Alex Lee

August 07, 2020

CommentaryTime in the Markets

Global equity markets staged a remarkable rally since the low on March 23rd, and some stocks have reached new all-time highs despite many economies still struggling to come back. The economy and equity markets may diverge at times because markets use pricing mechanisms that look beyond the current state of the economy. Unexpected events can either positively or negatively impact stock prices in the short-term, hence, markets were extremely volatile in March responding to great uncertainty from the coronavirus.

Both the fiscal and monetary responses to coronavirus helped to avoid a worst-case scenario in the economy, and markets recovered quickly from the March low as sentiment improved. The table below illustrates from a historical perspective, just how quickly markets can recover, and the magnitude of returns following market lows:

| Crisis | Market Low | 1 Year Later | 2 Years Later | |

| The Korean War | 07/13/1950 | 28.8% | 39.3% | |

| Cuban Missile Crisis | 10/23/1962 | 33.8% | 57.3% | |

| JFK Assassination | 11/23/1963 | 25.0% | 33.0% | |

| 1969 to '70 Market Break | 05/26/1970 | 43.6% | 53.9% | |

| 1973 to '74 Market Break | 12/06/1974 | 42.2% | 66.5% | |

| 1979 to '80 Oil Crisis | 03/27/1980 | 27.9% | 5.9% | |

| 1987 Stock Market Crash | 10/19/1987 | 22.9% | 54.3% | |

| Operation Desert Storm | 10/11/1990 | 21.1% | 30.2% | |

| Soviet Coup D'état Attempt | 08/19/1991 | 11.1% | 21.2% | |

| Asian Financial Crisis | 04/02/1997 | 49.3% | 76.2% | |

| Dotcom Crash, Sept. 11th, Enron | 10/09/2002 | 33.7% | 44.8% | |

| Invasion of Iraq | 03/11/2003 | 38.2% | 50.6% | |

| North Korean Missile Test | 07/17/2006 | 25.5% | 2.1% | |

| Subprime Mortgage Crisis | 03/09/2009 | 68.6% | 95.1% | |

| Average Appreciation | 33.7% | 45.0% | ||

| ||||

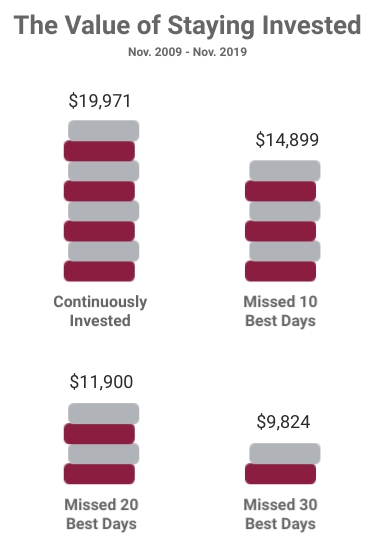

It's very difficult to predict markets in the short-term because sentiment can have a big impact, especially when emotions and economic uncertainties are high. During periods of uncertainty, there can often be an emotional response to sell, even for investors with long-term time horizons. The risk is that an investor may sell too early, and ultimately may end up buying back at a higher price. Timing markets is simply not a repeatable process. In fact, missing best days in market can materially impact long-term performance. Consider the example below - If you invested $10,000 shortly after the financial crisis, missing the 30 best days over the following 10 years actually lead to a negative return:

|

| Source: Bloomberg. S&P/TSX Composite Total Return Index, November 30, 2009 to November 29, 2019. It is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs or taxes. Value of investment calculated using compounded daily returns. Missing 10, 20 and 30 best days, excludes the top respective return days. |

