Milan Cacic

February 04, 2022

Money Economy Commentary Trending Weekly updateVOLATILITY SUCKS...

When volatility goes up like it has in 2022, we tend become more emotional about our portfolios. I thought this might be a good time to look at a few charts from a more objective basis.

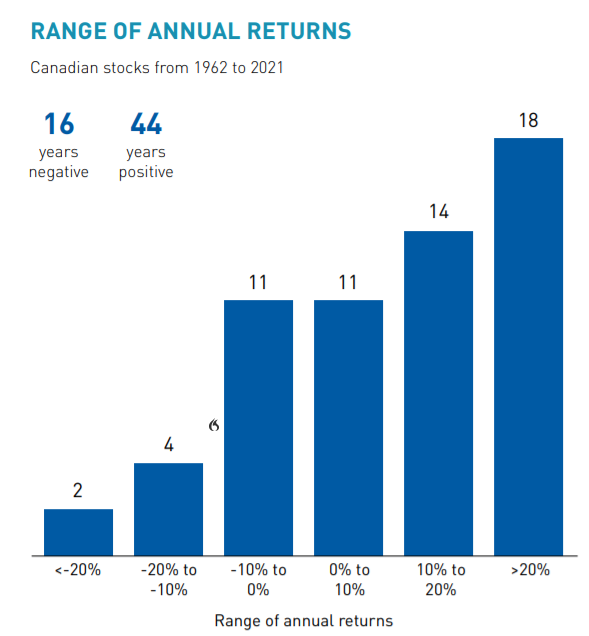

The chart below shows the returns over the last 60 calendar years. The chart is telling us that positive calendar return outcomes are three times more likely than negative outcomes, and more importantly the best outcomes, where the market goes up more than 20%, are 9 times more likely than a decline of the same amount.

1Source: It Pays to Stay Invested, NEI Investments, 2022 (PDF download)

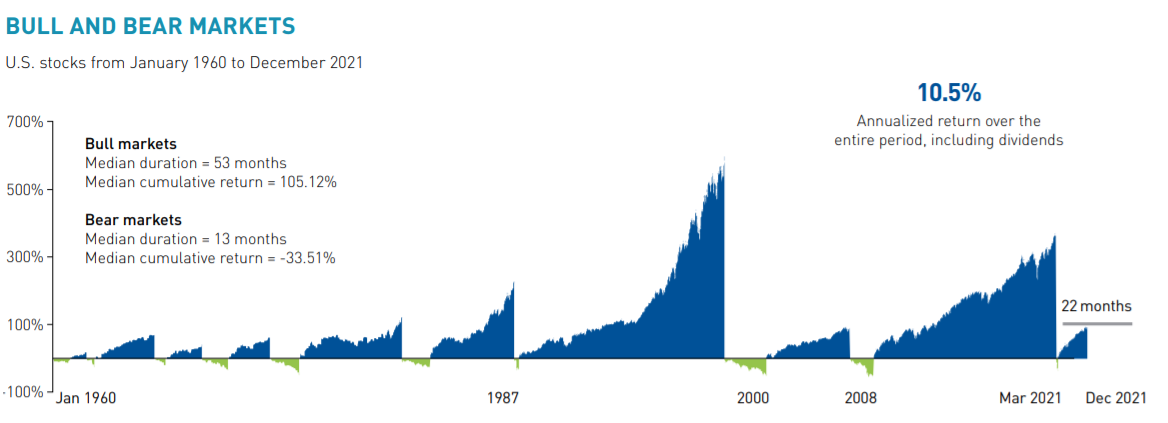

The other chart that I would like to show you is the bull versus bear markets chart. As you can see, bull markets tend to last longer than bear markets and provide considerably higher returns compared to bear markets. From a historical perspective, our current bull market, is in the early stages of duration as well as return.

2Source: It Pays to Stay Invested, NEI Investments, 2022 (PDF download)

So what does all this mean?

- Markets tend to go up more than they go down.

- Timing the market is almost impossible and missing even a few of the best days can be devastating to returns.

- Diversification is paramount and helps reduce portfolio volatility.

If we build a well-diversified portfolio that matches your risk tolerance and stay invested through all market conditions, portfolio returns are likely to be higher than trying to time the market. Although volatility can make us nervous, it also generates opportunities.

I have also included a piece from our CIBC Economics Team entitled "Some Crude Remarks".

If you have any questions please feel free to give us a call anytime.

Have a great weekend.

Milan