Milan Cacic

June 30, 2023

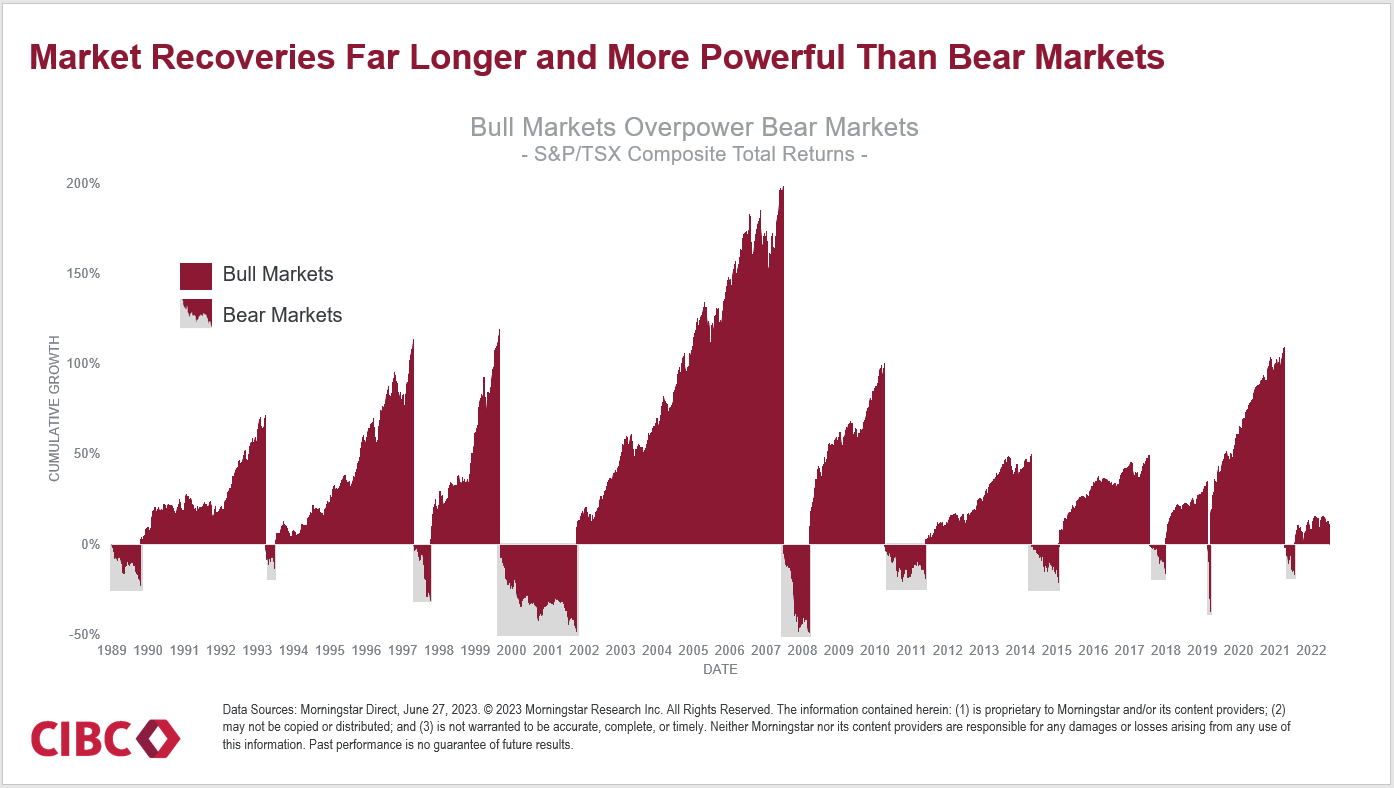

Money News Trending Weekly update Weekly commentaryTHE HISTORY OF BULL AND BEAR MARKETS.

Analysts and economists are split on whether this is the beginning of a new bull market or a bounce in a continuing bear market. Much of the confusion is because economists can't decide whether we are going to have a hard or soft landing in the economy.

The economists who believe were going to have a hard landing rightfully point out that;

- Bank deposits are down 4.3% year-over-year

- The US economy is weakening

- The yield curve is still inverted

- M2 money supply is declining rapidly

The economists who believe we will have a soft landing point out that;

- The consumers in good shape

- Housing is once again strengthening

- Employment is solid

- And the stock market rally is telling us the recession will not be deep.

Maybe the best way to make a decision on whether or not we will have a hard landing or soft landing is use historical data to see what's happened in the past.

As you can see from the chart below, any time we've had a 20% correction or more in the stock market followed by a 10% recovery over six months, this indicated the start of a new bull market. Considering that were six months into a stock market recovery and using history as our guide it would seem likely that this is the beginning of a new bull run. The chart also points out that if we are in a similar situation as the 1960s and 70s the bull runs don't tend to last long. As you can see from the chart below during the 60s and 70s the downturns were sharp and short and the bull market runs were to two three years with 50 to 80% recoveries. With the increase of technology and the speed of with which we get information it would seem likely that these timelines will get shorter and shorter. Time will tell!

I've also included a piece from our CIBC Economics Team entitled "Are rate hikes really not working?".

As always, if you have any questions please feel free to give us a call at any time.

Have a great long weekend!

Milan