Market corrections and bear markets are a normal part of the stock market but are no doubt scary for investors. As the data clearly shows, making decisions solely based on emotions can have dire consequences. It’s important to have a long-term view when investing in stocks to avoid making short-term decisions. Take a look at the table below, showing bull and bear markets in the S&P 500 Total Return Index from 1930:

| Day of Start | Length (Months) | Return |

| 6/1/1932 - Bull Market | 57.1 | 324.50% |

| 3/6/1937 - Bear Market | 61.8 | -60.00% |

| 4/29/1942 - Bull Market | 49.0 | 15.70% |

| 5/29/1946 - Bear Market | 36.5 | -29.60% |

| 6/14/1949 - Bull Market | 85.6 | 266.30% |

| 8/2/1956 - Bear Market | 14.7 | -21.50% |

| 10/22/1957 - Bull Market | 49.7 | 86.40% |

| 12/12/1961 - Bear Market | 6.5 | -28.00% |

| 6/27/1962 - Bull Market | 43.5 | 79.80% |

| 2/9/1966 - Bear Market | 7.9 | -22.20% |

| 10/7/1966 - Bull Market | 25.8 | 48.00% |

| 11/29/1968 - Bear Market | 17.8 | -36.10% |

| 5/26/1970 - Bull Market | 31.6 | 73.50% |

| 1/11/1973 - Bear Market | 20.7 | -48.20% |

| 10/3/1974 - Bull Market | 73.9 | 125.60% |

| 11/28/1980 - Bear Market | 20.4 | -27.10% |

| 8/12/1982 - Bull Market | 60.4 | 228.80% |

| 8/25/1987 - Bear Market | 3.3 | -33.50% |

| 12/4/1987 - Bull Market | 31.4 | 64.80% |

| 7/16/1990 - Bear Market | 2.9 | -19.90% |

| 10/11/1990 - Bull Market | 113.4 | 417.00% |

| 3/24/2000 - Bear Market | 30.5 | -49.10% |

| 10/9/2002 - Bull Market | 60 | 101.50% |

| 10/9/2007 - Bear Market | 17 | -56.80% |

| 3/9/2009 - Bull Market | 131.4 | 400.50% |

| Source: S&P Dow Jones Indices | ||

Bull markets on average are longer than bear markets, and more intense, providing a more significant percentage change. Based on the table above, we note that the average length of bull markets was 63 months compared to 20 months for bear markets, while the average gain in bull market was 183% compared to a -36% decline for Bear markets.

Headlines on mainstream media can be alarming, especially with an unprecedented decline in economic data. We recognize that this has been a challenging period. In response to the COVID-19 crisis, there has been commitment from both governments and central banks to support the economy. Some of the major central banks lowered interest rates close to zero percent, and began aggressive quantitative easing programs. Additionally, governments have demonstrated a strong commitment to support the economy with a number of fiscal stimulus packages.

We've outlined a few simple steps for long-term equity investors below:

1. Multi-Asset class diversification: We always start by determining an appropriate multi-asset class strategy based on our client's unique investment objectives and emotional tolerance for market volatility. By doing so, we can allocate the right amount of equity exposure to the portfolio to ensure our clients remain comfortably invested for the long-term. From there we look to add low correlation alternatives assets and fixed income to a portfolio to diversify equity market risk. We know that stocks can have higher correlation with one another during drawdown periods so it’s important to have the right asset mix to ensure that the overall portfolio volatility remains controlled. As we like to say, it’s all about creating a smooth flight path.

2. Diversify: It’s important to have a diversified portfolio of stocks to reduce risk associated with a single stock concentration. However, over-diversification can be a significant drag on long-term performance. Studies have shown that the risk reducing benefits of diversification begin to fade significantly beyond 20-30 positions; we think that level of diversification at the equity strategy level is sufficient, particularly when added to a broader multi-asset class strategy. We consider both geographic, market capitalization and sector diversification, and take particular focus on looking for opportunities outside of Canada.

3. Discipline: We focus on the long-term fundamentals of companies, and avoid investing fads. We have seen bubbles in the past (dot-com, cannabis, etc.) and recognize that investor exuberance can often create significant risk that must be avoided. We maintain a disciplined and systematic long term approach to investing that blends momentum, value, and dividend growth factors within our analysis.

4. Stay Invested: Successful investing is about staying invested for the long-term. It is essential to avoid making decisions based on short-term volatility in markets.

It's clear that time-in the market is far more important than timing the market; understand that periods of short-term volatility are simply part of the process and those who are able to maintain composure through these periods should ultimately be well-rewarded.

As always, we encourage you to call or email us anytime with questions.

Alex