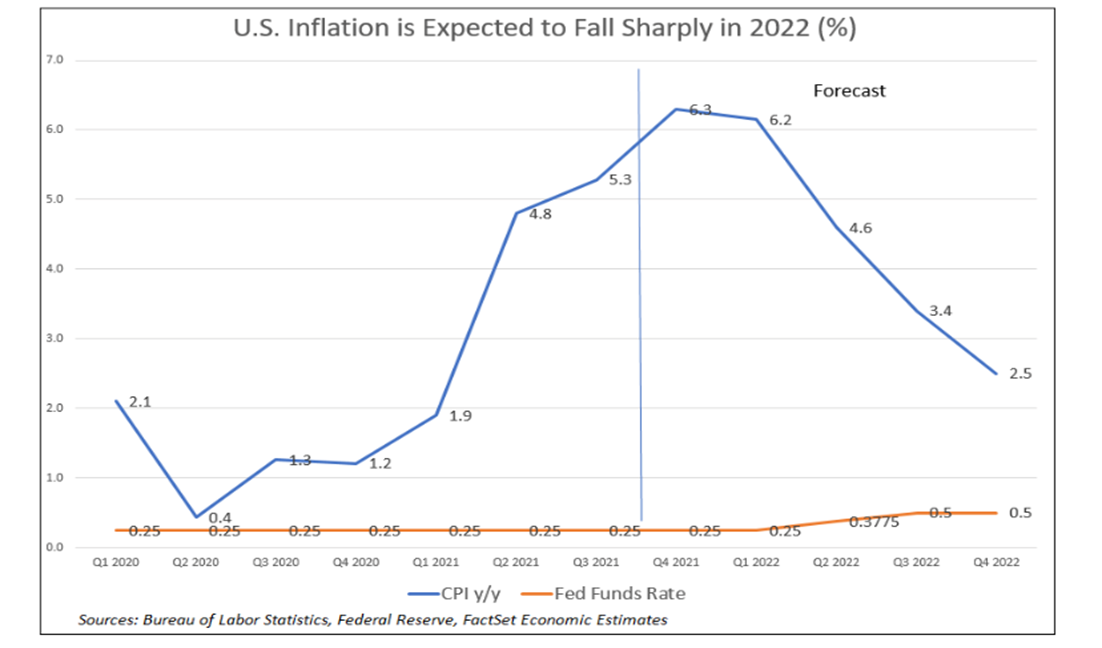

Let's be clear that interest rates are still very low based on historical standards. It is very unlikely that a move in the 10-year U.S. Treasury yield from 1.50% to 2.50%, or even 3.00%, would cause a global recession. Higher rates do impact valuation levels, but so far corporate earnings growth has been solid. This is keeping equity valuation levels reasonable, but in order to continue this they will need to keep delivering strong results in the coming quarters. Overall, the average U.S. inflation rate for the 12 months ended December 31st, 2021, was close to 5.00% - in fact, the recent headlines for the month of December was even higher at nearly 7.00%. A big number, but we need some perspective here. Including 2021, the three-year average inflation rate in the U.S. was 2.02%. Going back to 2016, we see the six-year average rate at 2.08%; one year anomalies like this should be viewed accordingly.

We consider inflation as a near-term issue but not a long-term secular problem. There remain too many disinflationary headwinds such as demographics, technological innovations, and low velocity (turnover) of the currently elevated money supply. Demand may be somewhat elevated, but it is challenged supply chains that are the main driver of inflationary pressures. These should loosen up in the coming quarters and we'll see a move back to normalized three-year and five-year average inflation rates. While we expect the U.S. Fed will raise the overnight lending rate this year, they may remain more patient than the market believes. As you can see from the chart below, inflation expectations are much lower in the second half of the year. Of course, we'll continue to watch the data closely.

Looking Ahead

We are prepared to deal with the near-term market uncertainty and associated volatility while global markets adjust to potentially higher interest rates. Remember, that modestly higher interest rates are usually not a problem for equities over extended periods. While markets generally react negatively (as they are right now) prior to the first of a series of interest rate increases, they tend to rally back in the following quarters. That said, some patience will be required here. Yesterday's sharp intra-day rally from very oversold levels was a positive, but I believe the market has more work to do until this corrective phase is complete. Market drawdowns like this tend to follow a pattern of rallies off a low, and then a re-test of that low on one or two more occasions. Generally, you'll see the next upward leg begin after this drawdown process.

If we look forward from these periods, good things often happen. In the example below, you can see 13 instances after the 2008 Financial Crisis where the NASDAQ 100 Index has declined more than 10% or more. In each case, the market was materially higher one year later. Of course this data is only a short 13 year look back in history and not a crystal ball, but it serves to remind us of the benefits of maintaining a long-term perspective.

|

| Source: Morningstar Direct |

Closing Thoughts

While we look at our portfolio strategy, we have made some modest changes to our specific allocations across all asset classes. We do remain equity biased overall and focused on high quality companies, many with pricing power, at reasonable valuations. We have seen more cyclicals and financials come into the portfolio in recent months. We do remain committed to some strong secular growth stories that we think have many years of double digit growth ahead, despite a significant pullback in prices. In bonds, we continue to be underweight and have maintained a short-term overall maturity/duration to defend against near-term rising rates. Finally, we remain overweight in our alternative strategies in order to diversify overall portfolio returns away from equity markets and interest rates. Here, areas such as private equity and private real estate along with market neutral strategies give us a non-directionally biased return profile that helps manage volatility across the entire portfolio strategy.

To summarize, we do expect Q1 2022 and perhaps the first half of the year to be challenging, but anticipated reduced volatility in the second half of the year. Periodic corrections like this across global markets are historically normal. They can be caused by macroeconomic or geopolitical events, or both. During these periods, patience and a steadfast focus on long-term objectives is essential. Diversification and high quality portfolio holdings should provide the confidence needed to look through periods of uncertainty like this one.

If you have any questions, please call or e-mail us any time. I wish everyone the best for a happy and healthy 2022.