Adam Slumskie

October 04, 2023

Volatility is a dish best served cold

Market volatility has become something of the norm over the last few years. Since the roller coaster markets during Covid in 2020, investors have seen more volatility than they have since the financial crisis 15 years ago. The headlines of the past two years have caused a lot of economic uncertainty. Will rates go higher or lower? Will there be a recession? Will there be another world war? These headlines all create uncertainty, and there is nothing that the equity markets hate more than uncertainty. It’s very easy to forget after such a long, seemingly stable stretch prior to COVID, that volatility is not only normal, but it can be the friend of the savvy investor. Although difficult to predict and even harder to stomach, we always want to keep in mind that volatility is necessary to good financial markets. It's what creates opportunity and allows for long term returns much greater than many other investments.

Given that inflation has been tough to tame throughout the world and is still sticking around today, I think investors should be prepared for more volatility as the year comes to close. I think the fight against inflation is heading in the right direction and, as the proverbial light at the end of the tunnel shines brighter, we will likely get another push higher in the equity markets and make our way to some more stability. This may come with a recession in between, but our thought is that North America in particular, is much better situated for a recession than we saw in 2008. Given the recency bias of the 2008 crisis, a lot of investors feel that 2008 is what every recession looks like. Recessions throughout history have generally been much milder. In fact, during the last four recessions since 1990 in the US, the S&P 500 declined an average of 8.80%, according to CFRA research. In over half of the 13 years with recessions since WWII, the S&P 500 has actually posted positive returns. This sounds like it goes against what everyone thinks of as a recession, but it’s the facts. Keep in mind the S&P and TSX posted double digit losses last year, and some of those losses were attributed to the fact that the market was predicting a recession in 2023.

I’ve said this many times before: you have to look at the equity market as a forward-looking tool. You can’t look at what is happening now, you have to look at where things may be a year or eighteen months from now. As the year goes on, the market continues to try to strike that balance between current data and where we might be in the future. This is why investing can be so difficult. In the worst periods of volatility, everyone has that feeling of despair and, as a result, many think that the best and easiest decision for their portfolio might be to move money out of the equity market. In reality, this is the opposite mentality that one should have. If your account is aligned how it should be, then staying put through these volatile periods, or in some scenarios adding more equity, is what will give investors much better returns than the average. It’s proven through research that the average investor performance pales in comparison to the index returns, and the real major difference is emotion. The bond markets are no different, as are many investment type vehicles. Buying during volatility or staying put in your allocations with no drastic decisions, is the way to superior returns. It just takes time.

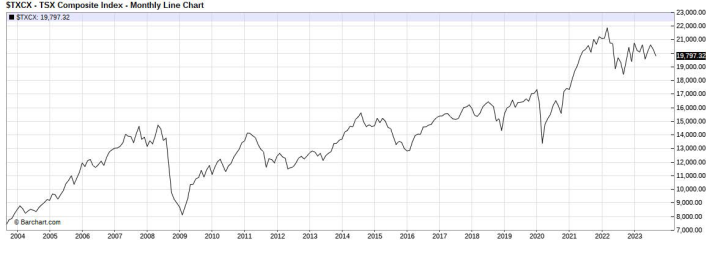

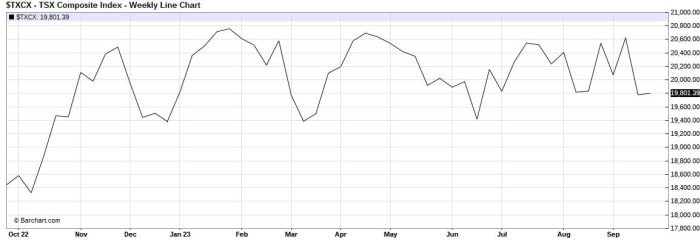

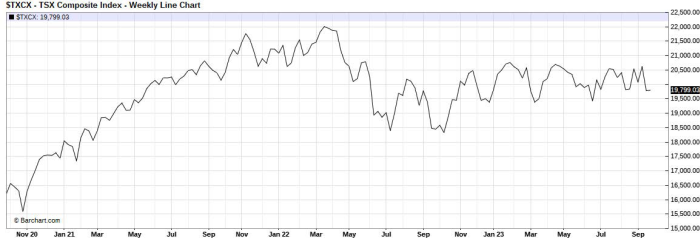

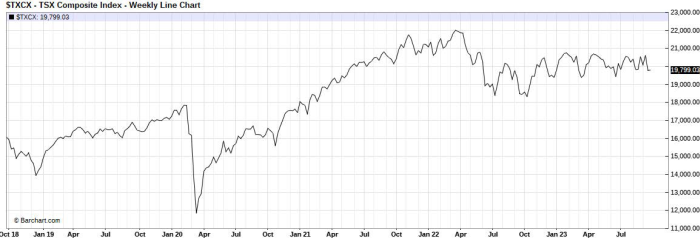

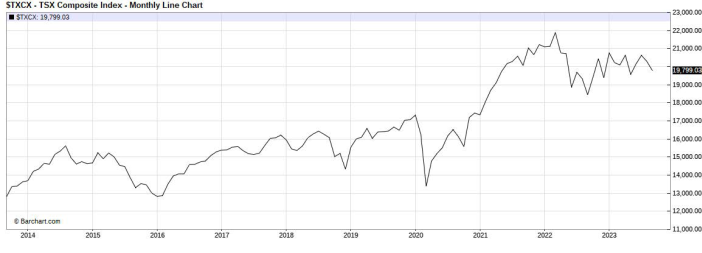

I’ll leave you with charts of the S&P 500 on a 1-year period, 3-year, 5-year, 10-year and 20-year period. As you can see by these charts, volatility is certainly a dish best served cold.

1-Year

3-Year

5-Year

10-Year

20-Year