Milan Cacic

May 04, 2022

Money Commentary In the news News Weekly update Weekly commentaryTHE MARKETS EMOTIONAL ROLLER COASTER IN EMOJI FORMAT.

I will be taking a few days off and not here on Friday so I thought I would share a market update a little earlier this week.

The volatility over the past month has certainly changed sentiments and emotions towards the market. I thought this might be a good opportunity to take a step back and look at the broader view.

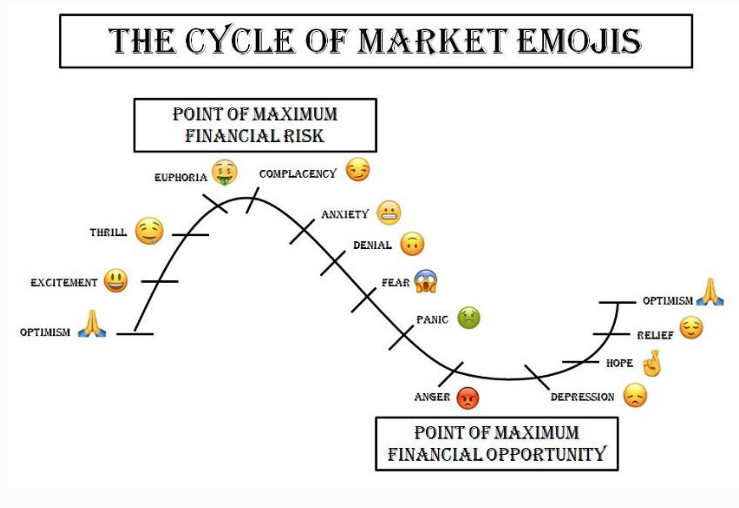

The graph below has been used for decades to describe the emotional roller coaster that most people experience when investing in the stock market. Basically what it says is that, when the sentiment towards the market is at its most negative, the market begins to rebound. I thought it might be more appropriate to portray this using emojis.

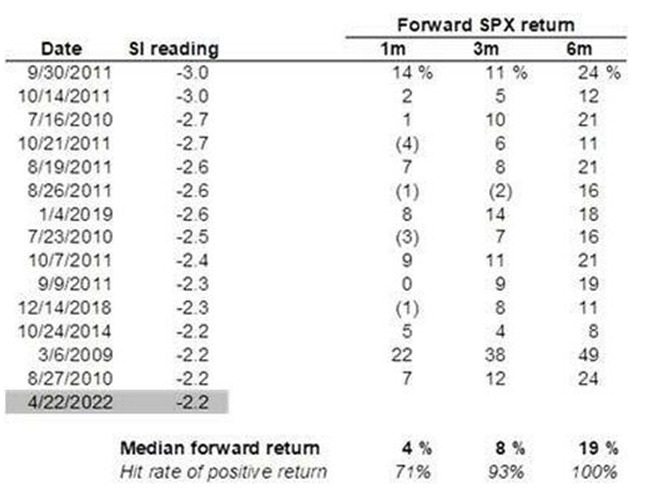

So the obvious question is, “which emoji best describes the current market sentiment" The chart below is the Goldman Sentiment Index [SI]. The current reading is -2.2. This index started in February 2009 and out of the 687 readings, there have only been 14 times where the indicator was below -2.2.

Source; Zerohedge

The Goldman Sentiment Index (SI) tells us that the current negative sentiment is very rare (has only occurred 2.04% of the time). According to this data, we are likely somewhere close to maximum negativity.

As you can see from the table below, the last 14 times that the reading has been at or below -2.2, the market has been up 100% of the time six months later, by an average amount of 19%.

Source; ZeroHedge

Now I want to be clear: we are not calling a bottom on this market, -however, we do think we are close. When this market does finally decide to put in a bottom the ongoing bull market will look quite different than it has in the past. It is likely that the growth will be much slower because of cyclical headwinds. If high inflation persists it will continue to cause bonds and stocks to have a positive correlation. This means that bonds do not protect the portfolio as well as they have in the past. It is likely that the market recovery will be led by a different group of companies other than the tech stocks that have been leading us for the past two years.

I have also included the Monthly Market Commentary from CIBC’s Investment Strategy Group.

As always, if you have any questions please feel free to give us a call at any time.

Have a great day.

Milan

Go Flames Go!