Milan Cacic

November 18, 2022

Money Education Financial literacy Social media Economy Good reads Quarterly update In the news Weekly update Weekly commentaryBUBBLES…

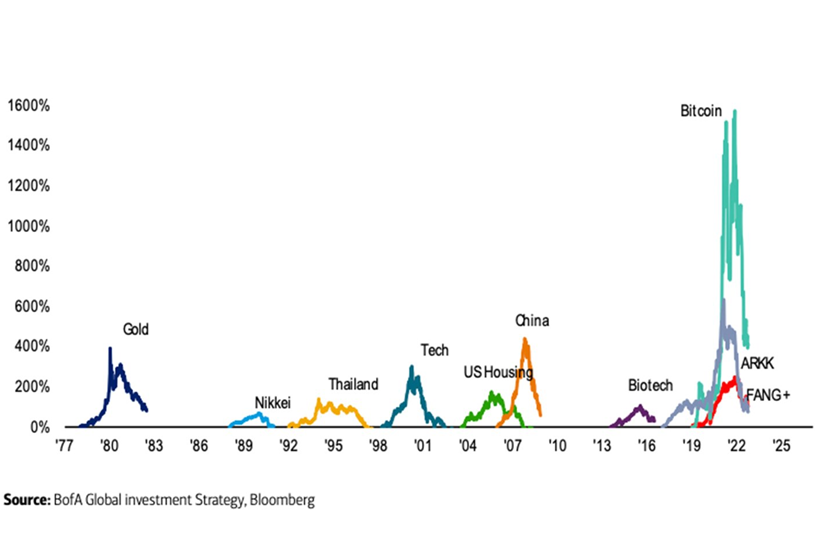

It would be inadequate to describe these past few years as interesting. We have had lots of volatility with some small bubbles bursting as well as some major asset bubbles burst all around us. Think of the massive increase in stay-at-home stocks after the pandemic hit in March 2020. Companies such as Zoom, Peloton, Netflix and many other companies that benefited from people not leaving their houses went to the moon. Most of those companies have now come back to earth. For the most part these were small bubbles that did not have a huge effect on the economy. However, over the past couple years we have also seen some major bubbles that have wiped out trillions of dollars of wealth. The chart below gives you an idea, from a percentage point of view, the bursting bubbles that have taking place over the last 50 years.

You may wonder how these bubbles affect the market. Well, the simple answer is they help the Federal Reserve on their quest to cut inflation. As trillions of dollars get wiped out from fraud related activity or overpriced securities, the liquidity that came with these securities get sucked out of the system. This has a wealth effect on people that causes them to lower personal spending, which in turn helps lower inflation. It is effectively the same as the Federal Reserve reducing the money supply, which in turn helps lower inflation. For the most part, this is a good thing with regard to inflation, as long as you did not partake in these bubbles!

The downside is that when these bubbles burst, we sometimes find out that companies that we would not expect to have exposure in the assets, were, in fact involved. In some cases, even the companies do not know that they have exposure to these asset classes until after they have burst.

There are a few lessons here that sometimes have to be learned many times before they sink in. If it seems too good to be true, it probably is, and diversification is paramount!

I have also included a piece from our CIBC Economics team entitled “Look over here, not over there".

As always if you have any questions, please feel free to give us a call at any time.

Have a great weekend.

Milan