Dean Colling

October 24, 2025

There's a Bubble... in People Calling a Bubble

Every few months, financial headlines start to sound eerily similar: “Markets are in a bubble,” “This rally feels unsustainable,” “It’s 1999 all over again.” Ironically, the only bubble that’s really growing lately is the bubble in people calling for a bubble. After nearly two years of steady equity gains and strong corporate earnings, skepticism has become the new consensus. Yet history shows that markets rarely peak when everyone’s bracing for the fall.

Why People Keep Calling It vs. What the Data Says

Bubble calls are comforting. They make investors feel prudent or disciplined, and make enticing headlines. But corrections, while inevitable, aren’t proof of systemic excess. There is an old saying in our business that markets don’t die of old age, they die of excess — excess leverage, excess speculation, and excess optimism. None of those indicators are flashing red right now.

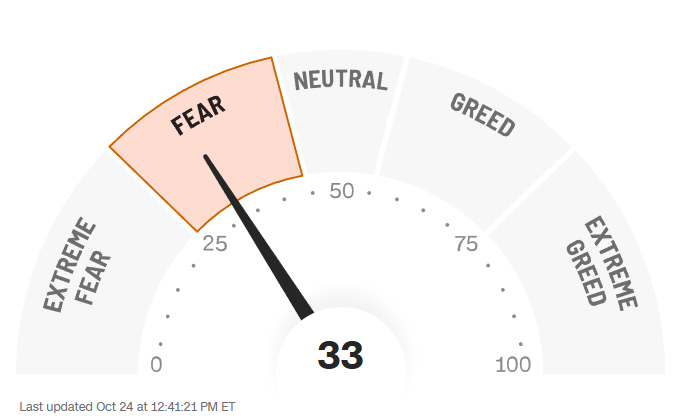

According to Bank of America’s long-running Fund Manager Survey, when cash levels among global investors rise above 5%, it typically signals fear, not euphoria. Today, cash levels remain elevated at 4% — hardly the hallmark of a market top. The AAII sentiment survey, which tracks U.S. retail investor optimism, has hovered below its long-term average for months. Additionally, some technical indicators we use to gauge market sentiment are currently sitting in a neutral, or slightly negative position. A popular contrarian indicator, CNN's Fear & Greed Index, has gone from Greed to Fear over the course of the last few months, signaling that investors are still more anxious than exuberant.

Our Take

At the Colling Group, we’re cautious when we need to be, but we’re also guided by evidence, not emotion. We see healthy rotation, improving earnings breadth, and selective opportunity beneath the surface. In our view, the real risk isn’t being caught in a bubble, it’s sitting out a bull market out of fear of one. We remain level-headed, and focused on our long-term investment process across our diversified multi-asset class strategies, acknowledging that volatility is normal and that collectively, a market bubble consensus is rarely the right one.