Milan Cacic

December 10, 2021

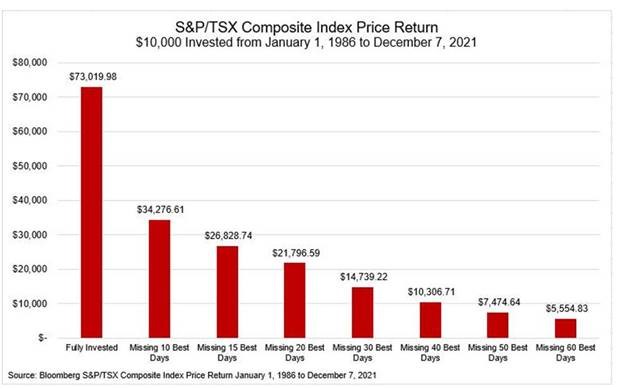

Money Economy Commentary Trending Weekly updateTIME “IN THE MARKET” IS MORE IMPORTANT THAN “TIMING” THE MARKET!

Over the last couple of weeks, we've seen some significant selloffs in the markets. First came the news of an emerging COVID variant followed by Federal Reserve Chairman Powell’s testimony before the Senate banking committee where he appeared more hawkish than expected. Both these events appears to have caused the yield curve to flatten and credit spreads to widen, which triggered a selloff in growth and cyclical stocks. Since then, we have seen the stock market recover on news of a potentially milder Omicron variant as well as strong economic data.

These sudden and sharp selloffs, which unfortunately are becoming more common, are gut wrenching to say the least. We’ve had a few clients ask if we were raising cash or getting defensive. The short answer is no, we don't believe in timing the market. It only works if you’re correct twice – you need to liquidate before the drawdown and invest back in at the bottom of the market. I don't know anyone who can do that consistently. During times of volatility, we stick with lessons we've learned over the past 30 years, as well as the processes that we have in place which are non-emotional. We listen to federal bank policy carefully and watch credit spreads closely.

I have included a chart below to illustrate how devastating it is to portfolios if investors had missed just the 10 best trading days over the last 35 years.

I've also included a piece from our CIBC Economics Team titled “ Someday, we’ll be together”.

I also wanted to bring to your attention that December 29 is the last day of tax-loss harvesting for 2021.

As always if you have any questions please give us a call anytime.

Have a great weekend.

Milan