Milan Cacic

May 13, 2022

Money Economy Professionals Commentary In the news Weekly updateWHAT CAN WE LEARN FROM THE 70’S?

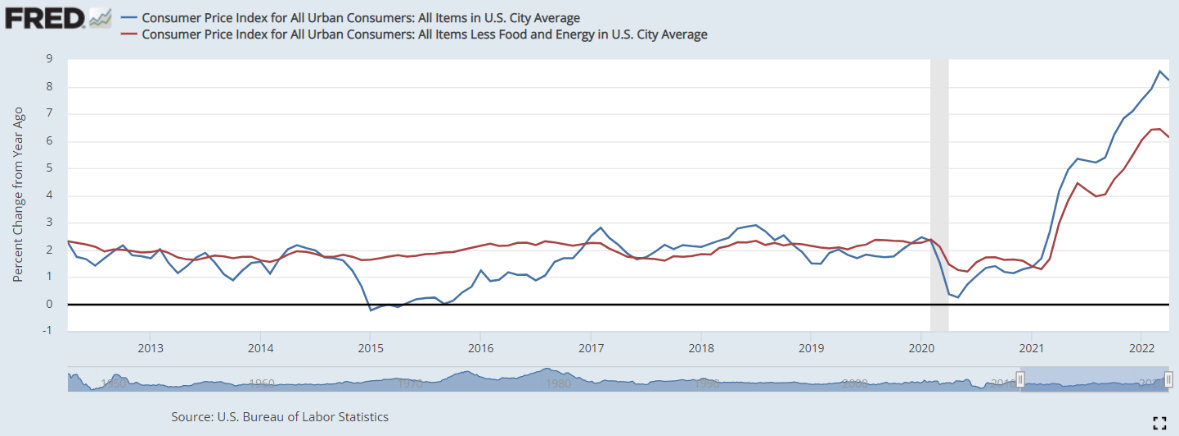

The US CPI data was released on Wednesday. The markets were watching this number closely because the Federal Reserve has been aggressively talking about fighting inflation. The headline CPI number came in at 8.3%, a slight decrease from last month's 8.5%. The core CPI number came in at 6.2%, a slight decrease from the 6.5% recorded last month. These numbers are still well above the Federal Reserve's 2% target, however, it's the first sign that inflation may be beginning to abate.

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; May 12, 2022

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; May 12, 2022

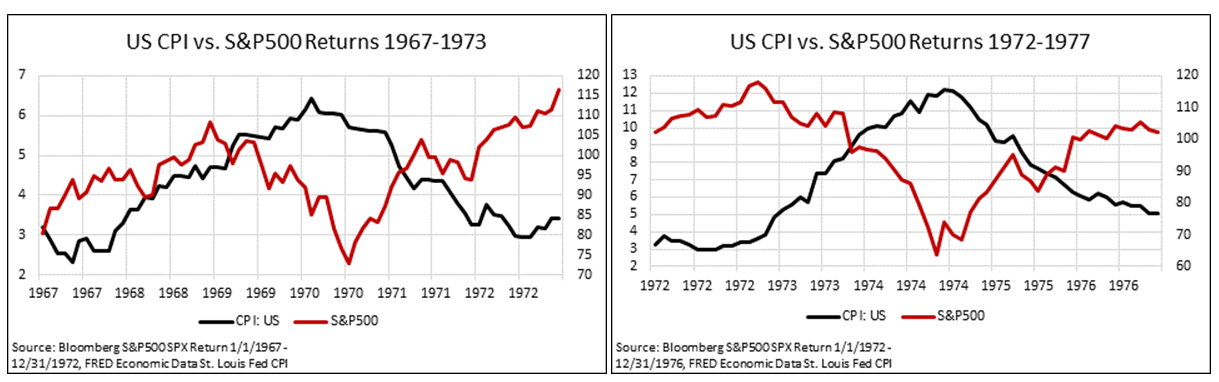

So the question that we ask ourselves is, "if inflation has peaked, what happens to the market as inflation starts to come down to a normalized rate?" To answer this, we can take a look at what happened in the 70s for some insight.

Source: Bloomberg

As can be seen from the charts above, we had two runs on inflation in the late 60s and early 70s. In both cases, when inflation started trending down, the markets rallied. It also should be noted that bonds rallied when inflation trended down as well. The overall level of inflation was not important for the market to rally. What was important, is the direction that inflation was moving: down. Hopefully history repeats itself and we’ve hit peak inflation.

I have also included a piece from our CIBC Economics team titled "Where have all the workers gone?"

Have a great weekend.

Milan

Go Flames Go